Rig Recovery a Game of Fits and Starts

Coming off of gains in both the natural gas and oil arenas the previous week (see Shale Daily, June 17), U.S. rig watchers and their claims of recovery were forced to digest mixed news Friday as the number of gas rigs continued to climb, but the oil count stumbled, according to Baker Hughes data for the week ending June 24.

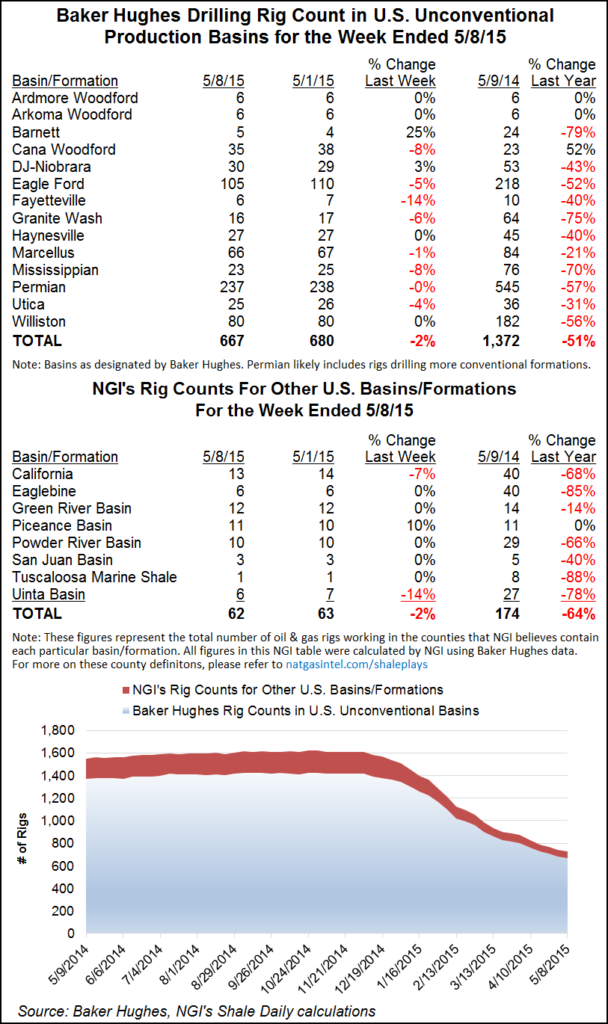

For the week, U.S. oil rigs dropped seven to 330, while U.S. natural gas rigs added four to 90. Despite gains or losses, low commodity prices still have the current counts well below a year ago, with oil 47% below the 628 rigs running one year ago, and gas 61% below the 228 rigs in operation at that time.

Looking at unconventional drilling across the country, a few plays stuck out for their advances and declines. It would appear that analysts at Tudor, Pickering, Holt & Co. were on to something a few weeks back regarding the Haynesville (see Shale Daily, June 10). On June 10, they wrote that “unconstrained basins like the Haynesville, which are now approaching breakeven economics between $2.00-2.50/Mcf with new completion techniques,” would be “the first areas the market looks to add back capital.” That week, Baker Hughes recorded a two-rig uptick in the basin to 17, and for the week ending June 24, the Haynesville added another two rigs to 19.

The Permian and Williston basins also put in strong showings in the most recent week, adding four and two rigs respectively, to 150 and 26 rigs. Sticking out to the downside was the Cana Woodford, which lost three rigs to 24 for the week.

Some market watchers believe the backlog of drilled but uncompleted wells (DUCs) combined with the current level of active rigs don’t stand a chance against coming natural gas demand, which could lead to rig recovery (see related story). Speaking at Hart Energy’s annual DUG East Conference & Exhibition, Ponderosa Advisors LLC Managing Partner Bernadette Johnson said she believes higher prices are coming sooner than expected.

“Natural gas production volumes are coming off pretty significantly,” she said. “They were up above 73 Bcf/d on the dry gas side and now we’re only at about 70.5 Bcf/d, and that’s only over the past few months, so we’re seeing some declines.

“The forward [price] does not support natural gas production growth, but a cold winter could push natural gas production prices north of $4,” she added. “We’re out in the world saying, ‘we think gas prices could be over $4 next year,’ and a lot of people think we’re crazy.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |