Markets | NGI All News Access | NGI Data

NatGas Futures Ease Following Plump Storage Stats

Natural gas futures worked lower Thursday morning after the Energy Information Administration (EIA) reported a storage injection that was somewhat greater than what the market was expecting.

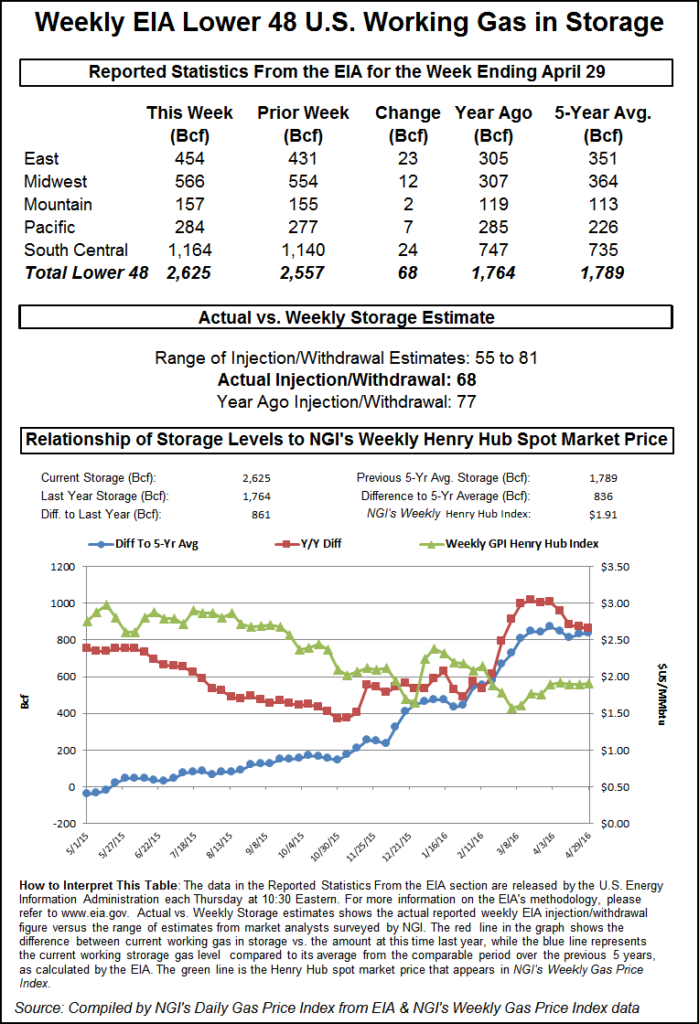

EIA reported a 68 Bcf storage injection in its 10:30 a.m. EDT release, about 4 Bcf more than what traders were anticipating. June futures dropped to a low of $2.086 shortly after the figures were released, and by 10:45 a.m. June was trading at $2.090, down 5.1 cents from Wednesday’s settlement.

“I was looking for a 64 Bcf number, and I think the numbers that were out were anywhere from 52 Bcf to 74 Bcf,” a New York floor trader told NGI. “I think $2 is a good support level. If we break $2, we may see another 10 cents down. If it stays above $2 for another couple of days, it should rally.”

“The 68 Bcf net injection for last week was somewhat more than the consensus expectation and above the 64 Bcf five-year average, and so we’d rate it as a minor bearish surprise,” said Tim Evans of Citi Futures Perspective.

“As it is simply difficult to forecast the precise impact on storage from temperatures at a time of year when neither heating nor cooling loads are strong or consistent, we don’t think the data should have much impact on the forward outlook.”

Inventories now stand at 2,625 Bcf and are a robust 861 Bcf greater than last year and 836 Bcf more than the five-year average. In the East Region, 23 Bcf was injected and the Midwest Region saw inventories increase by 12 Bcf. Stocks in the Mountain Region rose 2 Bcf, and the Pacific Region was higher by 7 Bcf. The South Central Region added 24 Bcf.

Salt cavern storage was higher by 10 Bcf to 362 Bcf, while the non-salt cavern figure rose 14 Bcf to 802 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |