Marcellus | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

Appalachian Operators Preparing For Increasing NatGas Demand With Well Optimization, Efficiencies

Capital discipline, operational efficiency and well optimization have kept the Appalachian Basin’s leading oil and natural gas producers afloat over the last 18 months amid a severe commodities downturn but the trend also has given way to technological breakthroughs.

Speakers kicking off an industry conference in Pittsburgh on Wednesday touched on the technology topic. They said that as a result of innovation, the basin is better prepared to handle an increase in demand that is expected to begin next year as liquified natural gas (LNG) exports ramp-up and more gas is burned for power generation in the region and across the country.

“We’re currently navigating through a very challenging environment, but it’s also an exciting time for our industry,” said Consol Energy Inc. COO Tim Dugan. “This environment is driving improvement and efficiency across all operational areas.”

Consol, which has steadily transitioned away from coal to natural gas production, turned its first Utica Shale well in Westmoreland County, PA, to sales last year. The Gaut 4I tested at more than 61 MMcf/d, and the company expects the Utica to continue to be a larger part of its production mix going forward (see Shale Daily, Jan. 30, 2015) One Utica well has the volume equivalent of roughly three Marcellus wells, Dugan said.

“There will be fewer wells required to maintain growth in the basin and we will all be challenged to reach the point of optimization much quicker in the Utica than we did in the Marcellus,” Dugan said. “We can no longer afford to wait for 12 to 24 months of production data to understand if the landing zone is optimal or a completion technique is effective. A host of technologies are needed to model the many scenarios to make economic decisions now that will allow us to maximize Utica value.”

At the moment, few Appalachian companies epitomize the push to optimize results more than Ohio pure-play Eclipse Resources Corp. The company has faced financial strains in recent months, but it has been intent on “revolutionizing” development in the basin (see Shale Daily, Feb. 29). Earlier this year, Eclipse drilled what is thought to be the longest onshore lateral in the world (see Shale Daily, May 5).

The Purple Hayes 1H in Guernsey County was completed with an 18,544 foot lateral and 124 fracture (frack) stages at a total measured depth of 27,031 feet (see Shale Daily, May 18). The well was drilled in the condensate window for $15.8 million.

Eclipse’s Oleg Tolmachev, senior vice president of drilling and completions, said it took 60 days of intensive planning before the company started drilling the well. Eclipse reviewed everything from bit selection and cement design to wireline models, fracture design and drill methods, among other things, to ensure that endeavor operations went smoothly.

Tolmachev said the vertical section was drilled, cased and cemented in 4.5 days. The curve was done in less than 18 hours, and it took 10 days to drill the entire lateral section. In all, he said, it took about 17.6 days to drill and another 23.5 days to complete.

Ultimately, Eclipse management believes it can drill even longer wells with a goal of reducing drilling and completion costs per foot and improving well economics. Tolmachev said the “super laterals” should drive down finding and development costs by 20-30% in the condensate area and improve well returns by 35-70%.

“We didn’t experience any issues with the frack stages, except for one where we think we intercepted a minor fault or other lithological feature,” he said, adding that the process went smooth and confirmed that the technology could be applied across the company’s acreage.

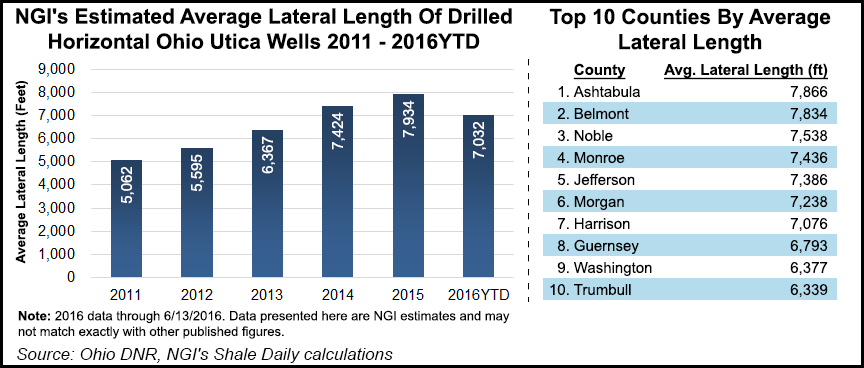

Tolmachev said the average length of Eclipse’s laterals went from 6,000 feet in 2013 to 13,500 feet in 2015, or an increase of about 300% when the Purple Hayes well is included. Other operators across the basin have been tweaking well spacing, lateral length and completion methods to maximize estimated ultimate recoveries (see Shale Daily, April 8; April 7).

“Why is production not falling more quickly?” Bernadette Johnson, managing director of Ponderosa Advisors LLC, asked attendees at Hart Energy’s DUG East Conference & Exhibition. “If you look at the break out of that, the rig fleet we have today is the most efficient, it’s the best operators, the best rigs, it’s drilling the sweet spots and it’s certainly helping production stay stronger than it would have.”

When oil prices rebound, Johnson said she expects associated gas to increase significantly in oilier plays such as the Bakken and Eagle Ford shales. But the Northeast, she said, is still expected to lead gas production growth over the next four years. Her firm is projecting about 5 Bcf/d of additional production in the Marcellus and Utica by 2020.

Apex Energy LLC CEO Mark Rothenberg said that growth will be needed nationwide. Although U.S. gas production this year is expected to be flat or slightly less than it was in 2015, demand is expected to increase starting next year. In the Appalachian Basin, as the drilled but uncompleted (DUC) well inventory is rapidly worked off, Johnson added, it could lead to a supply shortfall and the need for a fast rebound in supply that would be aided by more efficient production.

“We will need that gas production growth out of the Northeast,” she said, adding that demand for LNG exports and natural gas for electric generation is expected to start increasing sharply beginning in 2017. “At $2.25 gas and $50 crude, we’re declining pretty quickly and that’s kind of what we’re seeing with the production today. This is not the right answer next year, this is fine for today because storage is really full, but this is not fine for next year once the market resets and we have growing demand.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |