Markets | NGI All News Access | NGI Data

Bulls In Driver’s Seat Following Thin Natural Gas Storage Build

Natural gas futures bounded higher Thursday morning after the Energy Information Administration (EIA) reported a storage injection that was far less than what traders were expecting.

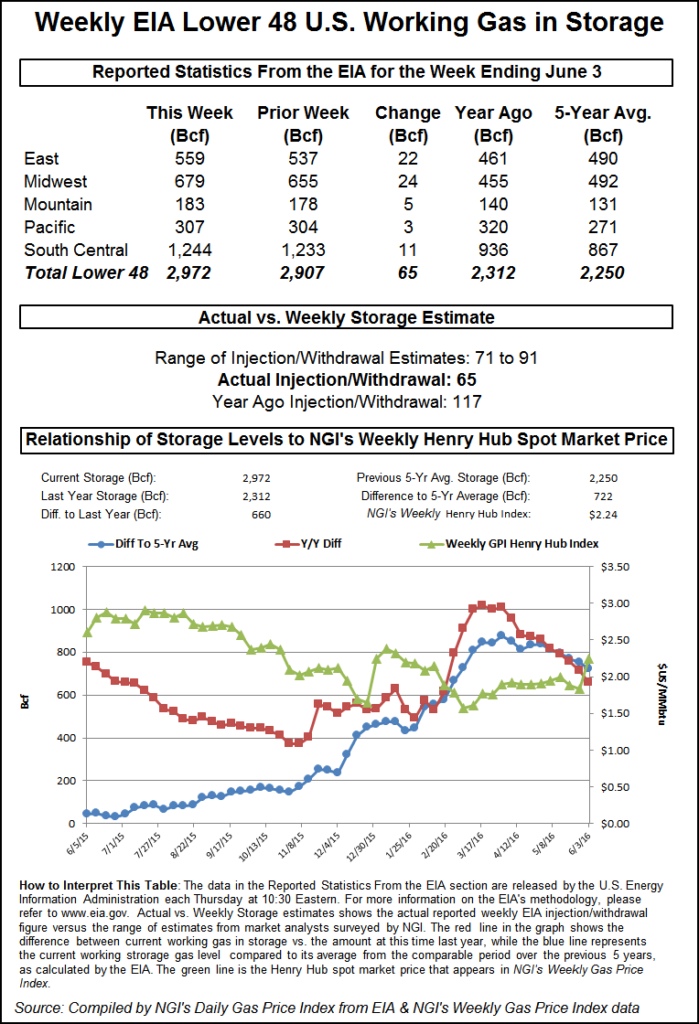

EIA reported a 65 Bcf storage injection in its 10:30 a.m. EDT release, about 13 Bcf less than what traders were anticipating. July futures rose to $2.545 immediately after the figures were released, and prices continued rising from there. By 10:45 a.m. July was trading at $2.581 up 11.3 cents from Wednesday’s settlement.

“We were expecting a build of 74 Bcf to 78 Bcf, so this could be something of a game changer,” said a New York floor trader. “A lot of people got short ahead of the number and they got burned. It’s about a 70-30 split most of the time, and I don’t know why but they get short. I think they got out real quick and got a little long.”

“The smaller-than-expected 65 Bcf build for last week was also bullish relative to the 95 Bcf five-year average benchmark, confirming that the market is continuing to trend tighter on a seasonally adjusted basis, although total storage remains high,” said Tim Evans of Citi Futures Perspective. “The data for last week implies a somewhat tighter supply-demand balance relative to recent reports, with bullish implications for the reports to follow.”

Inventories now stand at 2,972 Bcf and are 660 Bcf greater than last year and 722 Bcf more than the five-year average. In the East Region 22 Bcf was injected, and the Midwest Region saw inventories increase by 24 Bcf as well. Stocks in the Mountain Region rose 5 Bcf, and the Pacific Region was higher by 3 Bcf. The South Central Region added 11 Bcf.

Salt cavern storage was unchanged at 370 Bcf, while the non-salt cavern figure rose 11 Bcf to 874 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |