Markets | NGI All News Access | NGI Data

Weekly NatGas Cash And Futures Bound Higher As Weather Regime Changes

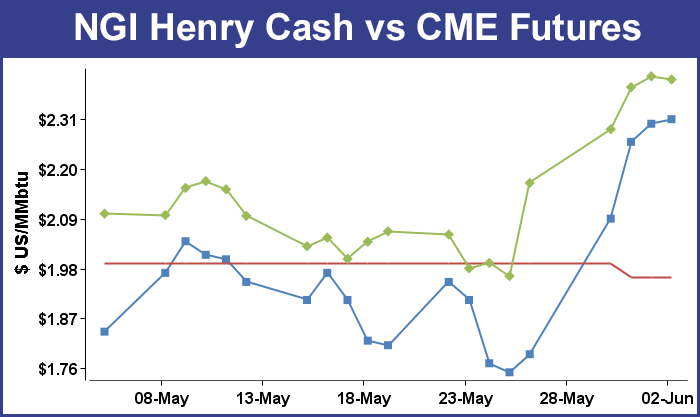

It was off to the races for weekly gas quotes for the week ended June 3. Not one point followed by NGI fell into the loss column and most points were up 20-30 cents or more.

Weather forecasters early in the week expected a broad ridge of high pressure to move eastward from California and prompt warm temperatures to settle in underneath as it moved east.

The NGI Weekly Spot Gas Average surged 32 cents to $2.06 and July futures gained comparable territory as well. Algonquin Citygate did flirt with the loss column and was the week’s softest point with a rise of just 2 cents to $2.01. At the other end of the scale, Florida Gas Transmission Citygate zoomed higher by 64 cents to $2.79.

Regionally, the Northeast gained the least with a rise of 13 cents to $1.76, and California managed to grab the top spot on the leader board with an advance of 48 cents to $2.26.

The Midcontinent rose 30 cents to $2.04 and the Midwest added 32 cents to $2.15. East Texas posted a hefty gain of 37 cents to $2.16.

Both South Texas and South Louisiana rose 38 cents to $2.16 and $2.18, respectively and the Rocky Mountains were right behind California with an advance of 41 cents to $2.03.

July futures jumped 22.9 cents to $2.398.

The primary market driver Thursday was the Energy Information Administration (EIA) storage report. The EIA reported a storage build of 82 Bcf, about 3 Bcf shy of market expectations and at first prices sagged. By the end of the session, however, July had risen 2.4 cents to $2.405 and August was up 2.9 cents to $2.482.

The addition of 71 Bcf into storage the week before may have signaled the end of sub-par injections. The 71 Bcf injected was well below the five-year pace of 97 Bcf, but this week looked different. Last year at this time, a stout 126 Bcf was added, and the five-year average currently stands at 98 Bcf.

Tim Evans of Citi Futures Perspective was on the high side of estimates with 96 Bcf, and he expected the year-on-five year surplus to drop from its current 769 Bcf to 732 Bcf by June 17. “[T]his fundamental price trend tends to limit the downside for prices and often translates into higher prices over the intermediate term, just as the higher lows registered last week and Tuesday’s price rally tend to confirm.”

Industry consultant Bentek Energy’s flow model was right on target with an 82 Bcf estimate. IAF Advisors also came in with an 82 Bcf estimate, and a Reuters poll of 18 traders and analysts showed an average 85 Bcf with a range of 72 to 96 Bcf.

Inventories now stand at 2,907 Bcf and are a robust 712 Bcf greater than last year and 753 Bcf more than the five-year average. In the East Region 26 Bcf were injected and the Midwest Region saw inventories increase by 26 Bcf as well. Stocks in the Mountain Region rose 7 Bcf, and the Pacific Region was higher by 6 Bcf. The South Central Region added 17 Bcf.

Analysts see the current levels in July futures as consistent with a seasonal advance and hint that prices, futures at least, may not have much room to move higher.

“$2.42 to $2.49, be careful up here,” said Walter Zimmermann, vice president of United ICAP. “We’ve just had an average seasonal winter to spring rally. We may get more than average, but we got more than what most people considered wildly impossible.

“At this point it’s like is that it? Or do the shorts really, really get crushed? That would be the next [price] leg higher and would be a disaster for these shorts. The other argument for going a little bit higher is that the higher you go the more likely you are to sell off into late August early October.

“The holiday guide to trading natural gas is sell Thanksgiving, buy Martin Luther King Day, sell Mother’s Day, buy Labor Day and then sell Thanksgiving again. We are into that window of sell Mother’s Day buy Labor Day. The higher the pre-season rally carries the more likely those highs are to discount the bullish case for summer demand and to set you up for a decline into the end of the summer.

“The issue is have we flushed out enough shorts to give us a spring to summer decline?” he queried.

In Friday’s trading physical natural gas prices for weekend and Monday delivery eased as supplies are abundant and traders saw little need to commit to three-day deals.

Minimal gains in the Midwest were no match for broad weakness in California, the Rockies and Gulf Coast. The NGI National Spot Gas Average dropped 4 cents to $2.08, but losses in the Rockies and California approached a dime as power generation concerns eased.

Futures trading was uninspired, with prices easing less than a penny. The July contract fell seven-tenths of a cent to $2.398 after trading at a new high of $2.454, and August drifted lower by six-tenths of a cent to $2.476. July crude oil fell 55 cents to $48.62/bbl.

California prices led the way lower in spite of temperatures at some spots expected to hit triple digits over the weekend. AccuWeather.com forecast that the high Friday in Sacramento of 103 degrees would hold for Saturday before easing to 99 by Monday. The normal high in Sacramento is 85. Burbank’s Friday high of 93 was also expected to continue Saturday before easing Monday to 81. The seasonal high in Burbank is 78.

Gas for weekend and Monday delivery at Malin fell 8 cents to $2.14, and deliveries to the PG&E Citygate shed 6 cents to $2.36. Packages at the SoCal Citygate were quoted 8 cents lower at $2.37, and gas priced at the SoCal Border Avg. changed hands 9 cents lower at $2.19. Gas on El Paso S Mainline also fell 9 cents to $2.19.

Other market hubs were mixed. Gas bound for New York City on Transco Zone 6 dropped 18 cents to $1.65, and deliveries to the Chicago Citygate added a penny to $2.20. Gas at the Henry Hub was seen at $2.31, up a penny, and gas on El Paso Permian fell four cents to $2.10.

In spite of the warm temperatures forecast for California, CAISO reported lower peak loads. Peak load Friday was expected to reach 37,507 MW but Saturday was seen 36,597 MW. Monday on-peak power prices were also steady. Intercontinental Exchange reported Monday on-peak power at NP-15 fell 53 cents to $31.03/MWh, and peak power at SP-15 added 13 cents to $31.64/MWh.

For the moment, healthy power demand in California hasn’t caused much difficulty as gas-fired generation and the grid seem to be holding up well. Although real-time power prices Thursday jumped as high as $414/MWh late in the day at SP-15, [with] “the power demand on the grid and the restriction due to Aliso Canyon, the grid seems to be holding up just fine,” said EnergyGPS, a Portland OR-based energy consulting firm, in a Friday morning report.

“We will see Diablo Canyon return to service this weekend as it is currently ramping up. This will add another 1,150 MW to the grid as baseload energy. On the weather front, it will be hard pressed to get this type of widespread heat again this summer. We will continue to watch the California market as the summer is not over, but for now things look to be in good shape.”

Analysts are finding a case for futures prices making it above $2.50 to be difficult. “[S]hort-covering appears to be a major ingredient behind this week’s sharp advance, and it would appear that the shorts will remain on the defensive today ahead of a weekend that could bring some additional strong CDD deviations from normal,” said Jim Ritterbusch of Ritterbusch and Associates in a Friday morning report to clients.

“But at the end of the day, we still feel that the gas market will need to recognize a sizable supply surplus against averages of around 750 Bcf or around 35% given a substantial cushion that will mitigate the impact of occasional hot spells or an early start to the hurricane season.

“But despite the fact that we are viewing this week’s advance to an overreaction to seemingly minor shifts in the balances, we cannot deny an improved chart picture that is forcing speculative shorts to run for cover. Our ability to maintain a short position could be challenged [Friday]. However, constructing a case for sustainable values above the $2.50 mark is extremely difficult within the context of a major storage surplus that may see only limited contraction next week.”

Forecasters are calling for a mixed temperature outlook. “Above-average warmth is expected to expand out of the West into the much of the central and southern U.S. during the six-10 day period,” said WSI Corp. in its Friday morning outlook. “Near to below average anomalies will be limited to the Northeast, South Texas and the Pacific NW. [Friday’s] forecast is warmer than yesterday’s forecast across the Rockies, Plains and Midwest.

“The Northeast and West Coast are cooler. CONUS PWCDDs are down 0.8 to 41.5 for the period.”

Gas buyers in charge of weekend purchases for power generation across the broad PJM footprint will have only modest wind generation to work with. WSI Corp. said, “A weak cold front will continue to sweep across the Mid Atlantic [Friday] with a chance for showers and storms. A second frontal system will sweep across the power pool during the weekend with the chance for additional showers and thunderstorms. Storms may be strong to severe across the Mid Atlantic. It will become breezy and seasonably cool behind this system with highs in the upper 60s, 70s to low 80s during Sunday through early next week.

“Light and changeable wind generation is expected through early Saturday. Output will fluctuate between 1-2 GW. A west-northwest wind behind the second frontal system will boost wind gen. late Saturday into early next week. Output may top out in excess of 4 GW.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |