Most Points Higher In Weekly NatGas Trading; Futures North of $2.50

Weekly natural gas trading for the week ended June 10 wasn’t quite able to match the plump gains of the week before, but put in a fair showing nonetheless. The NGI Weekly Spot Gas Average rose a nickel to $2.11, but points outside the East, Rockies and California were about a dime higher.

The Midcontinent and Gulf Coast were well represented atop the leader board for the market points gaining the most. Oklahoma Gas Transmission (OGT), Enable West, Northern Border Ventura, and the Houston Ship Channel all posted gains of 13 cents. OGT rose to $2.15, Enable West made it to $2.23, and Northern Border Ventura jumped to $2.18. Houston Ship Channel came in at $2.28.

Northwest Sumas was the week’s poorest performer losing 31 cents to $1.50.

Regionally the Midcontinent was the strongest with an average gain of 12 cents and at the other extreme the Northeast dropped 2 cents to $1.74. California was unchanged at $2.26, and the Rockies inched higher by a penny to $2.04.

South Texas, South Louisiana, and the Midwest all gained a dime to $2.26, $2.28, and $2.25, respectively. East Texas added 11 cents to $2.27.

July futures vaulted 15.8 cents to $2.556, thanks largely to a slimmer-than-expected natural gas storage build report for the week ending June 3.

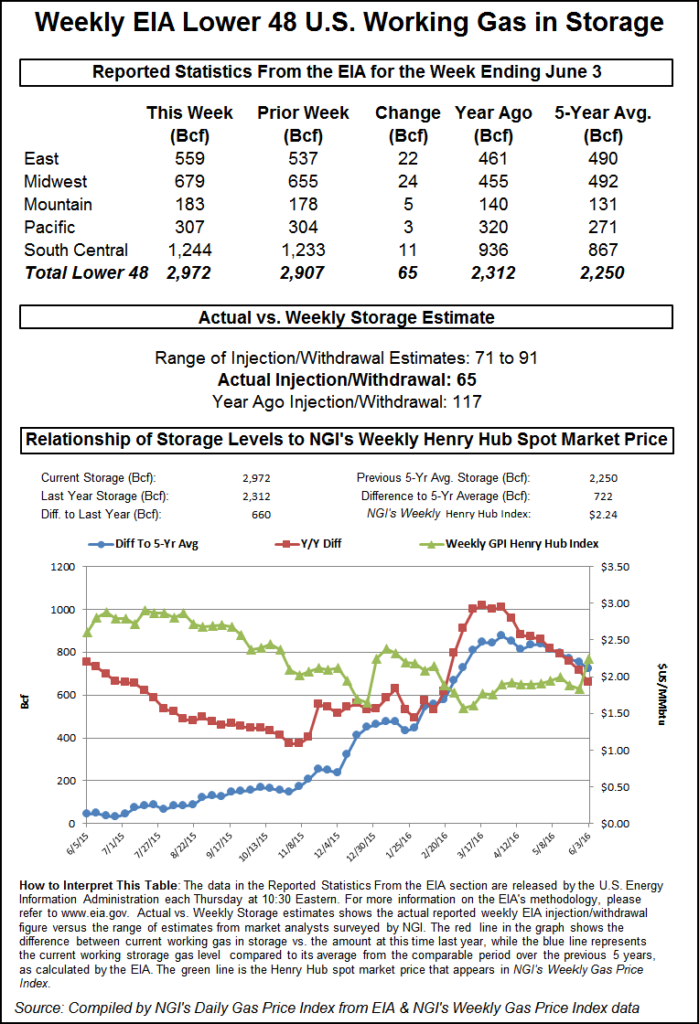

The bullish case for natural gas took center stage Thursday following the Energy Information Administration (EIA) storage report. After the EIA figures showed a thin build of 65 Bcf, about 13 Bcf less than anticipated, futures traders saw prices in a new regime. At the close Thursday July had added 14.9 cents to $2.617 and August was up a stout 14.6 cents to $2.690.

If the trading framework of one trader is correct, prices may be headed significantly higher. “Most of the day’s buying and selling took place after the release of the report and at the high end of the day’s range,” said a trader with FCStone Latin America in Miami. “$2.495 is an important price, and if the market can post a weekly settlement greater than $2.495, the next objective is $3.37.”

Others aren’t so sure. “I think this thing is a little overblown,” said a California trader. “You have to be careful buying the highs here, and there is still plenty of gas.

“The normal range for a nine-day RSI (Relative Strength Indicator) is 20, indicating oversold, and 80, showing overbought conditions. The RSI today is at 83.25. It’s a sale.”

The 65 Bcf came in significantly less than even the lowest estimates by traders and analysts. A Reuters survey of 20 traders and analysts revealed a range from 71 Bcf to as high as 91 Bcf.

Immediately after the figures were released July futures rose to $2.545 and prices continued rising from there. By 10:45 a.m. July was trading at $2.581 up 11.3 cents from Wednesday’s settlement.

“We were expecting a build of 74 Bcf to 78 Bcf, so this could be something of a game changer,” said a New York floor trader. “A lot of people got short ahead of the number and they got burned. It’s about a 70-30 split most of the time, and I don’t know why but they get short. I think they got out real quick and got a little long.”

“The smaller-than-expected 65 Bcf build for last week was also bullish relative to the 95-Bcf five-year average benchmark, confirming that the market is continuing to trend tighter on a seasonally adjusted basis, although total storage remains high,” said Tim Evans of Citi Futures Perspective. “The data for last week implies a somewhat tighter supply/demand balance relative to recent reports, with bullish implications for the reports to follow.”

Inventories now stand at 2,972 Bcf and are 660 Bcf greater than last year and 722 Bcf more than the five-year average. In the East Region 22 Bcf were injected and the Midwest Region saw inventories increase by 24 Bcf as well. Stocks in the Mountain Region rose 5 Bcf, and the Pacific Region was higher by 3 Bcf. The South Central Region added 11 Bcf.

Data errors and omissions and the holiday weekend aside the report raises the question of just how robust natural gas supply is in the wake of increased exports to Mexico, newly hatched LNG exports, and a plunging rig count.

Industry consultant Genscape cautiously notes that “Preliminary estimates of Lower 48 production show volumes have dipped to a 148-day low, though caution should be used as nomination revisions have been relatively large of late. In the past two weeks we’ve been seeing total daily nomination revisons ranging from -0.2 Bcf/d up to + 0.4 Bcf/d.

“[Thursday’s] Spring Rock Daily Pipe Production estimate is showing production below 72 Bcf/d for the first time since early January on a 0.67 Bcf/d day-over-day decline,” the company said in a morning note to clients.

Declines in the East were reported in northeast PA, Southwest PA, and Ohio, but declines were also seen in Texas, the New Mexico Permian, and Gulf of Mexico.

In Friday’s trading gas for weekend and Monday delivery rose as both gains in power prices and warm weekend temperatures were forecast for a good section of the Midwest.

Gains in the Midwest and Gulf outdid softer markets in the Northeast, Rockies and California. The NGI National Spot Gas Average rose 5 cents to $2.13. Futures consolidated gains after Thursday’s double-digit advance. At the close, July had fallen 6.1 cents to $2.556 and August had retreated 6.6 cents to $2.624.

Midwest quotes received a boost from strong next-day power pricing. On-peak Monday power at the Indiana Hub jumped $5.99 to $40.00, and peak power Monday at the PJM West terminal added $6.40 to $34.88/MWh.

Gas on Alliance gained 12 cents to $2.35, and deliveries to the Chicago Citygate also rose a dozen to $2.37. Gas on Consumers was quoted a dime higher at $2.36, and gas on Michigan Consolidated came in up 10 cents to $2.35.

The Tetco explosion in Southwest Pennsylvania knocked out service on a portion of Texas Eastern’s (Tetco) Penn-Jersey Line in the M3 Zone more than a month ago (see Daily GPI, June 8), but observers don’t see any major market disruptions although three pipelines still remain shut-in, limiting flows east of the Delmont Compressor station. The blast occurred off State Route (SR) 819 in Westmoreland County’s Salem Township, about 30 miles east of Pittsburgh, on a section of the system where four pipelines run parallel to one another.

“I don’t see any major market disruptions because of that,” said a Houston-based pipeline veteran. “I’m sure Tetco is trying to make it work as quickly as they can.

“It’s hard, though. What happens is that inspectors and those types all come in and say ‘you had a rupture here, so everywhere around here, 400 miles this way, 400 miles that way, (or whatever it is), you are going to be looked at.’ You are going to assume there are problems everywhere else.

“There’s pockets of deliverability [issues] and point-to-point stuff, but in general most of the economic routes are all full. The pattern is full,” he said.

Other market hubs were steady to higher. Gas on Dominion South changed hands at $1.53, up a penny, and parcels at the Henry Hub changed hands a dime higher at $2.41. Deliveries to El Paso Permian were flat at $2.12, and gas at the PG&E Citygate added two cents to $2.36.

Even with a down day Friday, futures traders were upbeat. “Probably older shorts are done and newer longs are in there, and they are in a good place,” said a New York floor trader. “As soon as the temperatures heated up, that was enough to turn it around.

“Probably $2.64 is the next resistance point and above that $2.69. If traders can close the market in the $2.60s on a pullback the next time we are above $2.58, longs will stay in, otherwise they will pull out.”

Fundamentals analysts are keeping an eye on the weather. “While some of this [storage] difference from most forecasts may have been holiday-related and could see some offset in next week’s report, the downsizing was large enough to suggest a bigger than anticipated coal-to-gas displacement, some lift in exports and a softer production than generally perceived,” said Jim Ritterbusch of Ritterbusch and Associates in a Friday morning report to clients. “But while considering such possibilities, we still feel that weather forecasts will continue to rule over the short term.

“While updates are looking less bullish than was the case 24 hours ago, CDDs still look higher than normal and should facilitate additional injections significantly downsized from normal and particularly reduced from a year ago. The market is already looking ahead to next week when current hot temps will likely show another contraction in the supply surplus in furthering a trend that could prove sustainable through much of the summer.”

Technical analysts see natural gas poised to advance another 25 cents but caution that the market is within a seasonal peaking window. “With $2.493-2.568 offering only minor resistance, the door is now open for a further advance to $2.763-2.854-2.870,” said Brian LaRose, a market technician with United ICAP.

“This next area of contention represents the 0.236 retracement of the $6.493 to 1.611 decline and 1.618 (A)=(C) up from the 1.611 low. Note, we strongly recommend keeping a very close eye on the rest of the petro complex for evidence of a seasonal top. Natgas could easily follow.”

Gas buyers with the responsibility for procuring supplies for weekend power generation across the Southern Power Pool will have to balance warm humid temperatures but also solid wind generation. “A midsummer-like pattern is expected,” said forecaster WSI Corp. in a Friday morning report. “An upper-level ridge and southerly wind will support above-average heat during the remainder of the week into the weekend, though an isolated thunderstorm cannot be ruled out each day. High temps will likely top out in the upper 80s and 90s across the entire power pool, [and] humidity levels will gradually creep up and push heat index values up into the 90s to low 100s.

“A weak frontal boundary and an upper-level low ejecting out of the Rockies will support an increasing chance of rain/storms late Sunday into early next week, likely causing the heat to relax. A south-southwest wind will support elevated wind generation during the forecast period. Output will likely peak at 6-9 GW.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |