E&P | NGI All News Access | NGI The Weekly Gas Market Report

United States Again Largest Producer of Petroleum, NatGas Hydrocarbons in 2015, EIA Says

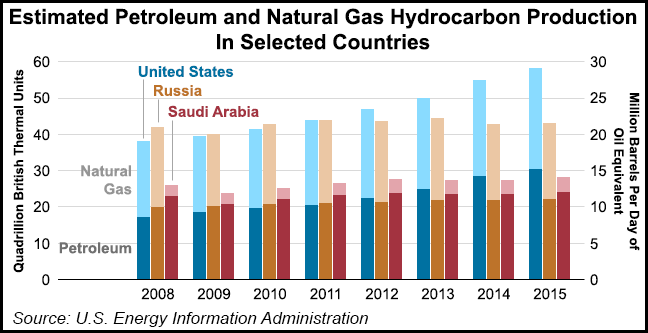

The world’s top producer of petroleum and natural gas hydrocarbons last year was, once again, the United States, according to the U.S. Energy Information Administration (EIA).

U.S. petroleum and other liquid fuels production is expected to decline from 15.0 million b/d in 2015 to about 14.5 million b/d in both 2016 and 2017, according to EIA’s latest Short-Term Energy Outlook (STEO), which was released earlier this month (see Daily GPI, May 10). Russian liquid fuels production, which was estimated at 11.0 million b/d last year, is expected to remain at about that level through 2017.

“Despite low crude oil prices and a 60% drop in the number of operating oil and natural gas rigs, U.S. petroleum supply still increased by 1.0 million barrels per day in 2015,” EIA said. “U.S. natural gas production increased by 3.7 Bcf/d, with nearly all of the increase occurring in the eastern United States.” Increases in U.S. petroleum and natural gas production over the past several years are directly attributed to production from tight oil and shale gas formations, the agency said.

U.S. petroleum and natural gas production first surpassed Russian production in 2012 (see Daily GPI, June 13, 2013). The United States has been the world’s top producer of natural gas since 2011 and the world’s top producer of petroleum hydrocarbons since 2013, EIA said.

For the United States and Russia, total petroleum and natural gas hydrocarbon production is almost evenly split between petroleum and natural gas, while Saudi Arabia’s production heavily favors petroleum.

In the United States, crude oil and lease condensate accounted for roughly 60% of the total petroleum hydrocarbon production in 2015, while 20% of production was natural gas plant liquids, EIA said. Biofuels and refinery processing gain made up most of the remaining U.S. petroleum and other liquids production volumes.

“Several factors kept hydrocarbon production increases in Russia smaller than increases in the United States in 2015,” EIA said. “Although Russian petroleum production continued to increase, natural gas production declined because of poor economic conditions and a mild winter, which resulted in lower domestic demand for natural gas. Russia’s total combined production of petroleum and natural gas increased by just 0.1 quadrillion Btu in 2015.”

Saudi Arabia did not reduce petroleum production in late 2014 or 2015, even as oil prices fell and global inventories of oil rose. As a result, Saudi Arabia’s total petroleum and natural gas hydrocarbon production rose by 3% in 2015. The United States produced more than twice the petroleum and natural gas hydrocarbons as Saudi Arabia in 2015.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |