Markets | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Record-High Power Burn to Spur Summer NatGas Demand Growth, According to NGSA

The electric sector will generate record natural gas demand this summer, pushing overall gas demand 4 Bcf/d higher than last year, the Natural Gas Supply Association (NGSA) said in its annual summer outlook report released Wednesday.

But after factoring in weather, the economy, production and storage, NGSA said it projects overall downward price pressure for summer 2016 despite record demand. The 2016 summer outlook mirrors last year’s report, which predicted that the balance of record highs in both production and demand would not lead to higher prices (see Daily GPI, June 4, 2015).

“When NGSA weighed the various factors, the picture that emerged for the upcoming summer is one of remarkable growth in demand,” NGSA President Dena Wiggins said. “Even with record-setting demand expected, production is projected to be abundant. With more than enough supply to meet demand, we anticipate downward pressure on prices compared to last summer.”

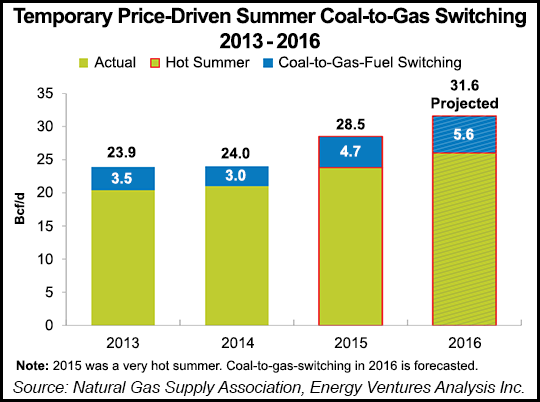

Combined customer demand — including the industrial, electric and residential and commercial sectors — will average 69.2 Bcf/d for summer 2016, compared with 65.1 Bcf/d last summer, NGSA said, citing research by Energy Ventures Analysis Inc. (EVA). The electric sector will account for most of the year/year demand growth, reaching 31.6 Bcf/d compared with 28.5 Bcf/d in summer 2015, according to EVA.

NGSA said the continued increase in natural gas power burn reflects both “a significant increase in permanent coal-to-gas switching due to retiring coal plants compared to the previous summer and an increase in temporary coal-to-gas switching.”

Temporary coal-to-gas switching will account for 5.6 Bcf/d of demand this summer (compared with 4.7 Bcf/d last summer), a figure that is “all the more remarkable in light of the fact that, prior to the shale revolution, coal-to-gas switching had never lasted longer than a few days at a time,” NGSA said. “In contrast, switching has now persisted for eight consecutive summers since 2008.”

The 2016 projections follow a banner year for gas demand growth in the power sector in 2015 (see Daily GPI, March 8).

Based on forecasts from the the National Oceanic and Atmospheric Administration, EVA expects the 2016 summer cooling season (April-October) to be 8% warmer than the 30-year average and have 1,339 cooling degree days (CDD), rivaling last summer’s 1,373 CDD.

Industrial demand will increase slightly to 19.8 Bcf/d this summer, compared with 19.5 Bcf/d in 2015, while residential and commercial demand will be essentially flat year/year, according to EVA.

Sluggish economic growth this summer won’t help gas prices, NGSA said. Citing research from IHS Economics, NGSA said U.S. gross domestic product (GDP) is expected to grow by just 1.4% over last summer, when it saw 2.4% year/year growth. The manufacturing sector is expected to contract by 0.1% this summer after expanding by an “unimpressive” 0.7% last summer, NGSA said. Lower unemployment and low energy prices have contributed to high consumer confidence, however, NGSA said.

A storage glut also figures to negatively impact gas prices this summer. Inventories were 67% higher than last year entering the 2016 summer cooling season, NGSA said.

“Going into the winter heating season, EVA projects that 3,875 Bcf of natural gas will be in storage by the end of the 2016 injection season, which would require an average weekly injection of 44 Bcf,” NGSA said. “This level of injection is relatively small for the industry and is much less than last summer’s average weekly injections of 81 Bcf. The difference in the size of the weekly injections between the two summers is expected place significant downward pressure on natural gas prices this summer.”

This comes as production is expected to reach 74.7 Bcf/d this summer, on par with the 74.6 Bcf/d produced last summer. Increased efficiencies, a drilled but uncompleted well backlog and improved takeaway capacity — along with newly-completed legacy offshore wells — will keep production strong this summer despite a decrease in drilling activity, NGSA said.

Also affecting the production outlook this summer will be Canadian imports (forecast to increase to 5.3 Bcf/d from 5.1 Bcf/d last summer), liquefied natural gas exports (expected to hit 0.2 Bcf/d this summer) and exports to Mexico (4 Bcf/d this summer, compared with 3.1 Bcf/d last summer).

In its Short-Term Energy Outlook last month, the Energy Information Administration raised its natural gas price forecast to an average of $2.25/MMBtu Henry Hub in 2016, with prices expected to “gradually rise through the summer, as demand from the electric power sector increases” (see Daily GPI, May 10).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |