NGI Archives | NGI All News Access

Market Players Drive Up Cali Summer Prices Amid Storage, Hydro and Heat Concerns

Summer prices over the last month have risen considerably in California amid growing concerns of a hot summer, the likely absence of key storage and a rapidly deteriorating hydro situation, an NGI’s Forward Look analysis shows.

On May 3, the fixed price at the Southern California citygate hit $2.50 for July, up 29 cents from April 6, the start of the steady rise in prices, analysis of Bloomberg data shows.

The Nymex July contract, meanwhile, climbed just 15 cents during that time.

SoCal citygate August prices are up 27 cents, compared with the Nymex August contract’s gain of 18 cents. SoCal citygate September prices are up 28 cents, versus the Nymex September contract’s increase of about 21 cents.

The robust gains extend into Northern California as well.

Pacific Gas & Electric citygate July fixed prices have climbed 23 cents over the same period. August has climbed 27 cents, and September has increased nearly 29 cents, according to NGI’s Forward Look.

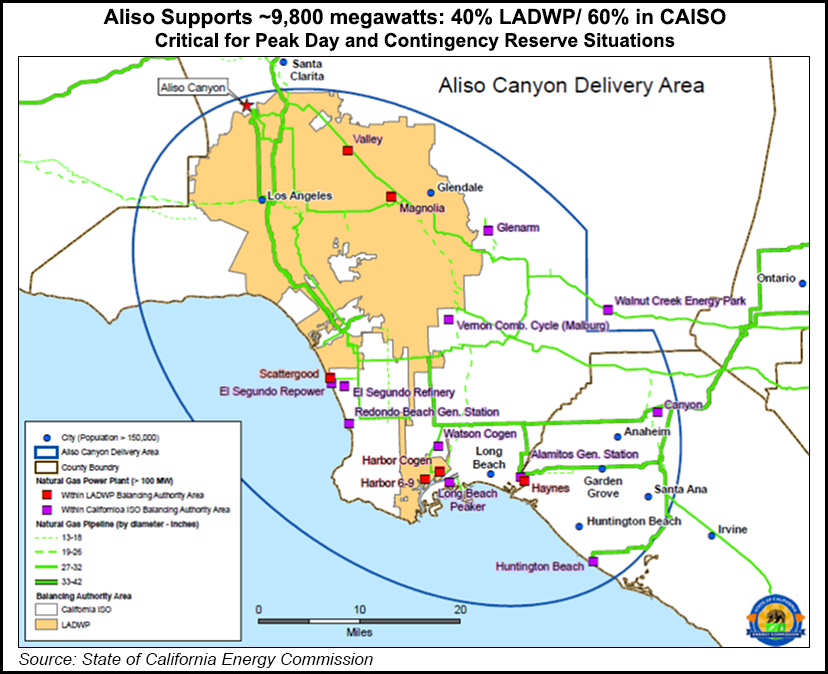

At the heart of the recent run-up in California summer prices is the likelihood that the Aliso Canyon storage facility will not be available for injections for most, if not all of, the summer, according to Genscape Inc.’s senior natural gas analyst Rick Margolin.

“SoCal has stated and implied that it believes it will be able to resume at least partial injections before the end of summer, but there is significant ambiguity around how that would happen and to what extent,” Margolin said.

What is clear, however, is that Southern California will have a greater reliance on flowing supply from the Desert Southwest lines, Rockies and PG&E, Margolin said.

“Accordingly, I believe PG&E’s rise is a product of the SoCal conditions,” he said.

Perhaps causing the market more anxiety is a presentation made in April by the state of California showing the possibility of brownouts on a handful of days this summer under the most extreme heat scenarios.

While it would take a “fairly unique” collection of circumstances to make that happen, those conditions are not unheard of the past few summers, Margolin said.

As weather conditions transition from an El Nino pattern to a La Nina pattern later this summer, market players are keeping a close eye on temperatures. The last late-summer-blooming La Nina that followed an El Nino occurred in 2010, according to Bespoke Weather Services’ chief meteorologist Jacob Meisel.

“Though not an exact parallel, that summer we saw extreme heat across much of the East. The heat wave did get into southern California late in September, where on Sept. 27, Los Angeles broke its all time high by recording a temperature of 113 degrees, and temperatures remained very elevated into the middle of October,” Meisel said.

“Again, this is not a forecast of that occurring again, but that is what the last transition from an El Nino to a La Nina during the summer months brought, and the rate of decay from the El Nino is mirroring that one, so it is a risk to keep monitoring,” he added.

Indeed, temperatures have been on the rise rather steadily this spring, as evident in the thawing of snowpack in the West.

“For a while this winter, the hydro situation in the West was looking pretty good,” Margolin said.

During several periods, Sierra snowpack had reached normal levels, something not seen in recent drought years. “But it’s shrinking real fast,” he said.

On April 1, Northern Sierra snow-water equivalent was 95% of normal, and Central Sierra was at 88%, Margolin said. Today, Northern Sierra is down to just 62% of normal, and Central Sierra is at 68%.

“While that is still lightyears better than where snowpack was at the same time last year (5% for both regions), you can see that it is no longer close to normal levels and deteriorating quickly,” he said.

Farther north, the snowpack looks better, though still lagging normal levels and also deteriorating. Snowpack levels throughout the Columbia River basin in Washington and Oregon range from 78% of normal (Central Columbia) to 81% of normal (Lower Columbia). In April, levels were more in the 90%-plus range, Margolin said.

Given the rapid decline in snowpack across the West, market players are sure to be watching just how the transition to La Nina plays out this summer and the impact it will have on hydro output.

Bespoke’s Meisel offers a couple of different scenarios. A strengthening La Nina, which is what is expected later in summer into fall, tends to bring about a variable Pacific jet stream, he said.

“This means that we could have weeks with sufficient rainfall across southern California, but also certainly weeks without much rainfall at all,” he said. “It is those weeks without rainfall that there will be a very heavy reliance on gas for power, and without rainfall above average, it is hard to see hydro output getting all that impressive.”

In a standard La Nina, it is typical to see a strong vortex south of Alaska that keeps sufficient moisture streaming into the Pacific Northwest, Meisel added.

In that region, including into Northern California, Meisel said decent hydro output is expected through the summer and continual dents into the residual drought heading through the summer.

“It is further south where, now that the El Nino is extremely rapidly decaying, there is less confidence in decent precipitation. That will, accordingly, bring about that increased gas demand that the market is now reflecting,” Meisel said.

Furthermore, Commodity Weather Group co-founder Jason Setree cautioned that one thing to consider with forecasts calling for above-normal precipitation during the summer is that “because normal precipitation amounts are so low and evaporation rates so high during the summer, even above-normal precipitation struggles to make much impact on streamflow — thus the heavy reliance on the amounts stored in reservoirs from snowmelt during the winter and spring.”

The uncertainty of just how hot weather will get this summer in California, the deteriorating hydro situation in the West and the questionable return of Aliso Canyon have certainly left their mark on gas prices. But skeptics of the magnitude of the price gains point to several factors that should keep prices in check this summer, including the Aliso Canyon situation being overblown, according to Margolin.

“There is reason to believe that – for the vast majority of summer-strip days – demand can be adequately satisfied with flowing supply,” he said.

In addition, there’s significantly higher renewables generation this summer. Specifically, as more solar capacity has come online in the last year, Genscape continues to see new generation records being set.

There’s also robust wind generation, Margolin added.

Meanwhile, on the gas-side, Genscape continues to see stagnant gas-demand-per-degree loads, particularly in Southern California.

“For the previous three summers, weather-independent gas demand has shown virtually no signs of growth in the summertime,” Margolin said. “The combination of renewables growth, California’s aggressive building efficiency programs (via Title 24) and demand response programs are scrubbing gas demand.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |