NatGas Cash Eases, Futures Squeak Higher Ahead of Expected Lean Inventory Data

Physical natural gas worked lower on Wednesday for Thursday trading as shoulder season temperature patterns gave buyers little incentive to make incremental purchases and a screen that had trouble holding $2 was also uninspiring. Modest gains in the Northeast were unable to offset weakness in the Rockies, Gulf, Midcontinent, and Texas, and the NGI National Spot gas average slid 9 cents to $1.68.

Futures tried but failed to get back on top of $2.00 on the day ahead of June futures expiration, despite expectations that Thursday morning’s storage injection report for the week ending May 20 was expected to come in well short of historical comparisons for the week. At the close, June settled 1.2 cents higher at $1.992, and July came in 3.5 cents higher at $2.181. July crude oil added 94 cents to $49.56 following a favorable inventory report.

Not only did the National Avg. drop 9 cents, but the Henry Hub and several market points in the Midcontinent posted new 30-day lows.

The Henry Hub fell to $1.77, solidly below its 30-day low of $1.81. The last time Henry Hub gas changed hands at that level was April 18.

Gas on ANR SW squeaked under its 30-day low of $1.62 with a $1.61 trade, but deliveries on Texas Eastern M1 24 were quoted at $1.68 — light years under its 30-day low of $1.83.

Elsewhere, gas on OGT was quoted at $1.60, a nickel under its 30-day minimum, while in the West, gas at Kingsgate also was seen 8 cents under its 30-day low at $1.34.

Gas in the Marcellus gained relative to its downstream market points on the REX Zone 3 Expansion. Marcellus points were seen flat to a couple of pennies lower, but interconnects on REX Zone 3 in Indiana and Illinois fell close to a dime.

Deliveries to Dominion South were unchanged at $1.48, and gas on Tennessee Zn 4 Marcellus fell 2 cents to $1.38. Deliveries to Transco-Leidy Line were also off a couple of pennies to $1.38.

Parcels on REX Zone 3 at the NGPL junction in Moultrie County, IL tumbled 9 cents to $1.72, and packages on REX at the Midwestern Pipeline interconnect in Edgar County, IL skidded 8 cents to $1.73. Gas on Panhandle Eastern at the Putnam County, IN point on REX was quoted at $1.74, down 8 cents also.

Traders said Wednesday’s fall under $2.00 could have been the result of options strategies making the call options worthless should the June contract settle under $2.00 at the options expiration.

Analysts expect sub-average storage builds to continue.

“While U.S. seasonal demand for natural gas may be at a low ebb, allowing nearby futures to revisit the $2.00 level, we continue to see enough cooling demand to limit storage injections to something less than five-year average rates,” said Citi Futures Perspective analyst Tim Evans. He is projecting a build of 60 Bcf in Thursday’s Energy Information Administration storage report, well below seasonal averages. Under Evans’ assumptions of weather, the current 795 Bcf five-year surplus is expected to be whittled down to 734 Bcf by June 10.

“The declining surplus confirms the market is becoming tighter on a seasonally adjusted basis, a supportive fundamental trend,” he said. “This prospect may not be sufficiently compelling to prevent the price weakness we’ve seen over the past two sessions, but should certainly help to limit the downside over the intermediate term in our view,” he said in closing comments to clients.

Evans is holding a long position in July futures initiated earlier at $2.105 with a protective stop at $2.115.

Cooling demand near-term in major population centers is seen above average, according to National Weather Service (NWS) forecasts. For the week ending May 28, NWS expects New England to see eight cooling degree days (CDD) or five more than normal. The Mid-Atlantic is predicted to experience 22 CDD, or 13 above normal, and the greater Midwest from Ohio to Wisconsin is forecast to endure 36 CDD, or 19 more than its seasonal norm.

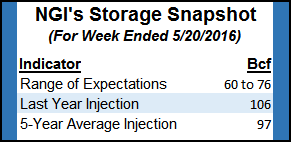

Thursday’s inventory report is expected to continue the trend of below average storage builds. Supplies currently stand 791 Bcf more than last year and 795 Bcf above the five-year pace. Last year a stout 106 Bcf was injected, and the five-year average is for a 97 Bcf increase.

This week’s build isn’t expected to come close. IAF Advisors is looking for a 65 Bcf build, and ICAP Energy calculated a 66 Bcf increase. A Reuters survey of 20 traders and analysts revealed a 68 Bcf build average with an injection range of 60 Bcf to 76 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |