Markets | NGI All News Access | NGI Data

Futures Relax Following ‘Slightly Bearish’ EIA NatGas Storage Stats

Natural gas futures slumped Thursday morning after the Energy Information Administration (EIA) reported a storage injection that was somewhat greater than what traders were expecting.

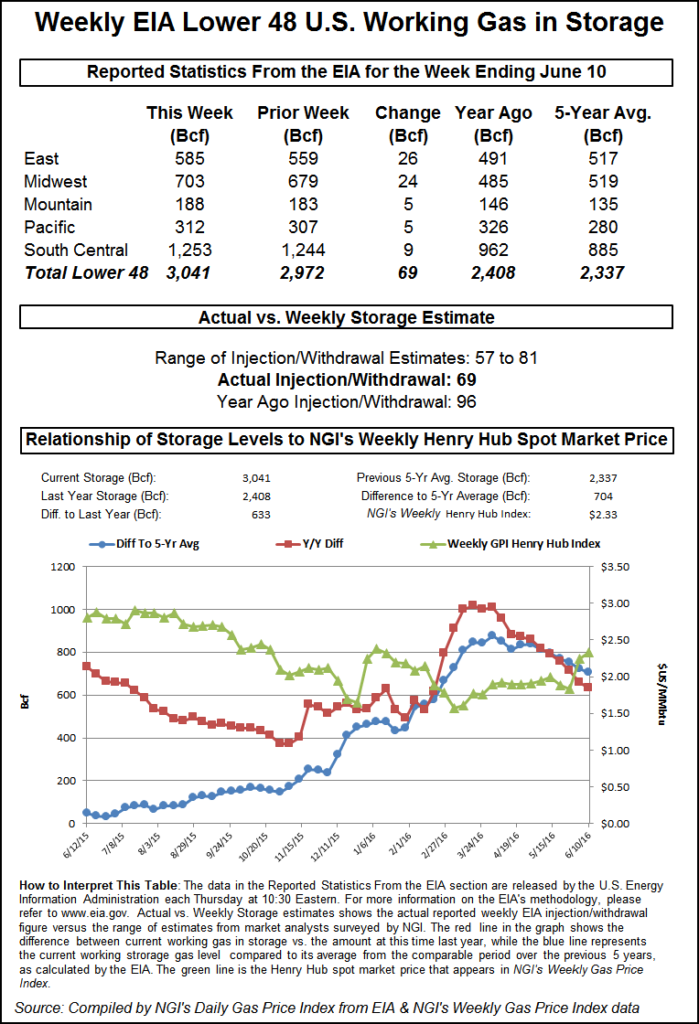

EIA reported a 69 Bcf storage injection in its 10:30 a.m. EDT release for the week ending June 10, about 5 Bcf greater than what traders were anticipating. July futures fell to a low of $2.553 immediately after the figures were released, and by 10:45 a.m. July was trading at $2.570 down 2.5 cents from Wednesday’s settlement.

“I was looking for 64 to 65 Bcf number. This was a little bit more than expected, but nothing really out of the norm,” said a New York floor trader. “I don’t really know if this had all that much of an impact. All the other markets are down sharply.

“We would need to trade $2.595 to $2.60 and settle at that level to get another move to the upside, but we are close enough.”

Bespoke Weather Services of Harrison, NY, said, “EIA data this week showed a slightly larger injection than last week with slightly fewer total degree days on the week. The result is that we did not see much week-over-week tightening, and instead see this number as indicative of a new supply-demand balance becoming established in the natural gas market. Record high storage levels for this time of year will still cap short-term upside from here.”

Citi Futures Perspective analyst Tim Evans deemed the storage number “slightly bearish,” and noted it marked a change from recent reports.

“The data for last week followed two bullish side misses versus expectations, suggesting that the trend toward a tighter background supply/demand balance may have come to an end, although we continue to see enough air-conditioning demand to limit injections to something less than the five-year average rate through the balance of the month,” he said.

Inventories now stand at 3,041 Bcf and are 633 Bcf greater than last year and 704 Bcf more than the five-year average. In the East Region 26 Bcf was injected, and the Midwest Region saw inventories increase by 24 Bcf. Stocks in the Mountain Region rose 5 Bcf, and the Pacific Region was higher by 5 Bcf. The South Central Region added 9 Bcf.

Salt cavern storage was down 2 Bcf at 368 Bcf, while the non-salt cavern figure rose 11 Bcf to 884 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |