E&P | NGI All News Access | NGI The Weekly Gas Market Report

Texas Again Leads Rig Declines, But Canada Sees Comeback

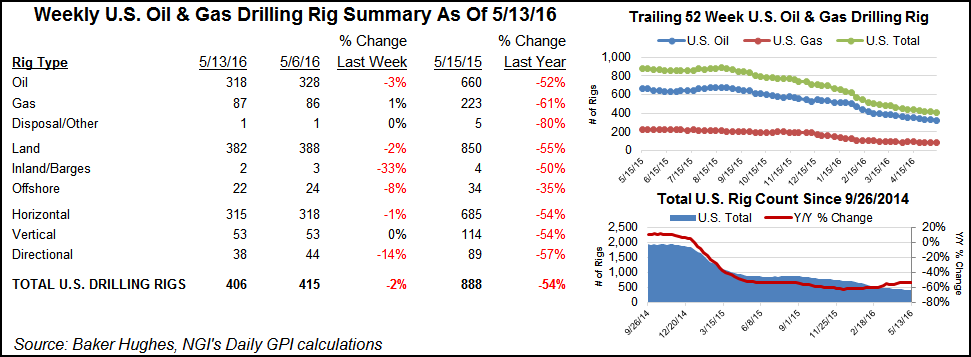

In its survey for the week ending May 13, Baker Hughes Inc. said nine rigs left U.S. play (six from land, one from the inland waters and two from the offshore). That compares with the preceding week when only five U.S. units departed (see Daily GPI, May 6).

In the latest U.S. tally, 10 oil-directed rigs left, offset by the return of one natural gas-directed rig. Six directionals left, joined by three horizontal units while vertical units remained in place.

Texas reprised its role as the biggest loser, giving up seven units, and the Permian did another turn in that same category, giving up five units, easily exceeding declines seen in other plays.

According to the Federal Reserve Bank of Dallas, the Permian Basin region shed 15,000 jobs last year, but it was holding steady during the first quarter and continuing to give 164,000 workers something to do.

The week ended with 406 rigs still running in the United States, with 318 of them targeting oil, 87 focused on gas, and one “miscellaneous” rig doing something. Of the 406 active units, 382 were operating on land.

To the north, Canada’s spring break-up appears to be ending (see Daily GPI, March 18) as the week saw the return of five oil and two natural gas rigs, bringing its operating tally up seven to rest at 43.

In Texas, drilling permits and well completions are still down compared with year-ago activity. The Railroad Commission of Texas (RRC) issued a 683 original drilling permits in April compared to 848 in April 2015. The most recent tally included 473 permits to drill new oil or gas wells, 12 to re-enter plugged wellbores and 198 for recompletions of existing wellbores. There were 209 oil, 36 gas, 403 oil or gas, 25 injection, zero service and 10 other permits issued in April.

Also in April, RRC staff processed 873 oil, 120 gas, 49 injection and five other completions compared to 1,867 oil, 314 gas, 125 injection and one other completions in April 2015. Total well completions for 2016 year to date are 4,499 down from 8,253 recorded during the same period in 2015.

“More with less” is still the theme for producers and the analysts who follow them. “…[E]fficiencies continue to drive cost thresholds lower, production holding up better than expected and guided higher (for same or less capital), and activity ramp may be sooner than we expected,” Wells Fargo Securities analysts said in a recent wrap-up of first quarter earnings season thoughts.

“Every E&P now has the playbook, and messaging of efficiency gains and exceeding type curves were commonplace in 1Q results season…” BMO Capital Markets analysts said in their own note.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |