E&P | NGI All News Access | NGI The Weekly Gas Market Report

No Rigs, No Problem as E&Ps Boost Output With DUCs, Shuttered NatGas

Drilling efficiencies and lower oilfield service costs helped many cash-poor U.S. producers overcome commodity price hurdles during the first quarter, and while natural gas was not the main theme for most, operators appear more bullish than they have in months.

This year, most exploration and production (E&P) companies said they plan to finish a big backlog of drilled but uncompleted (DUC) wells rather than drilling new ones, while they stand ready to increase activity at the first signs of sustained higher oil and gas prices.

Shale natural gas and oil productivity by the E&Ps is key, Goldman Sachs analyst Brian Singer said. During the quarterly conference calls, E&Ps kept pointing to completion efficiencies and their heightened know-how in the Permian Basin and Oklahoma’s stacked reservoirs. But there is also evidence that producers are hitting the “like” button more on their U.S. gas reserves, as domestic output eclipsed Goldman’s expectations for 2016.

“While we raised our U.S. oil production forecasts by 1%, we revised up our U.S. natural gas estimates for covered companies by 2%,” Singer wrote. “Interestingly, the revisions were largely not seen at the gassy E&Ps but rather among international diversified oils, North American diversifieds and oily E&Ps…”

What that means is that more E&Ps that aren’t necessarily weighted to gas are bringing back previously curtailed production in Appalachia — above and beyond the “traditional” gas players. In addition, the “production mix shifted gassier,” such as in the Bakken Shale because of more infrastructure and in some cases driven by oil declines. Oklahoma’s Sooner Trend in the Anadarko Basin, mostly in Canadian and Kingfisher Counties — the STACK — also lifted gas production because of productivity and activity gains, he said.

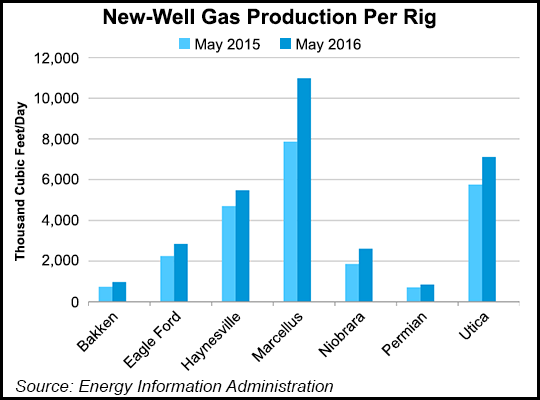

“Continued Appalachia productivity gains and companies’ ability to extend drilling/completion efficiency into legacy plays has helped contribute to the resiliency of U.S. gas production,” Singer said. Those gains, he said, also correlate to Energy Information Administration data so far this year.

DUCs Waiting in the Wings

And in fact, if only the DUCs were finished, and the spigot was turned back on for the shuttered gas in Appalachia, production growth y/y would be sustained from 2015 levels, without adding any rigs, according to an analysis by Genscape Inc.

Since late 2014, Northeast producers have reacted to low gas prices by reducing rig counts, shutting in active production and building up DUC inventories, Genscape’s Equity Insight Group reported. The group estimated about 914 MMcf/d of gas now is shuttered, mostly by Chesapeake Energy Corp. and National Fuel Gas Co. (NFG), which have Marcellus Shale wells in northeastern Pennsylvania (see Shale Daily, May 5; May 3).

“Our daily production estimates indicate these shut-in volumes have been (and will continue to be) first to come online when prices improve,” Genscape analysts said. And producers are beginning to work down their DUCs for the first time in a year, they said.

The first quarter “saw DUC inventories fall, decreasing by 84 wells from the end of 4Q2015,” Genscape said. Cabot Oil & Gas Corp., EQT Corp., NFG and Southwestern Energy Co. were estimated to have brought down their Marcellus DUC inventory by 45 total from the end of December, while Range Resources Corp. completed 15% more wells than in the year-ago period (see Shale Daily, May 3; April 29a; April 28; April 22).

Cabot CEO Dan Dinges during the conference call said the producer would be able to “economically grow our natural gas production in 2017” without a lot of rigs or fracture crews because of the “quality of rock that we have.”

Cabot and the other members of the Appalachian gas wrecking crew are the reason that Genscape is forecasting a 13% y/y increase in Northeast production. “We expect further DUC inventory reductions ahead, given some moderate strengthening of forward curve prices,” Genscape analysts said.

For instance, Southwestern management has said the company can remain cash flow positive and work through DUC inventories with a 25 cent/Mcf increase in forwards. And another gassy Appalachian player, Consol Energy Inc., said last month it plans to reduce its DUC inventory to 73 from 109 by end of this year (see Shale Daily, April 26). Consol’s Marcellus partner Noble Energy Inc. also indicated that completions are loaded to the first half of this year.

“Cabot currently has 54 DUCs in Northeast Pennsylvania and plans on bringing that down to 15 by completing about 40 wells for the remaining part of the year,” Genscape said. “Similarly, NFG currently has 82 DUCs and plans on bringing it down to 60-65 by end of September.”

Meanwhile, in the sister Utica Shale, Hess Corp. doesn’t plan to add rigs but instead plans to “spend the rest of the year relying on their DUC inventory to maintain (or slightly increase) its current production levels” (see Shale Daily, April 29b).

Price Rebound in 2017?

The U.S. gas markets “could see a sharp late-year upward move on tightening supply/demand conditions and more normal storage,” said Jefferies LLC analysts. “Supply is cracking (finally) amid severe underinvestment and worsening Northeast infrastructure bottlenecks…We remain gas bulls, estimating prices of $3.50/4.00 in 2017/longterm. Weather induced spikes above our forecast appear likely in many years.”

It’s back to the “days of ‘spikes and roses,'” the Jefferies analysts said. “We think the U.S. natural gas ‘set-up’ could be exceedingly bullish in 4Q2016-plus, with potential winter spikes well above our $3.50/MMBtu 2017 view. Why? The storage surplus is likely to be shed materially during refill season (our supply/demand factor model now shows Nov. 1 storage at 4.1 Tcf), production is falling, and capital formation and regulatory conditions for infrastructure are challenged.”

Producers can’t just turn on the gas taps if prices rise, Jefferies analysts argue. “There is no argument here that vast quantities of low-cost gas resource exist in the U.S. onshore, but activation times measure at least six-to-nine months from the ‘time zero’ capital investment decision.” Jefferies’s updated 21-basin gas supply model shows 2016 production down 6.4% from 2015. Of note, preliminary March data showed a 1 Bcf/d month/month decline.

However, don’t underestimate the Marcellus Shale, said Morningstar Inc. analyst Mark Hanson. If gas prices were to increase to $3.50/Mcf, the play would be “insanely attractive…It would only take 15 or 20 more rigs to ramp up production in a meaningful way.”

Regardless, the gas bulls will need hot temperatures this summer to boost power plant demand, according to Wells Fargo.

“There’s always the risk of lower prices,” Wells Fargo analyst Gordon Douthat said. With a “cool summer, we’re going to start to have concerns about high stockpiles.”

The “big picture takeaway” overall from the quarterly results seemed fairly straightforward, as efficiencies drove cost thresholds lower, particularly in the key plays, while production was trending higher “with what appears to be a potential ramp coming starting mid-year,” according to Wells Fargo. David Tameron said the E&P management comments were more positive than in quarters past.

The bottom line is, “we walk away from the quarter feeling micro good (company specific) but macro bad.” The “overwhelming production trend has been beating expectations and raising the full-year outlook,” with 22 of the 29 E&Ps covered by Wells Fargo reporting higher than consensus production even with lower spend and activity.

“Importantly, the source of savings is mixed with operators citing service costs, drilling efficiencies and facilities costs driving capital efficiency,” Tameron said. “While it’s different for every operator, we estimate that on average 30-40% of the cost savings generated during this commodity trough are permanent in nature and likely to persist as we transition to a recovery. This is important because it implies that project returns at $60/bbl are now competitive with those in prior operating environments when oil was $100/bbl, indicating a structural industry shift with clear macro implications.”

Tudor, Pickering, Holt & Co. (TPH) still is updating its models based on 1Q2016 results, but onshore production appears to be “biased 1-2% higher” than internal forecasts, driven by growth in natural gas liquids (NGL), with natural gas “closest to our expectations.” Analysts previously had modeled their coverage group production for natural gas to decline by 2% year/year (y/y) and NGLs to fall by 5%, while oil was expected to be down 9%.

“On gas, we think the combination of shut-ins during 2Q2016 and an already conservative forecast shouldn’t materially change our 2 Bcf/d y/y declines,” TPH analysts said. “Given drilling efficiency gains and asset level improvements, the lowest cost operators in our coverage are now able to hold production flat y/y within cash flow at $45/bbl versus $50/bbl previously.”

Producers Ready to Pounce

Haynesville Shale-focused Memorial Resource Development Corp., 73% weighted to gas, is waiting for a sign to ramp it up. Average production in 1Q2016 increased 52% y/y to 420 MMcfe/d, including 306 MMcf/d of gas. If prices strengthen, watch out, CEO Jay Graham said. A big focus would be the DUCs.

“Just go back and look at history of gas prices,” Graham told analysts. “When they move, they move abruptly. They don’t gradually move. And so we’re sitting here, things seem to be turning.” With the rig count in the Marcellus and the Utica, “they can’t sustain the production that they have.” So when the produced gas begins cycling through the system, “you’ll see those prices change.

“And with our uncompleted well inventory and with the service providers we have in North Louisiana, we can react to that in weeks…Some of the Northeast companies talk about cycle times of nine months to 12 months…Our cycle time here, both for new rigs and new completions, is considerably less than what you see in some other areas…So we’ll be able to react much quicker than anybody else can.”

The U.S. onshore productivity gains — and a narrower decline in oil production — are indicative of the “secular shale productivity trend” that should keep long-term West Texas Intermediate oil prices prices “in the $50-60/bbl range,” Goldman’s Singer said.

“In the near term, the ‘glass half empty view’ sees U.S. productivity gains as restraining upside to oil prices, particularly after the recent rally to close to the $50/bbl,” and some E&Ps “indicated they could bring back drilling activity. The ‘glass half full’ view sees that oil prices have risen in spite of resilient U.S. production and greater-than-expected supply out of Iran, suggesting better demand/lower supply elsewhere and a greater near-term (at a minimum) call on U.S. oil.”

Goldman leans toward the “glass half full view” as signs point to the world needing “a restart of the shale machine,” as a potential positive catalyst for oil equities despite the recent rally.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |