PDC, Noble Agree to Trade Acreage in Wattenberg Core

Six months after devoting most of its capital budget for 2016 into Colorado’s Wattenberg field, PDC Energy Inc. announced Thursday that it has agreed to trade acreage in the formation with Noble Energy Inc., a move that consolidates PDC’s position there.

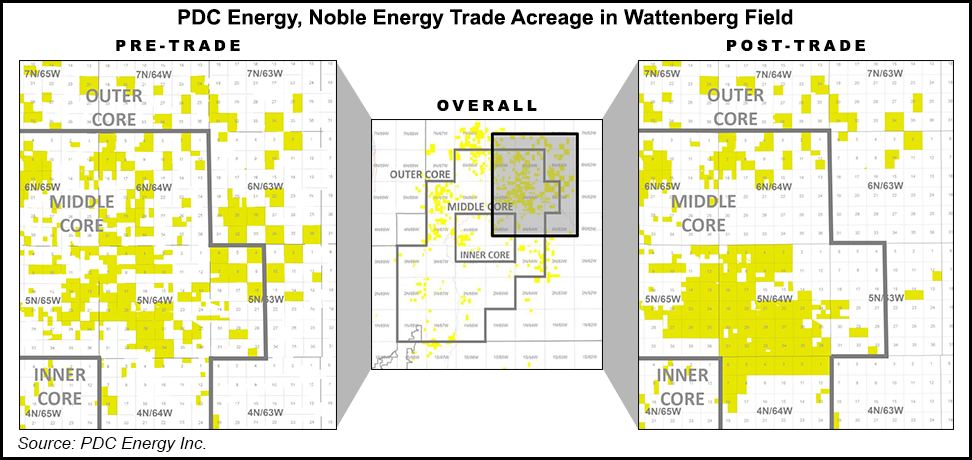

Denver-based PDC said the definitive agreement with Houston-based Noble and its affiliates amounts to a strategic trade for leasehold acreage only, and does not include production or wellbores. Under the agreement, PDC will receive approximately 13,500 net acres in the middle core of the Wattenberg from Noble. In exchange, Noble will receive about 11,700 net acres.

According to PDC, the difference in net acres being traded between the two producers is attributed primarily to variance in net revenue interests.

All of the acreage being swapped is in Weld County, CO, and is subject to title examination and other customary adjustments. PDC anticipates the deal will close in early 4Q2016.

“The anticipated acreage trade creates significant operational efficiencies and incremental value for both PDC and Noble by consolidating our operated acreage positions in this premier field,” said Bart Brookman, CEO of PDC. “This will enable us to design more comprehensive, long-term development plans, capture operational synergies, and streamline marketing and midstream.

“Most significantly, the trade increases opportunities for longer horizontal laterals with significantly increased working interests, all while minimizing potential surface impact.”

Last December, PDC announced that it would spend around $440 million of its $450-500 million budget for 2016 capital expenditures (capex) on a four-rig drilling program in the Wattenberg (see Shale Daily, Dec. 9, 2015). The company also said it plans to spud 135 wells and turn in-line 160 wells in the formation in 2016, and remarked that reduced drill times from spud-to-spud have led to a 25% increase in lateral feet drilled per rig-year.

In a statement Thursday, PDC said it was reviewing the potential effects of the trade with Noble on its 2016 development plans. “The company continues to prioritize its balance sheet strength while it evaluates the impact of a variety of factors, including: higher working interests, increased horizontal lateral lengths, faster drill times, anticipated reductions in non-operated activity and [a] modestly improving commodity price outlook.”

Meanwhile, Noble announced last January that its capex budget for 2016 would total $1.5 billion, about half of what it was for 2015 (see Shale Daily, Jan. 28). The company agreed to sell 72,000 gross acres in the Wattenberg to Synergy Resources Corp. (see Shale Daily, May 4). At the time of the Synergy deal, Noble had divested more than $775 million in assets in 2016.

Noble long has been one of the largest operators in the Denver-Julesburg Basin, which includes the Wattenberg (see Shale Daily, Feb. 18).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |