Heat Wave Lifts Eastern NatGas Points, But Futures Steady Ahead of Inventory Data

The price spotlight Wednesday was on New York, both upstate and downstate, as sultry heat was forecast to envelope the eastern portion of the state. Gas for next-day delivery added a few pennies to a nickel in Texas, the Midwest, Midcontinent and Louisiana, but deliveries to the East, and New York in particular, posted gains of more than 20 cents. The NGI National Spot Gas Average rose 6 cents to $2.59.

Futures started strong but ended up marking time ahead of Thursday’s Energy Information Administration storage inventory report. August rose three-tenths of a penny to $2.737, and September gained seven-tenths to $2.707. August crude oil gave up all of Tuesday’s gains and tumbled $2.05 to $44.75/bbl.

Next-day gas in New York proved to be the day’s big gainer, as weather was forecast to be a scorcher. Forecaster Wunderground.com predicted that the high in New York City of 90 on Wednesday would ease slightly to 88 Thursday before reaching 94 on Friday. The normal high in New York this time of year is 84. Albany, NY, was expected to see its high Wednesday of 91 slide to 89 Thursday before ratcheting up to 90 on Friday. The seasonal high is 83.

Gas on Transco Zone 6 into New York City jumped 29 cents to $2.29, and gas on Transco Zone 6 non-NYNorth serving southeasternmost Pennsylvania, Trenton, NJ, and southern New Jersey rose 37 cents to $2.39. Gas on Tennessee Zone 5 200 L jumped 19 cents to $2.96.

Power loads for New York City were expected to vault higher. The New York ISO forecast that Wednesday’s peak load of 8,802 MW would rise Thursday to 9,592 MW and reach 10,029 MW Friday.

Next-day power prices also advanced. Intercontinental Exchange reported that next-day on-peak power at the New York ISO Zone G terminal rose $2.67 to $45.96/MWh, and on-peak power to the PJM West delivery point jumped $10.99 to $48.29/MWh.

Other market hubs showed more tempered advances. Gas at the Chicago Citygate added 4 cents to $2.76, and deliveries to the Henry Hub were quoted 6 cents higher at $2.81. Gas on El Paso Permian also added 6 cents to $2.64, and packages at the SoCal Citygate rose 12 cents to $2.86.

“Temperatures more typical of the middle of July will return to the northeastern United States by midweek,” said AccuWeather.com meteorologist Kristina Pydynowski. “As an area of high pressure swings offshore, the door will open for temperature and humidity levels to trend upward.”

By midweek, she said, “widespread highs in the upper 80s and lower 90s” were expected throughout the Northeast. “The greatest departures from normal and most numerous 90-degree readings will likely occur from the eastern Great Lakes to New England on Wednesday.”

Further out, forecasters still see a warm pattern in place, tempered by periodic bouts of cooling. “The latest weather data continues to advertise very warm to hot temperatures the next couple days over all but the Northwest and north-central U.S., but then with several degrees of cooling spilling across the Great Lakes, Mid-Atlantic and Northeast late this week through the coming weekend,” said Natgasweather.com in a Tuesday report.

Weather data “is still showing a very strong ridge of high pressure next week over much of the country, with record setting temperatures,” but it has “trended a bit slower in setting up with the hottest temperatures focused on the central and southern U.S., including the Midwest, while the East Coast warms, but likely not as impressively.

“Next week’s hot ridge does look fairly intimidating, so it could spook the markets, but we continue to see the same issue.”

For the week ended July 16, the National Weather Service forecasts above-normal cooling degree day requirements in major markets. New England is expected to see 61 CDDs, or 20 more than normal, and the Mid-Atlantic states of New York, New Jersey and Pennsylvania should simmer under 69 cooling degree days (CDD), or 13 more than than what it normally sees. The greater Midwest from Ohio to Wisconsin is anticipated to see 73 CDD, or 17 above normal for this time of year.

Tim Evans of Citi Futures Perspective said the market turn higher Tuesday “supported by a warmer temperatures forecast that added some power sector demand to the market balance for the next two weeks.”

Market analysts see no immediate trend to natural gas prices.

“Natural gas is now sitting in the same position the rest of the petro complex has been stuck in since early June,” said United ICAP technical analyst Brian LaRose. “Bears need to crash through the 0.236 retracement at $2.671 and a=c down from the $2.998 high at $2.570 to signal a top is in. Bulls need to bust through the $2.998 high to keep the up-trend going.

“As long as we are stuck between support and resistance, we sit on our hands.”

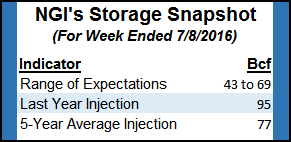

Thursday’s inventory report may be just the catalyst to lift or sink prices beyond resistance or support. Expectations vary widely but fall well below last year’s 95 Bcf injection and a five-year average of 77 Bcf.

IAF Advisors calculated a build of 67 Bcf but Citi Futures is looking for only a 46 Bcf injection. A Reuters poll of 20 traders and analysts revealed an average 59 Bcf, with a range of 43 Bcf to 66 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |