Markets | E&P | LNG | NGI All News Access | NGI The Weekly Gas Market Report

EIA Bumps 2016 NatGas Price Forecast Back Up to $2.25/MMBtu

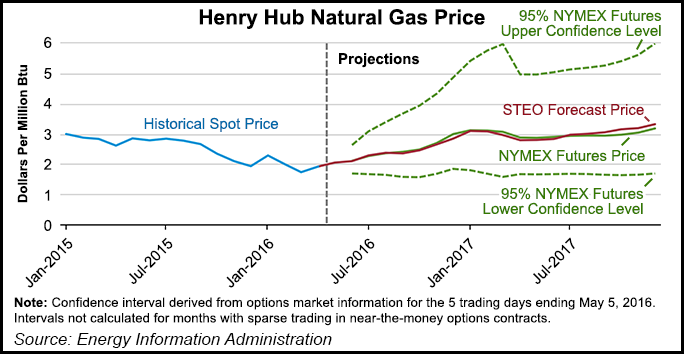

Henry Hub natural gas prices will average $2.25/MMBtu this year, the Energy Information Administration (EIA) forecast Tuesday, up 7 cents from the agency’s previous prognostication. It was the first time EIA has increased its 2016 forecast in nearly a year.

Last month, EIA said it expected 2016 Henry Hub prices to average $2.18/MMBtu and 2017 prices to average $3.02/MMBtu (see Daily GPI, April 12). In its latest Short-Term Energy Outlook (STEO), EIA increased the 2016 price forecast and held steady on the 2017 forecast.

“Through the 2015-16 winter, prices remained relatively low because of lower demand as a result of warmer-than-normal temperatures, record inventory levels, and production growth,” the agency said. “EIA expects prices will gradually rise through the summer, as demand from the electric power sector increases, but forecast prices remain lower than they were last summer. Monthly average Henry Hub spot prices are forecast to remain lower than $3.00/MMBtu through December 2016.”

The latest natural gas price forecasts are back to where EIA had placed them two months ago (see Daily GPI, March 8) but remain sharply below the agency’s February forecasts of $2.64/MMBtu this year and $3.22/MMBtu next year (see Daily GPI, Feb. 9). It was the first time EIA has increased its natural gas price forecast for 2016 since the March 2015 STEO, when it predicted $3.48/MMBtu, a penny higher than the previous STEO. EIA’s price forecasts declined steadily throughout 2015 (see Daily GPI, Dec. 8, 2015; Jan. 13, 2015) before firming a bit in January (see Daily GPI, Jan. 25).

Henry Hub prices averaged $1.92/MMBtu last month, an increase of 19 cents from March, according to the STEO. Natural gas futures prices for August 2016 delivery (for the five-day period ending May 5) averaged $2.36/MMBtu.

Current options and futures prices imply that market participants place the lower and upper bounds for the 95% confidence interval for August 2016 contracts at $1.64/MMBtu and $3.39/MMBtu, respectively. At this time last year, the natural gas futures contract for August 2015 averaged $2.85/MMBtu and the corresponding lower and upper limits of the 95% confidence interval were $1.98/MMBtu and $4.11/MMBtu, EIA said.

Plump natural gas storage inventories don’t paint an optimistic picture for those hoping for higher prices next winter. EIA last week reported an injection of 68 Bcf, leaving 2,625 Bcf in natural gas storage, significantly more than a year ago (1,764 Bcf) and the five-year average (1,789 Bcf) (see Daily GPI, May 5). The agency expects end-of-March working inventories to reach 2,288 Bcf, compared with 2,096 in the previous STEO and 666 Bcf more than the five-year end-of-March average.

“Inventories in March ended at 2,478 Bcf, the highest end-of-withdrawal-season level on record,” EIA said. “The first significant inventory increase of the injection season occurred the week ending April 22, with a 73-Bcf build.” EIA expects gas inventories to be 4,158 Bcf at the end of October, which would be the highest level on record to begin the heating season.

Total marketed production averaged 80.1 Bcf/d in February, a 1.4% decline from January and the second highest production level on record, EIA said. “Growth was strongest in the Marcellus and Utica production areas,” EIA said. “Production in Pennsylvania (measured in Bcf/d) increased by 3.5% from January levels, and production in Ohio and West Virginia increased by 10.7% and by 1.7%, respectively.” But preliminary data since February indicates that production growth may be slowing because of reduced drilling activity in response to low natural gas prices.

EIA expects natural gas exports by pipeline to Mexico will increase because of growing demand from Mexico’s electric power sector and flat natural gas production in Mexico. EIA projects liquefied natural gas (LNG) gross exports will increase to an average of 0.5 Bcf/d in 2016, with the startup of Cheniere’s Sabine Pass LNG liquefaction plant in Louisiana, which sent out its first cargo in February (see Daily GPI, Feb. 24). EIA projects gross LNG exports will average 1.3 Bcf/d in 2017, as Sabine Pass ramps up its capacity.

Total natural gas consumption is expected to average 76.5 Bcf/d this year and 77.4 Bcf/d next year, compared with 75.3 Bcf/d in 2015. Gas consumption is expected to increase in the electric power sector by 4.0% this year before declining 1.6% in 2017 as natural gas prices rise and contribute to increasing coal generation. Forecast industrial sector consumption of natural gas increases by 2.4% in 2016 and by 2.0% in 2017, as new fertilizer and chemical projects come online.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |