Shale Daily | E&P | Eagle Ford Shale | NGI All News Access | NGI The Weekly Gas Market Report

Dallas Independent Buys in Eagle Ford, Looking For More Deals

After a private placement capital raising, recently formed Dallas-based Energy Hunter Resources Inc. said it acquired two lease acreage blocks in Karnes County, TX, in the Eagle Ford Shale. The company is also targeting acreage in the Permian Basin and mineral rights in the Marcellus and Utica shales.

Oil-focused Energy Hunter raised about $3.15 million from a private placement of 3.15 million shares of common stock. The offering initially consisted of 2,500,000 shares, issued at $1.00/share, for gross proceeds of $2.5 million. CEO Gary Evans invested 10% percent in the offering. A 25% over-subscription yielded total proceeds of $3.15 million.

Evans is the former CEO of Magnum Hunter Resources Corp. He was ousted from the position earlier this year amid the company’s bankruptcy, from which it emerged in May (see Shale Daily, May 11). Wildcatter Evans founded Energy Hunter immediately after. There is a Facebook page that references Evans’ time at Magnum Hunter and calls him the “least respected CEO in America.”

Despite the hard feelings among some, Evans was able to raise money for his new venture.

“The recently completed private placement could not have come at a more opportune time due to this downcycle,” Evans said. “Asset prices in the industry, even with the recent uptick in commodity prices, remain at severely depressed levels. Many operators that may be over-leveraged or that may be seeking to unload noncore assets, are creating opportunities for companies like Energy Hunter Resources. Additionally, existing leases are expiring from their primary term due to the lack of capital being deployed.”

A portion of the proceeds from the capital raising was used to acquire the Eagle Ford acreage. Remaining proceeds are to fund general corporate purposes, Energy Hunter said. An initial public offering is planned, the company said.

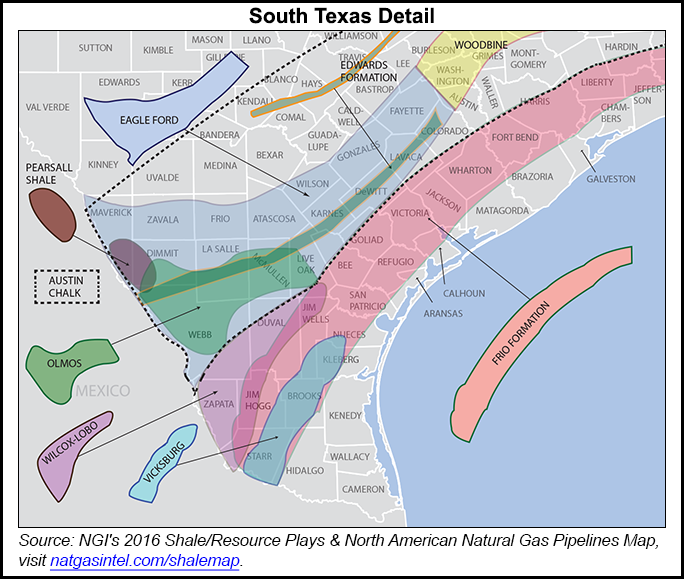

Energy Hunter acquired two separate blocks totaling about 500 net acres along the Karnes Condensate Trend. The total acreage position is prospective for both the lower and upper Eagle Ford Shale, as well as the Austin Chalk formation, the company said. There are no drilling commitments on the acreage until 2017. Energy Hunter owns 87.5% of the working interest in the properties and will be the operator on all new wells drilled.

About 14 wells can be drilled in the lower Eagle Ford formation between the two prospects, as well as an additional 10 wells in the upper Eagle Ford formation for a total of 24 wells, excluding the Austin Chalk and potential drilling sites therein, Energy Hunter said. Combined, total recoverable reserves are estimated at 16 million boe. At current strip pricing, adjacent wells have reached payout in less than one year with returns on equity exceeding 80% at current commodity prices.

“We believe that the economic returns of these plays provide some of the best economics of any properties in the country at current commodity prices,” Evans said of the Eagle Ford assets acquired. “We will continue to explore and analyze similar opportunities and provide updates as we begin development of our new acreage position in the Eagle Ford Shale.”

The Eagle Ford, however, has fallen out of favor relative to some other plays, BTU Analytics analyst Erika Coombs said in a recent note.

“As producers like Pioneer [Natural Resources Co.] and others continue to make significant gains in unlocking the Permian Basin, the Eagle Ford has lost its position as the favorite child in the U.S. oil industry,” Coombs wrote.

Flint Hills Eagle Ford Condensate posted prices, for both ultra-light condensate and condensate, have not reconnected with WTI prices, despite production declines, she added. This has significant implications for producers in the Eagle Ford condensate window. Some of these operators have positions elsewhere, such as the Permian, where returns are more attractive. The Permian offers strong differentials to WTI and “lots of running room,” Coombs said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |