Utica Shale | E&P | Marcellus | NGI All News Access | NGI The Weekly Gas Market Report

Hedging, Declining Well Costs Help Antero Post Strong 2Q2016 Production

Boosted by strong hedging and firm transportation portfolios, combined with continued declines in well costs, Antero Resources Corp. maintained a 19% year/year increase in total production for 2Q2016 that included record liquids output.

The Denver-based exploration and production (E&P) company, one of the largest Appalachian-focused operators, posted net production of 1,762 MMcfe/d for the second quarter, with 26% weighted to liquids, according to a quarterly operations update released Thursday. Total average net quarterly production was in line with the 1,758 MMcfe/d the E&P company reported in 1Q2016.

Net liquids production for the quarter averaged 75,041 b/d, a 10% increase over the prior quarter and a 63% increase year/year.

Antero had to shut in 7.3 Bcfe in production, or 80 MMcfe/d, in 2Q2016 due to an outage at MarkWest Energy Partners LP’s Sherwood processing facility after flooding in West Virginia in late June (see Shale Daily, June 28).

Antero’s combined average realized price for the quarter was $3.95/MMcfe, a $2/MMcfe premium to the New York Mercantile Exchange (Nymex). The combined average realized price before hedging was $2.13/MMcfe.

For gas, Antero realized an average price of $4.31/MMcf for the quarter after hedging, or $1.93/MMcf before the effect of hedges — a 2 cent differential to Nymex.

For its 5,244 b/d of oil production, Antero realized an average price of $35.08/bbl, a $10.33/bbl negative to Nymex. Its C3+ natural gas liquids production of 52,424 b/d averaged $18.98/bbl, $17.08/bbl before hedges. Ethane production averaged 17,373 b/d, bringing an average realized price of $8.36/bbl.

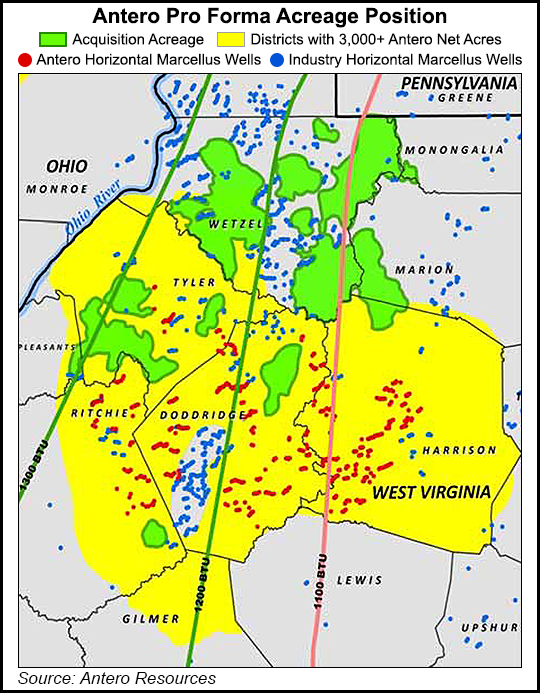

The second quarter saw Antero announce a $450 million deal to bolt on 55,000 net acres mostly located in its core operating area in the Marcellus Shale in Wetzel, Tyler and Doddridge counties, WV (see Shale Daily, June 10). The company said Thursday that a third party intends to exercise tag-along rights that would add another 13,000 net acres to the deal for $108 million, bringing total net production added from the transaction to 17 MMcfe/d and the total cost to $558 million. The deal is expected to close in 3Q2016.

“The acreage adds a significant amount of highly economic well locations to our portfolio, ties in directly with our existing firm transport portfolio allowing us to sell our gas at currently favorably priced markets and provides value creation for Antero Midstream through the acquisition of more than 100,000 gross acres in the dedication area,” CEO Paul Rady said. “Going forward, we believe we are well positioned to achieve further consolidation in Appalachia during the downturn given our continuous operating improvements that further amplify our low cost development competitive advantage, along with our significant hedge position, diversified firm transportation portfolio, ample liquidity and healthy balance sheet.”

Antero completed and placed online 22 horizontal Marcellus wells during the second quarter with an average lateral length of 9,200 feet. It placed online nine Utica wells with an average lateral length of 8,400 feet.

Antero’s drilling and completion costs for the quarter declined 24% in both the Marcellus and Utica, the company said. For 9,000 foot laterals, costs averaged $0.9 million per 1,000 feet of lateral in the Marcellus and $1.04 million per 1,000 feet in the Utica. These represent sequential cost decreases of 5% and 9% respectively compared to 1Q2016. The company attributed the declines to reduced service costs and continued operational efficiencies.

During 2Q2016, Antero said it drilled a record 7,274 feet of lateral in a 24-hour period.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |