Drop in Oil Prices Cripples OPEC’s Net Oil Export Revenues, EIA Finds

The collapse in crude oil prices has decimated net oil export revenues for the Organization of the Petroleum Exporting Countries (OPEC) over the last three years, and the decline is expected to continue into 2016, according to the U.S. Energy Information Administration (EIA).

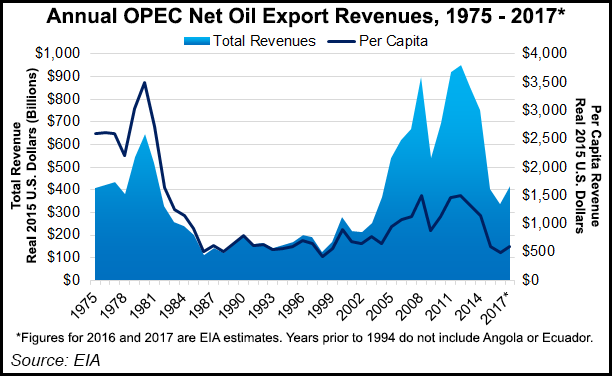

In a report released Tuesday, the EIA estimates that the cartel earned about $404 billion in net oil export revenues in 2015. That figure marks a 46.4% decline from 2014 ($753.7 billion) and a 57.5% decline from a peak in 2012 ($950.7 billion), in 2015 dollars. It is also the lowest mark for OPEC’s net oil export revenues since 2004, when it was $370.2 billion.

The outlook for 2016 is expected to be worse for a major revenue stream underpinning the economies of most of the OPEC nations. Based on projections of global oil prices and OPEC production from the EIA’s most recent Short-Term Energy Outlook (STEO), the cartel’s net oil export revenues are projected to fall another 16% ($66.1 billion), to $337.9 billion (see Shale Daily, June 7). If realized, it would be the lowest mark for that metric since 2003, when net oil export revenues totaled just $255.2 billion.

The EIA attributed the staggering loss in revenue to “a precipitous fall in average annual crude oil prices during the year, and to a lesser extent to decreases in the level of OPEC net oil exports.” The agency added that on a per capita basis, the cartel’s net oil export earnings are expected to fall by 17%, from a nominal $606 in 2015 to $503 in 2016.

“The long-term trend in per capita revenues doesn’t look good for OPEC countries who rely so heavily on them,” said NGI Market Analyst Nathan Harrison. “As a result of the recent downturn, it seems Saudi Arabia at least has gotten the message and has been publicly outlining plans to diversify its economy.”

The EIA added that “the expected decline in OPEC’s net export earnings is attributed to lower forecast annual crude oil prices in 2016 compared with 2015. The price declines are expected to more than offset OPEC’s increased production and exports in 2016.”

In its latest STEO, the EIA projects OPEC’s crude oil production will average 32.4 million b/d in 2016, an increase of 800,000 b/d from 2015. The latest projection excludes production from Gabon, a former cartel member that is expected to rejoin effective July 1.

Net oil export revenues are projected to rebound slightly in 2017. The EIA said that a nominal increase in revenues to $427 billion in 2017 could be attributed to “an increase in forecast crude oil prices, coupled with higher OPEC production and exports, contributing to the rise in overall earnings.”

The STEO shows glaring disparity among the cartel’s 14 members in terms of net oil export revenues. In terms of real 2015 dollars, Saudi Arabia led the field in revenues with $130 billion, followed by Iraq at a distant second with $57 billion and Kuwait with $40 billion. On a per capita basis, Qatar led the field at $18,658, followed by Kuwait with $12,133.

“History suggests a good recipe for dooming an organization, regime or even a country is to take a pie, shrink it dramatically, and divide the pieces very unevenly,” Liam Denning, an energy columnist for Bloomberg, wrote in a piece, “OPEC’s Chasm of Doom,” published online Wednesday. “That’s where OPEC finds itself today.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |