NGI Weekly Gas Price Index | Markets | NGI All News Access | NGI Data

Northeast, Southeast Gains Highlight Weekly Physical NatGas Trading; Futures Slump

Wide regional variations characterized weekly spot natural gas trading for the shortened week ended July 8. Towering double-digit gains in the Northeast and Southeast, however, were unable to counter losses extending from Appalachia to California and the Rocky Mountains to the Gulf Coast.

The NGI Weekly Spot Gas Average, however, moved a mere penny lower to $2.55. The market point with the week’s greatest gain was Florida Gas Transmission with a jump of $1.90 to $5.50, and the week’s biggest setback was endured by gas at the PG&E Citygate of 41 cents to $2.75.

At the upper end regionally were the Northeast and Southeast with gains of 40 cents and 35 cents to $2.60 and $3.17, respectively.

At the low end were California and Rocky Mountain points averaging losses of 24 cents and 12 cents to $2.57 and $2.39, respectively.

The Midcontinent saw weekly quotes average a 10-cent decline and both South Louisiana and South Texas lost 9 cents to $2.72 and $2.69, respectively.

East Texas shed 8 cents to $2.70, the Midwest fell a nickel to $2.69 and Appalachia eased a penny to $1.62.

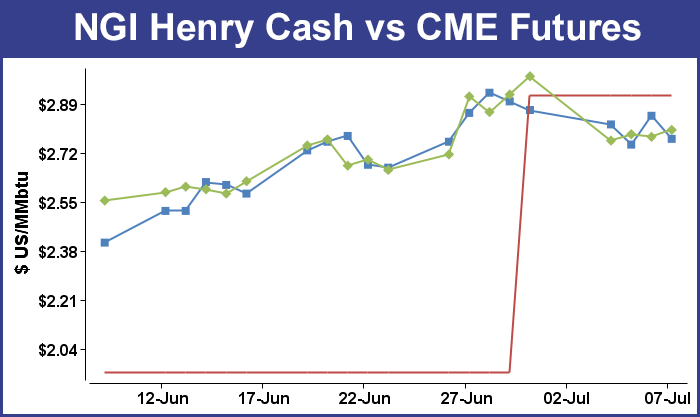

August futures tumbled 18.6 cents to $2.801.

Thursday’s activity saw the day’s main price driver, the weekly Energy Information Administration’s (EIA) storage report, set to reignite a bullish futures price move stalled by Tuesday’s 22-cent drubbing, which took August futures down from near $3 to $2.764. Last year 83 Bcf were injected and the five-year pace stood at a stout 77 Bcf.

Industry estimates were coming in sharply lower, around 43 Bcf ,and the EIA reported a build of 39 Bcf in its weekly storage report, often enough of a difference to spark a price rally. At first prices rose, but those gains proved to be elusive, and at the close August had eased 9 tenths of a cent to $2.777 and September was lower by 1.3 cents to $2.764.

Once the EIA report of a 39 Bcf storage injection rattled across trading desks, August futures reached a high of $2.841 and by 10:45 a.m. August was trading at $2.830 up 4.4 cents from Wednesday’s settlement.

Futures traders spun the day’s activity in a mostly positive light. “We bent the [support] line at $2.725, but holding that area there still shows that the base is still intact especially since it rallied off that area and settled at $2.77,” said a New York floor trader.

“It was an interesting day. The lower close may be saying we are seeing a market top. If nothing comes in fundamentally to give the market another push up, we may be seeing the end of the ride to the upside.”

Inventories now stand at 3,179 Bcf and are 538 Bcf greater than last year and 599 Bcf more than the five-year average. In the East Region 22 Bcf were injected and the Midwest Region saw inventories increase by 22 Bcf also. Stocks in the Mountain Region rose 4 Bcf, and the Pacific Region was lower by 2 Bcf. The South Central Region fell by 7 Bcf.

In Friday’s trading physical natural gas for weekend and Monday delivery parted ways with firmer futures.

Physical gas sustained broad setbacks across most market points, with only the Rockies and California showing any resilience. West Coast and Rocky Mountain quotes came in a few pennies higher, but the Midwest, Midcontinent, Northeast and Southeast were hit with substantial selling before the weekend.

The NGI National Spot Gas Average skidded 15 cents to $2.47. Futures managed to keep their head above water, with the August contract added 2.4 cents to $2.801 and September gaining 2.4 cents as well to $2.788. August crude oil rose 27 cents to $45.41/bbl. The Dow Jones Industrial Average gained 251 points to 18,147 on favorable employment data.

The broad declines in the physical market were prompted by weather forecasts calling for falling temperatures in major metropolitan areas. AccuWeather.com predicted the high in New York City Friday of 87 degrees would drop to 75 Saturday before recovering to 79 by Monday. The seasonal high in the Big Apple is 84. Chicago’s 85 high Friday was anticipated to slide to 76 Saturday before making it back to 86 by Monday, one degree above normal.

Gas at the Algonquin Citygate tumbled 99 cents to $2.07 and deliveries to Iroquois, Waddington shed 32 cents to $2.59. Parcels on Tennessee Zone 6 200 L skidded $1.08 to $2.00.

Mid-Atlantic points were no better off. Gas on Tetco M-3 Delivery fell 16 cents to $1.43, and gas bound for New York City on Transco Zone 6 tumbled $1.28 to $1.64.

Market hubs east of the Continental Divide fell while those west were steady to higher. Gas at the Chicago Citygate dropped 12 cents to $2.66, and deliveries to the Henry Hub changed hands 8 cents lower at $2.77. Packages at Opal, however, added 3 cents to $2.50, and gas at the PG&E Citygate was seen at $2.69, unchanged.

Rain and thunderstorms were expected to usher in much of the cooler regime affecting the Midwest and East. “An area of low pressure will move eastward from the upper Mississippi Valley to the eastern Great Lakes,” said Kari Strenfel, a meteorologist with Wunderground.com. “This system will usher rain and thunderstorms across the upper Midwest and portions of the Northeast. A cold frontal boundary associated with this system will stretch southwestward from the lower Great Lakes to the southern high Plains.

“As this frontal system transitions eastward, it will interact with warm and humid air coming from the Gulf of Mexico. This interaction will lead to strong to severe thunderstorms across the Mid-Atlantic, the Midwest, the Tennessee Valley, the middle Mississippi Valley, the central Plains and the southern Plains.”

Futures traders saw nervous short-covering giving the market support. “I think some of the shorts that were out there covered, and now we are looking at $2.92,” a New York floor trader told NGI. “We are looking at a week or two of hot weather. It might test $3, but that is going to be a real push.”

In spite of a weak performance following the release of supportive storage figures Thursday, fundamentals for the coming week appeared sound as warmer than normal temperatures were expected in major market areas. “A moderate warm-up in temperatures should lift demand in regions east of the Rockies next week,” said industry consultant Genscape in a Friday morning report.

“Genscape meteorologists are forecasting total population weighted CDDs will move above seasonal norms of 127 CDDs starting Tuesday, peak at 153 CDDs by Thursday, and remain well above normal through the rest of the 14-day forecast period. Western regions (California, Desert Southwest, Rockies) will actually experience below-normal temperatures, but all regions east will be above. The largest deviations will focus on the Midwest and Northeast.

“Midwest CDDs are forecast to run nearly double seasonal norms. As a result, Genscape’s Midwest demand forecast nears a peak of 9.5 Bcf/d by Thursday, 1 Bcf/d above current levels. Appalachia demand is forecast to climb to a peak of 11.8 Bcf/d by Thursday, about 1.7 Bcf/d above current levels, [and] New England demand is coming off levels around 2.3 Bcf/d and will fall to around 1.6 Bcf/d this weekend. But next week’s warm-up is expected to get demand back to current 2.3 Bcf/d levels.”

Analysts see the market repositioning for a further advance.

“This market continues to digest the sizable price declines seen Tuesday-Wednesday in gradually developing a base for a renewed price advance in our opinion,” said Jim Ritterbusch of Ritterbusch and Associates. “Although [Thursday’s] 39 Bcf storage injection was 8 Bcf smaller than we had anticipated, bullish response by the market was limited by the fact that the supply overhang remains sizable at about 600 Bcf. But we expect further surplus contraction to around 575 Bcf next Thursday with further narrowing likely during the second half of this month.

“We are maintaining a theme that this dynamic of surplus reduction is a more important price motivator than the static factor of a large supply overhang that has been well discounted. And while conceding to a recent larger than expected upswing in production, we will note that the bulk of the summer remains ahead and that unplanned disruptions or major hurricane activity could easily reverse output gains.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |