Regulatory | NGI All News Access | NGI The Weekly Gas Market Report

California’s Multi-State Grid Proposal Suggests Reducing Fossil Fuel Dependence, Including NatGas

California’s grid operator on Tuesday issued a 12-volume, 688-page tome analyzing various scenarios to create a multi-state, regional electricity market that would continue to phase out the use of fossil fuels, including natural gas, for power generation.

Promising up to $1.5 billion in annual savings by 2030, the study by the California Independent System Operator (CAISO) concluded that expanding the power market by affiliating dozens of now separate balancing areas would enhance climate change initiatives seeking ever-greater dependence on a combination of efficiency programs, renewables and distributed generation. It downplayed gas-fired generation, even as large numbers of coal-fired generation plants are retired.

Mandated by the California Clean Energy and Pollution Reduction Act (SB 350) enacted last year, the CAISO study was completed by four research organizations. It considered two scenarios tied to 2020 and three with a 2030 time frame. The 2020 combination of CAISO and Berkshire Hathaway’s Portland, OR-based PacifiCorp multi-state western utility operations is one of the scenarios examined.

The four research groups involved — the Brattle Group, Energy and Environmental Economics Inc. (E3), Aspen Environmental Group and Berkeley Economic Advising and Research LLC (BEAR) — determined that there would be positive economic and reliability results from the regional market.

For 2020, the study concluded that up to 776 MW of energy transfers from CAISO to PacificCorp and 982 MW of transfers from PacifiCorp to CAISO (the amount of existing transmission capability between the two areas) are “free of economic and operational hurdles.”

The latest studies confirmed preliminary results that predicted benefits to grow over time from a broad electricity market in the West, said CAISO CEO Steve Berberich. He said the studies should “help drive the formation of a new, more efficient, cost-effective and greener western electric grid. It is also clear that a regional grid allows California and other states to eventually exceed their renewable goals, including California’s 50% renewable mark.”

The initial economic and other benefits from the CAISO-PacifiCorp partnership are relatively modest in 2020, with the big bang advantages by 2030, according to CAISO’s Keith Casey, vice president for market and infrastructure development. “As the regional footprint grows and the amount of renewables on the system grows as well, those two effects are really driving the market benefits we see in 2030,” he said.

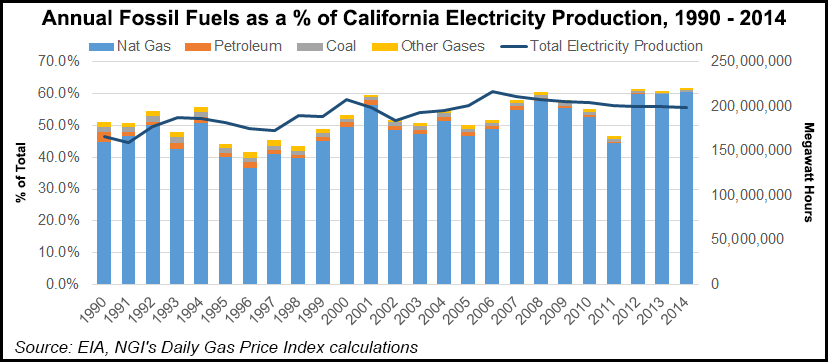

From the gas industry’s perspective, Berberich and Casey agreed that the move to a broad regional market would reduce the amount of gas-fired generation needed throughout the region.

“I think this regional market in the West would provide a platform for enabling that transformation, and we see how that is playing out in a lot of other regional markets,” Casey said.

Berberich added that there are going to be lot of coal plant retirements and displacement from a mixed portfolio of gas and renewables, and it would be up to the policymakers to decide what that mix is.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |