E&P | NGI All News Access | NGI The Weekly Gas Market Report

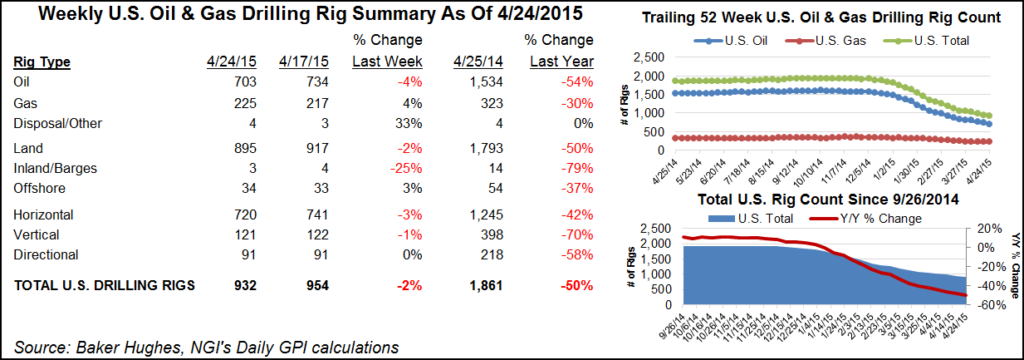

Pace of Rig Decline Stabilizing

The U.S. land rig count fell by a modest seven units in the latest tally by Baker Hughes Inc. (BHI).

Changes across major plays were modest compared with the previous week. The Permian Basin picked up three rigs to end at 137 active, while the Haynesville added one unit, bringing its tally to 14. The Cana Woodford also saw a gain; two rigs were added, bringing its total to 29.

In its previous survey, for the week ending May 13, BHI said nine rigs left U.S. play, six from land (see Daily GPI, May 13).

In the latest count, while Texas was hit with the departure of eight more rigs, seven actually returned to action in Louisiana. Louisiana had 47 rigs running, and Texas was left with 173 after its most recent decline.

The Barnett dropped three rigs, bringing its tally to two units by BHI’s count. Last month, RigData, which also counts active rigs, put a goose egg by the Barnett in the active rig column (see Daily GPI, April 29).

Cowen and Company also has its own methodology for counting active rigs. In a Thursday note, it said its land rig tally added four units to end at 377, marking the second week to realize an increase. “We expect weekly changes in the rig count will be choppy in coming months similar to last summer,” analyst Marc Bianchi and colleagues wrote.

According to BHI, at week’s end, there were 375 active U.S. land rigs out of 404 total U.S. actives. Of the 404, 318 were oil-directed and 85 were focused on natural gas after two gas rigs departed and oil rigs stood pat.

Four directional units were added, bringing that tally to 42, while one horizontal and five vertical units left, leaving 314 and 48, respectively. Three rigs were added in the inland waters and two joined the offshore fleet, making for a net decline of two rigs for the United States overall.

Since the previous week, only one natural gas rig was added in Canada, bringing that tally to 27; oil-directed rigs up north stayed put at 16.

“Despite falling AECO prices, Canadian production has continued to be resilient,” Barclays Commodities Research analyst Nicholas Potter said in a Monday note. “Data from Canada’s National Energy Board show production reaching a peak of about 15.6 Bcf/d in March. A mix of production shut-ins due to low cash prices and a lack of drilling activity should, however, result in falling Canadian production this summer.

“NEB projections show production bottoming in September at about 15.3 Bcf/d, a 364 MMcf/d drop from peak production in March.” That could be conservative, Potter said, noting the low gas-directed rig count.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |