Markets | NGI All News Access | NGI The Weekly Gas Market Report

Supportive Storage Report Fails to Vault NatGas Forwards Into the Black

Natural gas forwards markets were lower across the board between May 13 and 19, falling by an average of nearly 7 cents, despite getting a boost from a bullish storage report, according to NGI’s Forward Look.

The Nymex June contract lost 5.8 cents during that time, and it would have fallen more had it not been for a late-week 3.8-cent bump that came the day the U.S. Energy Information Administration reported a 73 Bcf build in storage inventories for the week ending May 13.

The 73 Bcf increase was smaller than the market consensus of 79 Bcf and indicates that market conditions are tightening as it was below last year’s 92 Bcf year-ago injection for the same week.

But the overall downward trajectory over the past week appears to suggest that tightening conditions are not enough to calm the market’s fear of record storage levels and the possibility of reaching maximum capacity by the end of the injection season.

U.S. working gas in storage is now at 2,754 Bcf, which is 40.6% above the five-year average of 1,959 Bcf, and 40.3% above last year’s level of 1,963 Bcf.

“While it has taken some time, it looks like the market has come around to our fear that the slow start to the injection season was not as structural as hoped,” said Societe Generale’s Breanne Dougherty, a natural gas analyst.

As cooler weather for much of May in several key consumption regions has kept residential/commercial loads in check, Dougherty said it could be challenging to maintain buoyancy on the demand side of the ledger over the next few weeks.

“It is not that recent demand isn’t good for this time of year, but it isn’t outperforming enough to provide confidence in a sustained soft injection trajectory through the rest of summer. The 4.25 Tcf storage capacity limit is clearly weighing on the market’s mind,” Dougherty said.

The good news, she said, is that production has been soft.

“We like the tilt down to the low 71 Bcf/d range and feel good about how it will help keep balances reined in through summer. The extent of our bullishness on 2017 hinges on the evolution of that tilt post summer,” Dougherty said.

Production on May 20 was reported to be around 70.5 Bcf/d.

Meanwhile, weather patterns are expected to remain bearish for the next couple of weeks as several weather systems track across the United States, bringing heavy showers and thunderstorms.

Overall, it is expected to be slightly warmer than normal over the northern and eastern United States and near to slightly cooler than normal over the West and South due to the slow-moving systems, according to forecasters at NatGasWeather.

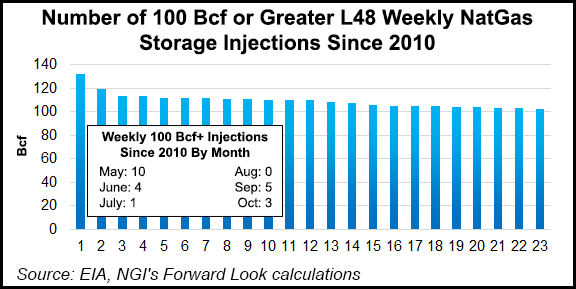

Despite the bearish weather patterns, weekly builds to storage will continue to struggle to exceed +100 Bcf this shoulder season, NatGasWeather said.

Weekly builds exceeded +100 Bcf four times in the spring of 2015 and eight times in the spring of 2014, the forecaster said.

“This highlights a tighter supply picture where builds should be expected to continuously underperform compared to the past few years, and also against five-year averages, highlighted by next week when the build is expected to come in well under the five-year [average] of +97 Bcf,” NatGasWeather said.

And while supplies are still quite hefty, surpluses versus the five-year average are likely to decline steadily in the months ahead, it said.

The weak storage builds, and production levels coming in near lows of the year, make the case for higher for natural gas prices.

“Therefore, if Lower 48 state production drops below 70 Bcf/d (today about 70.3), or when hotter temperatures start showing up in the weather data, these could serve as catalysts for higher prices,” NatGasWeather said.

It’s possible some volatility could be seen in the next week in the forwards market as bidweek commences and the market looks ahead to the Memorial Day holiday.

For this week, however, the bearish sentiment was apparent throughout the curve.

For the period between May 13 and 19, the Nymex was down 5.8 cents for June, 4.9 cents for July, 4.4 cents for the balance of summer (July-October) and 3 cents for the winter 2016-2017 strip.

On a national level, prices fell an average 6.7 cents for June, 5.8 cents for July, 5.2 cents for the balance of summer and 3 cents for the winter 2016-2017, according to Forward Look.

New England prices, however, posted more substantial losses at the front of the curve as temperatures have averaged below normal so far this spring, an interesting development considering the record warm winter.

Algonquin Gas Transmission (AGT) citygates June prices dropped 17.4 cents between May 13 and 19 to reach $2.23, while July plunged 17.7 cents to $2.82. The balance of summer was down 16 cents to $2.72, Forward Look data shows.

The weakness comes as power burn estimates for the Northeast are averaging 4.9 Bcf/d, 1.1 Bcf/d below 2015, according to Bentek Energy. The decline is largely attributed to the below-average temperatures that have lowered regional power demand, while sustained low gas prices indicate that regional fuel-switching potential may be exhausted.

Northeast temperatures in May have averaged 57 degrees F month-to-date, almost 3 degrees below normal. May 2015, on the other hand, started off almost 6 degrees warmer than normal, averaging 66 degrees month-to-date in the Northeast, Bentek said.

Further out the forward curve, however, Algonquin continues to reel from the recent slew of blows related to infrastructure development in the Northeast, including the denial of a water permit to Constitution Pipeline and Kinder Morgan’s suspension of work on the Northeast Energy Direct project.

AGT’s prompt-winter strip jumped 13 cents between May 13 and 19 to reach $6.34, winter 2017-2018 rose 9 cents to $6.28 and the winter 2018-2019 climbed 11 cents to $6.25, according to Forward Look.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |