Rigs Decline Again, But Not So Much

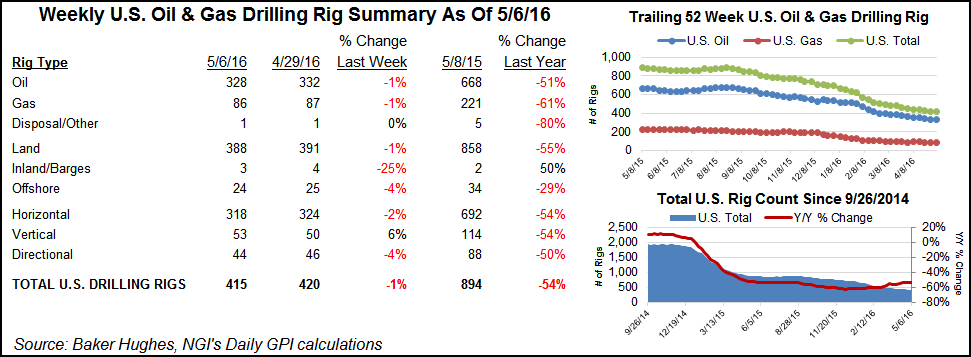

The declining rig count trend continues, but the pace has slowed in recent weeks. Meanwhile, producers have learned to economize, doing more with less, and natural gas market rebalancing could be around the corner, analysts said.

Only three U.S. land-based rigs left action in the latest tally, released by Baker Hughes Inc. on Friday. Five units actually returned to the Permian Basin; two returned to the Mississippian Lime, and long-suffering Texas saw its active rig census increase by three.

The Granite Wash added a rig, too, and the count was static in a number of plays, including the Barnett, Haynesville and Marcellus shales.

Could the rig rout be almost over?

“The subset of [exploration and production companies] that have disclosed rig count plans have another nine rigs to drop. This group accounts for about 45% of 2016 capex,” analysts at Cowen and Company said in a Thursday note. “We expect [the] rig count to trough over [the] next few weeks.”

In the Permian Basin — where the week’s rig rebound was strongest and where producers have talked up resilient well economics amid withered prices — there’s a “party” going on, according to Wells Fargo Securities LLC.

“Well costs have come down significantly, driven by what seems to be a fairly even split between continued service cost concessions and efficiency gains, namely faster cycle times,” Wells Fargo said. Cost savings will increase further as Permian operators continue to climb the learning curve and high-grade acreage, the analysts said.

In another note out Thursday, analysts at BMO Capital Markets analysts alluded to Samuel Beckett’s famous play and suggested that the “Godot” of gas price recovery on declining production might be on its way.

“We think that Marcellus and Utica production could plateau through mid-2017 as a result of the sharp drop in drilling activity and infrastructure constraints,” the BMO analysts said. “At the same time, we believe that natural gas produced from oil shale plays is poised to decline significantly due to the collapse in oil drilling activity; we forecast a decline in natural gas production from the ‘Big 4’ oil shale plays from a peak of 19 Bcf/d in 4Q15 to 16.2 Bcf/d in 4Q16E and 15.1 Bcf/d in 4Q 17E.

“Assuming ‘normal’ weather, this could lead to a re-balancing of the gas market by the end of 2016 followed by a significant supply deficit in 2017.”

The week ended with 388 rigs running on land along with three in the inland waters and 24 offshore to make for a total of 415 active units.

Canada had 36 rigs running after losing one in the latest count, leaving the North America tally at 451.

In the United States, four oil rigs left, joined by one gas-directed unit. Two directional rigs departed along with six horizontal units. Three vertical units returned to the game. Meanwhile, Canada lost two gas rigs but gained one oil-directed unit.

Y’all don’t come back too soon now, rigs.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |