Markets | NGI All News Access | NGI Data

June NatGas Fades Fast Following ‘Slightly Bearish’ EIA Storage Data

Natural gas futures slumped Thursday morning after the Energy Information Administration (EIA) reported a storage injection for the week ending May 20 that was somewhat greater than what the market was expecting.

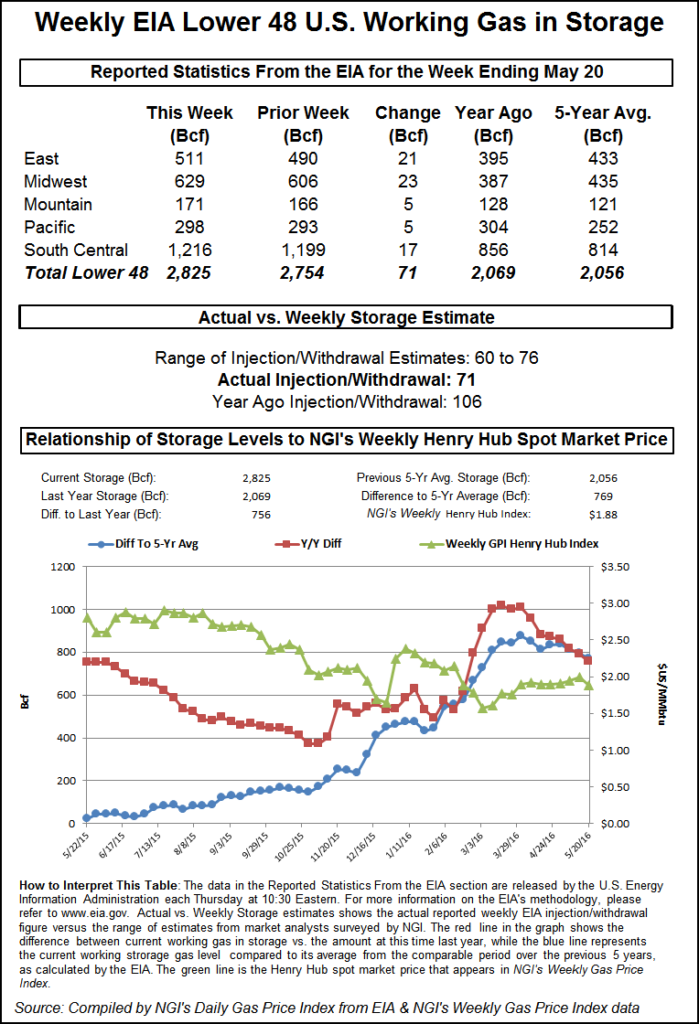

EIA reported a 71 Bcf storage injection in its 10:30 a.m. EDT release, about 3 Bcf more than what traders were anticipating. The expiring June futures contract dropped to a low of $1.914 shortly after the figures were released, and by 10:45 a.m. June was trading at $1.935, down 5.7 cents from Wednesday’s settlement.

“I don’t think there is a strong intention to force it [the market lower]. The market is just drifting with a lean towards the downside,” a New York floor trader told NGI.

Citi Futures Perspective Analyst Tim Evans deemed the report “slightly bearish” when compared to industry expectations, but added that the build was actually supportive when compared to last year’s 106 Bcf build for the week and the five-year average addition of 97 Bcf.

“The 71 Bcf net injection for the week ended May 20 was slightly more than the consensus expectation but still supportive compared to the 97 Bcf five-year average for the date,” said Evans. “The data followed a bullish surprise in the prior week, suggesting that there may have been some temperature swings at the margin between the two periods. Overall, this could be a modest bearish correction to what had been signs that the background supply-demand balance was tightening.”

Inventories now stand at 2,825 Bcf and are a stout 756 Bcf greater than last year and 769 Bcf more than the five-year average. In the East Region 21 Bcf was injected, and the Midwest Region saw inventories increase by 23 Bcf. Stocks in the Mountain Region rose 5 Bcf, and the Pacific Region was higher by 5 Bcf as well. The South Central Region added 17 Bcf.

Salt cavern storage was higher by 1 Bcf to 372 Bcf, while the non-salt cavern figure rose 16 Bcf to 844 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |