Bulls Uninspired by Lean Storage Injection

Natural gas futures worked lower Thursday morning after the Energy Information Administration (EIA) reported a storage injection that was somewhat lower than what the market was expecting.

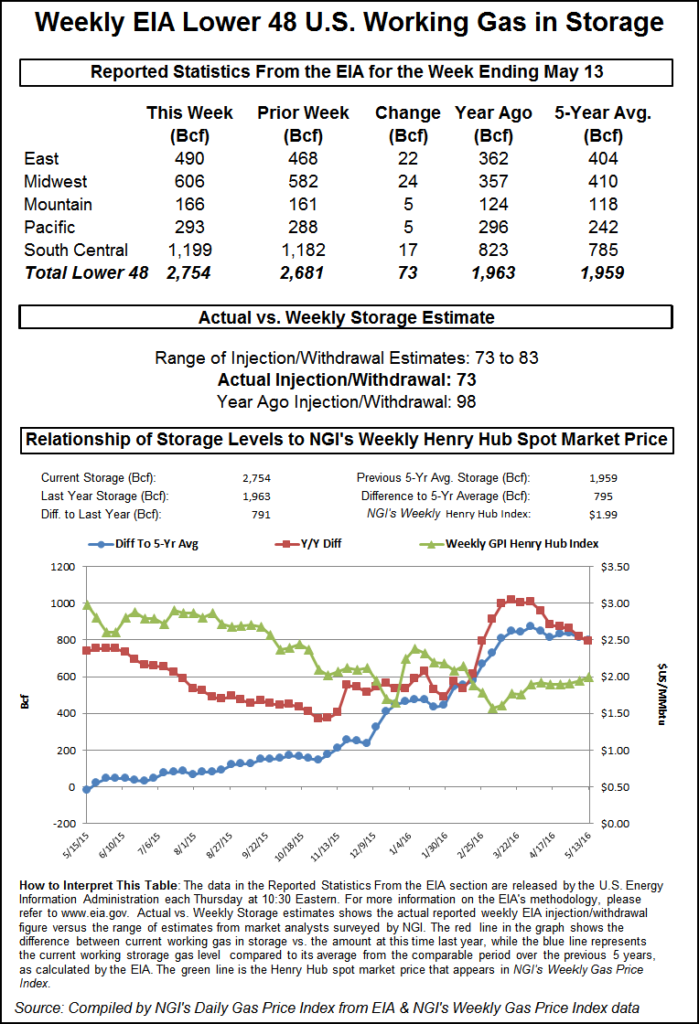

EIA reported a 73 Bcf storage injection in its 10:30 a.m. EDT release, about 5 Bcf less than what traders were anticipating. Curiously, June futures dropped to a low of $1.952 shortly after the figures were released, and by 10:45 a.m. June was trading at $1.981, down 2.0 cents from Wednesday’s settlement.

“We were hearing a 78 Bcf increase, but the market was poised to fail when it couldn’t break through that $2.18 to $2.19 area,” a New York floor trader told NGI. “The market should have a half-hearted rally to $2.01 to $2.03 and then close lower on the day.”

“The smaller-than-expected build in DOE storage implies some tightening of the background supply-demand balance,” said Tim Evans of Citi Futures Perspective. “The data was also bullish relative to the 91 Bcf five-year average refill, trimming the year-on-five-year average storage surplus.”

Inventories now stand at 2,754 Bcf and are a robust 791 Bcf greater than last year and 795 Bcf more than the five-year average. In the East Region 22 Bcf was injected, and the Midwest Region saw inventories increase by 24 Bcf. Stocks in the Mountain Region rose 5 Bcf, and the Pacific Region was higher by 5 Bcf. The South Central Region added 17 Bcf.

Salt cavern storage was higher by 3 Bcf to 371 Bcf, while the non-salt cavern figure rose 15 Bcf to 828 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |