E&P | NGI All News Access | NGI The Weekly Gas Market Report

Sidelined Projects Foretell Shortfall in Oil, NatGas Reserves, Say BP, Statoil Economists

The United States last year reinforced its position as the world’s largest natural gas and oil producer, “but don’t be fooled” by the comparative resilience because the sharp pullback in investments may foretell reserves shortfalls within a few years, BP plc’s chief economist said Wednesday.

Spencer Dale and Group CEO Bob Dudley spent more than an hour outlining the oil major’s annual Statistical Review of World Energy. Statoil ASA on Thursday also outlined its outlook for energy to 2040 in its annual Energy Perspectives 2016.

What’s changed most profoundly are the technology advances in the energy arena, which have boosted the range and availability of fossil fuels and alternatives. That technology, a lightning bolt for the unconventional revolution, also has unlocked profound energy efficiencies, which ironically have been a drag on consumption.

“This is truly the age of plenty,” Dale said. The U.S.-led revolution in onshore gas and oil production helped lift technically recoverable resources by 15% from 2014.

The United States last year set new record highs, both for gas and oil production, retaining its position as the world’s largest producer of gas, oil, renewables and nuclear power. Domestic gas production was 74.2 Bcf/d, while consumption, representing 31% of energy demand, also set a new record high at 75.3 Bcf/d. According to BP, the country also remained the world’s largest consumer of gas at 23% of global consumption.

“U.S. natural gas production increased by 3.7 Bcf/d in 2015, accounting for over 50% of global gas growth last year,” Dale said. Gas imports, meanwhile, fell by 0.7 Bcf/d to 2.6 Bcf/d, the lowest level since 1986. On the oil side, U.S. production increased by 1 million b/d to 12.7 million b/d, slower than in 2014, but still the world’s biggest increase. Net imports fell by 440,000 b/d to 4.8 million b/d — the lowest level since 1985.

“The U.S. shale revolution has unlocked huge swathes of oil and gas resources,” Dudley said. “And rapid technological gains have supported strong growth in renewable energy, led by wind and solar power. These advances meant that, despite the weakness of energy demand, oil, natural gas and renewable energy all recorded solid growth in 2015.”

Global gas consumption rose by 1.7%, up significantly from 2014’s anemic 0.6% increase, but it still was sharply below the 10-year average of 2.3%. A mild winter in North America and Europe were to blame for the sputtering output, Dale said.

Even with the big slump in commodity prices, output worldwide remained solid, albeit at slower levels than in year’s past.

“But don’t be fooled,” Dale said during the presentation, which was webcast. “This comparative resilience of other types of production is largely a matter of timing. Investments in oil and gas related projects is estimated to have fallen by around $160 billion in 2015 at around a quarter off in 2014 level, which is the largest proportionate fall since the late 1970s. And capital has continued to fall sharply this year.

Some of the reduction in “has been matched by cost deflation, but the lower levels are invested in oil never to be de-tracked from future supply growth.

“Indeed, a key issue for the next few years is the impact this reduction in capital expenditure will have on future output growth and the risk that this will cause the oil market to tighten excessively.”

With all of the events of the past 18 months, the combination of stronger oil demand worldwide and the smaller increase in supply should have “gone a long way” in rebalancing the global markets, Dale said.

“I said prices work. But that wasn’t all that happened last year.” For instance, the Organization of the Petroleum Exporting Countries (OPEC) increased supply by 1.6 million bbl to a new record high, lifted by a surge in output of OPEC members Iraq and Saudi Arabia, which accounted for most of the increase.

“Based on current trends it seems likely that the market will move broadly into balance in the second half of this year,” Dale said. “But to be clear, that doesn’t mean the problem is solved. It simply means that the problem in terms of growing oil stocks stops getting worse.”

The “really big issue” for the next three to five years is the very significant fall in investment spending of the order of around $160 billion…around the quarter of investment levels relative to 2014.

“It looks like we saw another reduction of around $50 billion this year. So, investment spending by the end of this year will be around a third lower than it was in 2014.”

A “comparable” decline in investment spending is “back 30 years,” during the market decline in the 1980s. “At the same time, we’ve also seen very significant cost deflation,” Dale said. BP and its peers are acknowledging cost reductions since prices collapsed in 2014 of 20-25%. Capital expenditure spend also has fallen sharply, averaging 30-35%.

“That implies perhaps that the overall reduction in real investment spending is significantly less than that headline number would imply but still substantial,” he said. “And what we know from history is the impact of that investment spending…will gradually build up through time. Its impact…certainly isn’t visible in the 2015 data and would be very visible in this year’s data, or build up in 2017, ’18, ’19, and ’20.

“So, the question will be how big an impact will that have on supply growth? In the world where demand continues to grow relatively steadily, what risk would that have in terms of leading the market to tighten excessively? I don’t have a punchline to that; I don’t have a clear sort of simple answer to that, but it’s something we’re spending an awful lot of time thinking about because the magnitudes here are significant and implications that can have over the sort of the near term, sort of the three, four, five-year cycle of the oil market I think are very important.”

Exploration and production upstream investments always have been keyed to maximize shareholder value. And push has come to shove, Dudley said.

“You’ve certainly seen us respond with the lower prices to the amount of capital investments we’re making in the upstream right now,” he said. Organic capital spend during 1Q2016 was $3.9 billion, versus year-ago spend of $4.4 billion (see Daily GPI, April 26). Total organic capex this year is pegged at around $17 billion, and if low oil prices continue, 2017 spend is expected to average $15-17 billion. That compares with about $24 billion in 2013 spending, when oil prices were averaging $90-100/bbl.

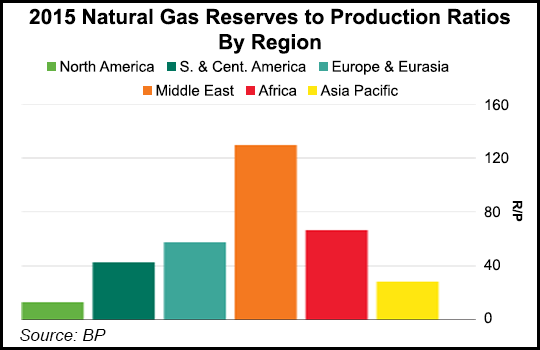

BP has a reserves-to-production life of “only 12 years,” the CEO said. “So, if we produce all of our reserves, in our production, in 12 years, we would not have any reserves any more. So, it isn’t the 50-year world for us. So, when people talk about stranded assets, we have lots of time to adjust to the price signals, to price of carbon, and regulation to be able to modify our portfolio over the many decades ahead. We’ll still have somehow oil and gas longer term projects. But, we make decisions constantly to adjust.”

Statoil, which has substantial North American stakes onshore and offshore, said large investments are required to offset falling output from existing fields — even if energy efficiencies have reduced demand.

“There is a lot of oil in storage, but within two to three years markets will be tightening significantly,” Statoil chief economist Eirik Waerness said. “The question is whether the pace of investment is sufficient to deliver the new supply that is needed. You can’t rule out that you’ll get a price spike.”

Existing global fields today “are nowhere near being able to produce what we need in 2040,” he said. “There’s a gap that needs to be filled.”

Output from currently producing fields worldwide is forecast by Statoil to decline by 2040 to 20-50 million b/d from last year’s 95 million b/d, assuming an annual production decline of 3-6%.

And if global oil demand were to decline to only 80 million b/d by 2040, producers still would need to find and develop fields with additional production capacity of 30-60 million b/d to fill the supply gap from aging fields, Waerness said.

As of March, the oil and gas industry since November 2014 has deferred or canceled an estimated $270 billion of projects, according to Rystad Energy. The consultancy said most of the deferrals involved high-tech projects once seen crucial to sustaining energy supply. IHS Inc. also has estimated that the energy industry spent about 15% less in 2015 year/year on research and development.

A study by Wood Mackenzie warns that the global oil market could face a supply shortfall of 4.5 million b/d by 2035 if exploration success doesn’t improve. Researchers said recent discoveries have proved disappointing, with the volume of liquids discovered every year down by half between 2008 and 2015.

Discoveries made during the 2000s, which were significant, have secured medium-term oil supplies, but unless exploration improves, continued supply growth longer term could be unsustainable. Wood Mackenzie used its proprietary database to analyze more than 7,000 conventional fields discovered since 2000.

“In the last four years the industry has seen disappointing — largely gas prone — exploration results, with the volume of liquids discovered annually falling from around 19 billion bbl between 2008 and 2011 to 8 billion bbl between 2012 and 2015,” said Wood Mackenzie’s Andrew Latham, vice president of exploration research. “The price downturn has resulted in large reductions in exploration spend and activity levels have been significantly impacted; just 2.9 billion bbl of liquids were discovered globally in 2015.

“We currently expect the industry to invest $40 billion per year in exploration and appraisal over 2016 to 2018 — less than half its investment during 2012 to 2014.”

The shift by industry toward exploring “smaller, near-term opportunities,” including unconventional fields onshore, which have lower costs and shorter lead times, “now means that fewer large, high risk frontier finds are likely to be made in the near term,” Latham said.

Wood Mackenzie estimated that more than 10% of global liquids supply by 2035 will be sourced from conventional volumes yet to be discovered, with North America, Africa and Latin America accounting for around 60% of the volumes.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |