NatGas Cash Firm, But Futures Soften After Posting New Near-Term High

Spot gas for Thursday delivery held firm in Wednesday’s trading as strength in the Midcontinent, Midwest and Gulf were able to counter weakness in eastern markets. The NGI National Spot Gas Average added 3 cents to $2.13.

Futures managed to post another high for the move, which began in March, with July hitting $2.501, but at the close the prompt-month contract ended up slipping six-tenths of a penny from Tuesday’s finish to $2.468, and August was lower by 1.3 cents to $2.544. July crude oil gained 87 cents to $51.23/bbl, the first close above $51 since July 2015.

Gas for delivery at Midwest points was higher, as next-day power in the region proved supportive. Intercontinental Exchange reported that on-peak Thursday power at the Indiana Hub rose $1.14 to $28.18/MWh.

Gas on Alliance gained a couple of pennies to $2.25, and packages at the Chicago Citygate changed hands 3 cents higher at $2.26. Deliveries to Michcon also came in 4 cents higher at $2.27, while gas on Consumers was quoted 3 cents higher at $2.27.

A soft next-day power environment made it difficult for eastern quotes to climb into positive territory. Intercontinental Exchange reported that on-peak power at the ISO New England’s Massachusetts Hub fell $2.19 to $19.12/MWh, and next-day peak power at the PJM West Hub shed $1.28 to $25.09/MWh.

Gas at the Algonquin Citygate fell 21 cents to $1.93, and deliveries to Iroquois Waddington were seen 4 cents lower at $2.18.Gas on Tennessee Zone 6 200 L lost 18 cents to $1.88.

Deliveries to Tetco M-3 were off 9 cents to $1.63, and gas bound for New York City on Transco Zone 6 eased a nickel to $1.66.

Consulting firm PIRA Energy sees a firm cash market and by extension, a supported futures market.

“Nymex price volatility had been muted, due in large part to residual weakness still plaguing the physical markets in all regions, particularly in the case of Henry Hub (HH) in the South,” said PIRA in a note to clients. “Both futures and cash prices, however, should heat up sooner rather than later with the cooling season now getting underway.

“While U.S. storage inventories are more akin to Labor Day than Memorial Day, especially in the South Central, seasonally stronger electric generation loads will highlight the increased structural reliance on gas-fired EG and help stifle congestion worries — for the time being at least. As a result, a stronger bid should underpin cash prices not just for Henry Hub, but across the South despite ongoing challenges facing the Midwest and Northeast.”

Market bulls may take solace in longer-term weather forecasts.

“Once hot high pressure sets up over the central and southern U.S. in the next several days, we expect it to hold over large stretches of the country in some fashion well into the second half of June,” said Natgasweather.com. “This will result in above-normal temperatures by several degrees over many regions.

“The exceptions will be the Northwest and Northeast corners due to weather systems. With highs of upper 80s to lower 100s expected to expand in coverage, natgas demand for cooling will become moderate to strong for this time of the year, especially across Texas and the central and southern U.S.”

Tim Evans of Citi Futures Perspective expected the market Wednesday to “continue to consolidate within the higher levels reached on Monday, with support from a moderately warmer temperature forecast offset by some profit taking,” ahead of Thursday’s Energy Information Administration storage report for the week ended June 3.

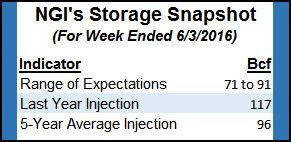

Evans is forecasting a storage build of 76 Bcf, and since that is well below the 96 Bcf five-year average, it’s a positive for prices.

“While the storage trend remains directionally supportive, we also see risk of a technical correction back to the $2.20-2.25 level in the weeks ahead as inventories remain much higher than a year ago,” he said.

Other estimates of for the storage report include JP Morgan, with an estimated 74 Bcf injection, and Ritterbusch and Associates with an 87 Bcf build. A Reuters survey of 20 traders and analysts revealed a 78 Bcf increase with a range of 71 Bcf to 91 Bcf. Last year a stout 117 Bcf was injected.

Market technicians versed in Elliott Wave and retracement analysis aren’t looking for a correction and favor a continuation of the slow but steady grind higher.

United ICAP’s Brian LaRose said his firm sees “$2.493-2.568 as the gatekeeper. This zone marks (A)=(C) up from the $1.611 low in flat price and (A)=(C) up from the $1.939 low in the July contract. If this area of contention can halt the ascent, we will need to entertain the case for a completed ABC advance off these lows. If it cannot, then $2.763-2.854-2.870 becomes our next objective. At this time we have little reason to favor peaking action.”

In the near-term, the National Weather Service is expecting modest increases in cooling requirements. For the week ended June 11, NWS is forecasting New England will see 19 cooling degree days (CDD), or 11 more than normal. New York, New Jersey and Pennsylvania are expected to experience 21 CDD, or two above its seasonal norm, and the greater Midwest from Ohio to Wisconsin is forecast to take on 31 CDD, or three above its normal tally.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |