Shale Daily | E&P | NGI All News Access

Most Efficiency Gains Will Stick After Price Rout, Canadian Producers Say

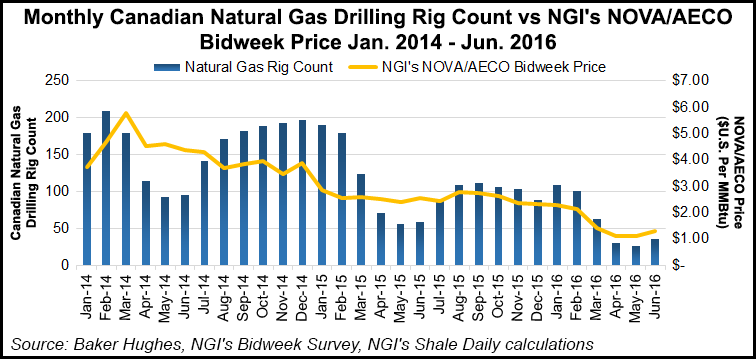

Canadian producers and field contractors are emerging stronger than ever from the two-year ordeal of paring down to cope with low oil, natural gas and liquid byproduct prices, company leaders told a two-day investor conference in Calgary.

Operating expense savings average 22%, capital cost go as deep as 50%, and both are permanently “structural” rather than temporary austerity, the industry assured the well-attended event held by TD Securities.

“We really have transformed,” said Ensign Energy Services Inc. Vice President Tom Connors. “We’re manufacturing well bores” with improved and automated hardware, added Connors, whose firm is a mainstay of Canadian gas and oil field work.

The contractor did not dispute an aggressive long-range forecast by Encana Corp.’s chief operating officer. Mike McAllister predicted that producers will keep two-thirds of the cost-efficiency gains after oil and gas prices, field activity, and service fees recover.

“We had to re-engineer everything we do,” said Trilogy Energy Corp. President John Williams. “The last 18 months has been a great learning experience.”

The exercise sweated all the industry’s small but costly stuff, from avoiding waste of paid time by scheduling work crews carefully, to speeding up drilling and well completions with better selections of tools and materials such as drill bits, fluids, muds and chemicals.

Efficiency improvements are continuing.

Precision Drilling Corp. President Kevin Neveu reported that all of its 251-rig fleet in Canada, the United States, Mexico and the Middle East has been converted into digitally controlled, automated, lighter-weight, and more mobile hardware.

Canyon Technical Services Ltd. COO Todd Tuley, reported that a new generation of giant truck-mounted pumps used in hydraulic fracturing is being tested. Advances make the well completions machinery 1.5 times more powerful, he said.

Accelerating the work pace as the energy price and activity cycle turns back up will be “a long slow process,” Tuley said. The total fracking pump strength of the Canadian well completions fleet has been cut in half, down to about one million horsepower, he said. About half of the idle machinery is obsolete or has been cannibalized for hardware to the point where it cannot be revived, he estimated.

The exploration and production companies are not banking on a fast price or field activity recovery either.

When investors asked what would happen if prices only rose modestly to averages of US$3.00/MMBtu for gas and US$50/bbl for oil, Williams said “we’d be ecstatic.” Crew Energy President Dale Shwed agreed, “At US$3.00 gas we can make very good returns.”

ARC Resources President Myron Stadnyk described the Montney shale and tight rock formation, straddling northern British Columbia and Alberta, as “very competitive” with every gas- and liquid byproducts-rich structure including the Marcellus in the United States.

The Montney is poised for accelerated development as gas, byproduct and oil prices recover, Stadnyk said. When ARC started drilling in the formation a decade ago only about 200 pioneer wells had been tried and adaptation of horizontal drilling and hydraulic fracturing to Canadian targets was only beginning. The number of Montney wells has since grown to 4,000, with knowledge of the geology and technology growing and costs falling every step of the way, he said.

“We’ve got a long way to go in the Montney,” agreed Advantage Oil & Gas Ltd. President Andy Mah. “It’s a monster. It’s huge.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |