Physical NatGas Steady, But Futures Tumble Ahead of Storage Report

Physical natural gas for delivery Thursday changed little on Wednesday as rising prices in Texas and the Northeast overcame flat pricing in the Midwest and Midcontinent and losses in California. The NGI National Spot Gas Average added two cents to $2.61, but futures struggled in an uphill battle with falling petroleum prices.

At the close July futures had fallen 9.1 cents to $2.677, and August was off 8.7 cents to $2.711. August crude oil fell 72 cents to $49.13/bbl.

Next-day prices at California points weakened as weather forecasts moderated. but southwest heat was expected to intensify next week. AccuWeather.com forecast that the 85 high in Los Angeles would ease to 80 Thursday and reach 81 Friday, 1 degree above normal. Burbank’s 88 maximum Wednesday was expected to slide to 84 Thursday before climbing back to 88 Friday, 6 degrees above normal. San Diego’s 73 high Wednesday was seen rising to 75 Thursday and 76 Friday, 4 degrees above normal.

Deliveries to Malin shed a penny to $2.67, and gas at the PG&E Citygate rose a penny to $3.02. Gas at the SoCal Citygate dropped 8 cents to $2.99, and parcels priced at the SoCal Border Avg. Average changed hands 7 cents lower at $2.84. Gas on Kern Delivery skidded 6 cents to $2.85.

CAISO predicted loads far below recent readings in excess of 45,000 MW. Wednesday’s forecast peak load of 38,413 MW was expected to drop to 37,967 MW Thursday.

Next week, attention will turn to another round of triple-digit heat in the Southwest, which is expected this weekend into early next week as another ridge of high pressure builds overhead.

“After a nice cooldown the last couple of days in Southern California, the heat will come right back by the latter half of the weekend and early next week,” said AccuWeather.com meteorologist Ken Clark. “Triple-digit heat will return to parts of the Los Angeles and San Diego areas by Sunday and Monday, and excessive heat will become likely in the Central Valley of California with some areas getting to, or just past 110 F.”

The desert Southwest isn’t the only area pounded by the severe heat. In Mexico, Sonora, Chihuahua, Baja, and Sinaloa have also been hit with high temperatures, resulting in surging gas exports.

Industry consultant Genscape Inc. estimated that exports to Mexico have crested at 3.7 Bcf/d as the heat wave pounding SoCal and the Desert Southwest envelopes the country.

“Estimated flows reached 3,715 MMcf/d [Tuesday], a 149 MMcf/d increase from Monday,” Genscape said. “The increase in exports is heavily concentrated on pipes exiting Arizona, which serve the above Mexican states.

“Daytime highs in Hermosillo — Sonora’s largest city — reached 114F on Tuesday (normal is 101). Exports via El Paso pipeline at Agua Prieta, AZ to Mexico’s state-run power agency — CFE — set a record high of 110 MMcf/d, double the month-to-date average, [and] exports via the North Baja pipeline at Ogilby (at the Arizona/California/Sonora border) set a year-to-date high Tuesday at 393 MMcf/d (an 84 MMcf/d day/day increase)” and had risen to 408 MMcf/d in Wednesday’s nominations.

In spite of the day’s setback, energy consultant PIRA Energy said the current rally in natural gas prices was intact. Despite last Thursday’s “slightly higher-than-expected storage release of 69 Bcf, the general momentum in structural tightness appears to be adequate to safeguard the approximately 15% rally in natural gas prices this month. To be sure, sequential domestic production losses and early cooling demand have raised the floor for the prompt futures contract as well as cash prices.”

Exports are expected to remain robust.

“Since 2014, Mexican energy policy reforms, coupled with low oil prices, have accelerated the nation’s dependency on U.S. gas exports,” PIRA consultants said. “Indeed, net shipments to Mexico remain upward trending, with June flows projected to average approximately 3.7 Bcf/d, an increase of approximately 0.7 Bcf/d versus the prior year. Equally striking is our expectation for 2017, which should see exports average approximately 4.5 Bcf/d and yield a year/year gain of approximately 0.9 Bcf/d.

“Notably, the upgrading and development of new critical infrastructure, including gas pipelines, electric generation and transmission capacity, are anticipated to significantly shape cross-border flows in 2017, providing a rich environment for gas demand.”

Weather models changed little overnight Tuesday. “The big picture idea of hottest anomalies in the western states with warm weather along the northern tier and lots of near normal Midwest, East and South (especially for the 11-15 day) continues again” on Wednesday, said Commodity Weather Group.

“We added more heat to California with now two days at 100-101 F for Burbank early next week and more for Sacramento. No significant demand adjustments are noted overnight as we see some mixed short-range forecast changes and then generally hotter West and same to cooler Midwest, East, and South at times for the six-15 day segment. The overnight models collectively lost demand with some minor cooler changes overall.”

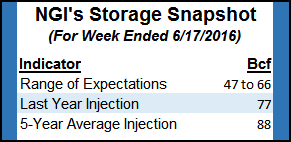

Thursday’s Energy Information Administration storage report is likely to continue the trend of sub-par injections. In spite of 2016 being the earliest point in which storage passed 3 Tcf in the 23 years of recordkeeping — a level once thought adequate for winter requirements prior to the massive switch by utilities to gas fired generation — the trend of below average builds is forecast to continue (see Daily GPI, June 21).

Last year 71 Bcf was injected, and the five-year pace stands at 88 Bcf. IAF Advisors is forecasting a 60 Bcf injection, and United ICAP is looking for a 64 Bcf build. Citi Futures Perspective calculates a 56 Bcf storage addition.

A Reuters survey of 19 industry veterans produced an injection range of 47 Bcf to 65 Bcf, with a median expectation of a 58 Bcf build.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |