Markets | NGI All News Access | NGI Data

Bulls Yawning After Release of Natural Gas Storage Stats

Natural gas futures rose and then fell Thursday morning after the Energy Information Administration (EIA) reported a storage injection that was somewhat less than what traders were expecting.

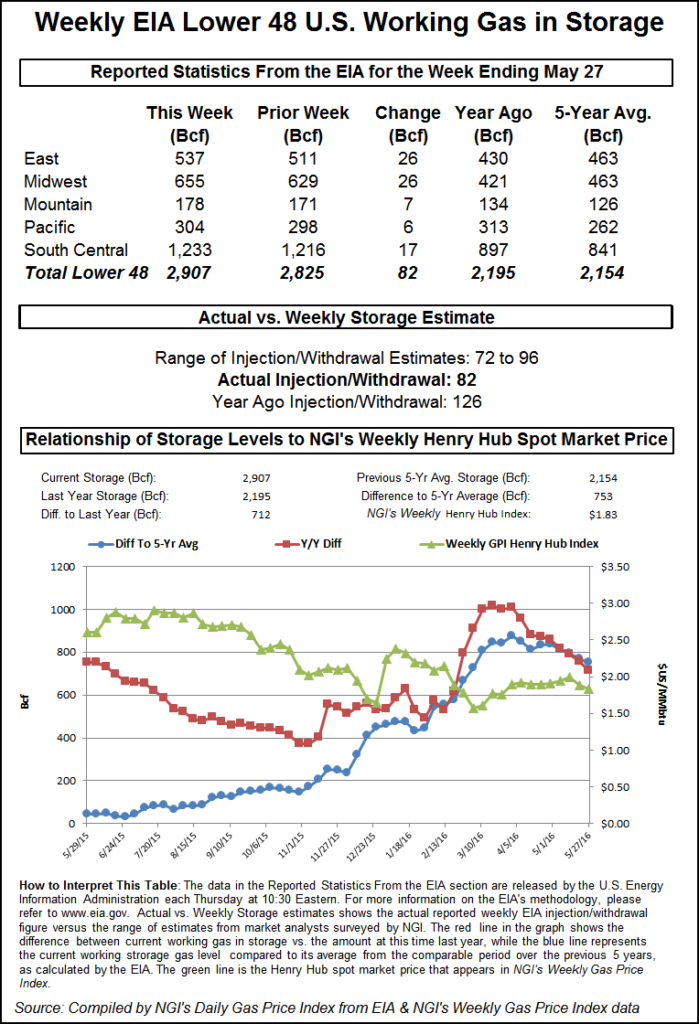

EIA reported an 82 Bcf storage injection in its 10:30 a.m. EDT release, about 6 Bcf less than what traders were anticipating. July futures rose to a high of $2.413 shortly after the figures were released, but by 10:45 a.m. July was trading at $2.375, down six-tenths of a cent from Wednesday’s settlement.

“We are not getting the big injections we used to, so that may be a good sign for this market,” a New York floor trader told NGI. “$2.50, here we come!”

Analysts see a bullish tone to the numbers. “The 82 Bcf net injection into storage for last week was slightly less than the consensus view and below the 98 Bcf five-year average for the date, and so at least somewhat supportive for prices,” said Tim Evans of Citi Futures Perspective. “The build was also well below our model’s 96 Bcf forecast, and so will translate into a more bullish baseline for the reports to follow.”

Inventories now stand at 2,907 Bcf and are a robust 712 Bcf greater than last year and 753 Bcf more than the five-year average. In the East Region 26 Bcf was injected, and the Midwest Region saw inventories increase by 26 Bcf as well. Stocks in the Mountain Region rose 7 Bcf, and the Pacific Region was higher by 6 Bcf. The South Central Region added 17 Bcf.

Salt cavern storage was lower by 2 Bcf to 370 Bcf, while the non-salt cavern figure rose 19 Bcf to 863 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |