Bakken Shale | E&P | NGI All News Access

Bakken’s 1 Million b/d Production Unlikely to Hold

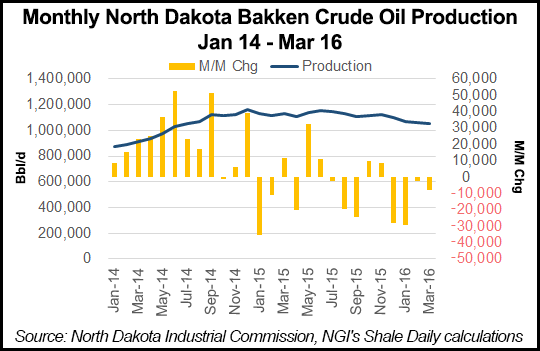

With the number of uncompleted wells continuing to rise in the Bakken Shale, it is doubtful the 1 million b/d production level can be maintained into next year, North Dakota chief oil/natural gas official Lynn Helms said Thursday in releasing the state’s latest production statistics.

Noting that he expected a bigger drop than 10,000 b/d in the latest statistics for March, Helms, director of the state’s Department of Mineral Resources, said he expects future months to show reductions in the 30,000-35,000 b/d range.

Given the continuing low commodity prices, “I keep expecting the kinds of [oil] production declines we saw in December and January,” Helms said. “Perhaps the small increases we have seen in oil prices and the problems with Canadian oilsands production has strengthened people’s resolve a little bit, because we’re still seeing ever-higher inactive and uncompleted well counts.

“We should start seeing drops of 30,000 b/d to 35,000 b/d. I continue to wait for that shoe to drop. You can’t have too many months at 27 rigs and less than 60 completions a month and maintain production, so I still think we are looking at 1 million b/d or slightly below that by the end of the year.”

Overall oil production was 34.38 million bbl (1.10 million b/d) in March, compared to 32.4 million bbls (1.11 million b/d) in February. The Bakken’s all-time monthly high was 1.22 million b/d in December 2014.

Conversely in March, natural gas production was up about 1% at 53 Bcf (1.7 Bcf/d), compared to 48.9 Bcf (1.68 Bcf/d) in February. Helms attributes the increasing gas production as oil production drops to the fact that low prices have forced producers to focus only on the Bakken core area or sweet spot for all 27 rigs still operating.

“That area has the highest gas-to-oil ratio,” Helms said. “The wells there also are the most productive [3,000 b/d], and the gas-to-oil ratios are two to four times what they are in other areas.

“Gas production continues to increase, and, fortunately, the operators have invested in a lot of gathering and processing infrastructure in the core, so that is why you see the enormous amounts of gas now being captured [90% for most recent month]. I think you have to credit 100% of the increased capture to increased investment in infrastructure and technology,” he said.

Another offshoot of the continuing low commodity prices is that the cost of drilling wells has been reduced dramatically, Helms said, adding that this in turn has increased the number of counties now in which it is economic to drill new wells. In some cases the new economic favorability is only found in certain parts of the county.

“Drilling and operating costs combined have dropped about 65%,” Helms said. “So this makes the economics a little bit better, and it speaks to what the industry has been saying — above $60/bbl WTI, the Bakken is the best place to spend money.”

Bakken natural gas prices were $1.57/Mcf in March for deliveries into the Northern Border Pipeline at Watford, ND, an 11-cent/Mcf increase.

Rigs dropped from 40 in February to 29 in April and 27 on Thursday, the lowest North Dakota rig count since July 2005. There were 13,024 producing wells in March, up by seven from February and 920 wells were awaiting completion at the end of the month in which 1,523 wells were inactive, an increase of 84 since February.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |