Rig Recovery Seen, But Will Price Strengthening Stick?

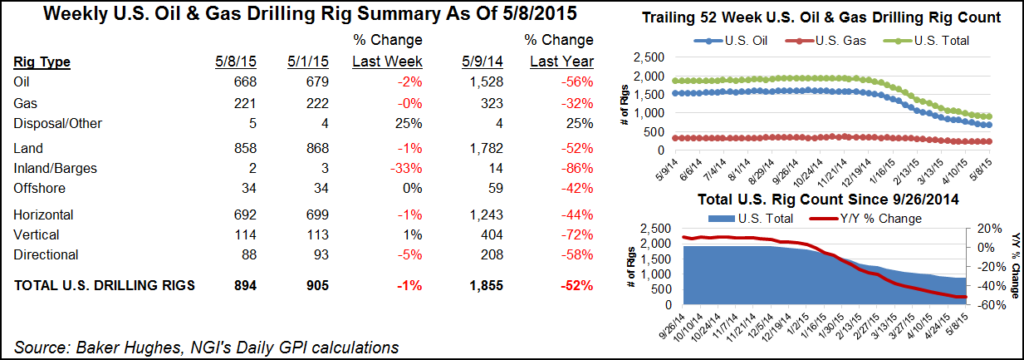

The U.S. land rig count began heading in the other direction on Friday with the latest iteration of the Baker Hughes Inc. (BHI) weekly rig count. Texas saw the biggest gains, including in the dry gas Barnett Shale, which has been out of favor for a while.

The U.S. land rig count jumped 10 units, with the hike made up of nine returning oil rigs and one gas-directed unit. The inland waters and offshore categories were static from the previous week, so the U.S. gained a total of 10 rigs in all. There are 398 active land units, five running in the inland waters and 21 active in the offshore.

Seven vertical units returned to U.S. action, accompanied by three horizontal rigs. Texas saw the biggest gain, adding 13 units. Four came back to the Permian Basin. Four returned to the Eagle Ford. And the Barnett Shale saw the return of five rigs, bringing its tally to seven actives. The Cana Woodford added three rigs, and the Marcellus saw the return of one. The Mississippian Lime lost one rig.

In Canada four gas-directed rigs came back along with one miscellaneous rig, offset by the departure of one oil unit for a net gain of four rigs to a total of 69. The North American count stood at 493 at week’s end.

Whether the soldiers returning to the field are coming back too soon and in too great a number remains to be seen. The last production response to strengthening prices brought a gusher of disappointment for many.

In a note on U.S. natural gas published Thursday, Societe Generale analyst Breanne Dougherty struck a cautious tone.

“Besides what the recent move up in price might mean for [power] generation, we are also watching for early signs of production implications,” she said. “If the Cal ’17 curve rises closer to our base case $3.50/MMBtu view before the end of 2016, stronger drilling programs may come as early as 1Q2017. An early and increased producer engagement could translate into production outperformance risk for 2017, which could soften some of the bullish bias we currently hold in our base-case outlook for the six- to 18-month time period.”

Goldman Sachs analysts took a global view on the oil price outlook in a Wednesday note and also recommended caution. “…[W]e continue to view the recovery in prices and fundamentals as fragile,” they wrote. “In particular, we expect that the 2H16 deficit will remain modest at current prices and that a return into surplus is likely in 1Q17 before inventories normalize by end-2017. This leaves additional significant disruptions in Nigeria or Venezuela, for example, as necessary catalysts to bring prices substantially above our three-month $49/bbl WTI forecast.”

Closer to home, Kathryn Downey Miller of BTU Analytics wrote recently that it would take only 100 horizontal rigs to reverse the decline in U.S. oil production. “The current relationship between rigs and wells is that a single rig can drill approximately 1.6 wells per month,” she wrote. “At that rate, how many rigs will we need to add to bring U.S. Lower 48 production declines to a halt? Not as many as you might imagine.

“Despite losing over 930 rigs from the field over the past two years, only 100 additional rigs are needed to flatten out the U.S. production profile.”

In his most recent weekly editorial, Louisiana Oil & Gas Association President Don Briggs put a different multiplier on rig count: jobs. “One rig can employ 180 direct and indirect jobs,” he said. “You do the math on losing 445 rigs multiplied by 180 jobs in one year’s time!”

Will that math work in reverse? The industry and its workers will have to wait and see if the return of 10 U.S. rigs will mean the return of 1,800 jobs. With frequently touted improvements in drilling efficiency, perhaps not.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 |