NGI Archives | NGI All News Access

Helmerich & Payne Keeping High-Tech Rigs Ready, but Expecting More Deterioration in U.S. Land

Contract driller Helmerich & Payne Inc. is keeping its fleet in top-notch shape for an eventual industry upturn, but management conceded on Monday that a return to business-as-usual is unlikely before the second half of the year.

The Tulsa-based global operator, which works in the onshore and offshore, issued sharply lower fiscal second quarter (ending March 31) results. Net income was $21 million (19 cents/share) from operating revenue of $438 million in fiscal 2Q2016, versus year-ago net income of $154 million ($1.41) on revenue of $886 million.

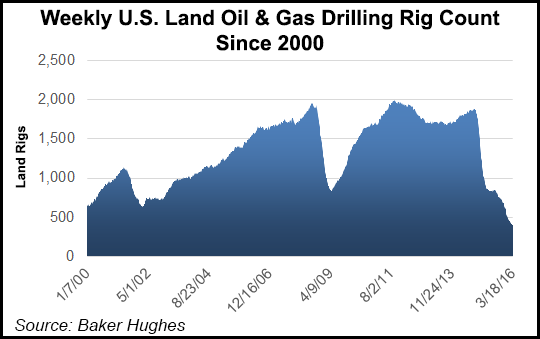

“These are demanding times in the energy service space, and the challenge for many is now one of survival,” CEO John Lindsay said. “The U.S. land rig count is comparable to the all-time record lows reached in 1999. Sharp reductions in personnel, expenses and investments are occurring worldwide, and we expect to see further deterioration in terms of drilling activity during the third fiscal quarter.

“But even if this difficult environment persists, we believe that H&P’s competitive and financial positions remain very strong. Our long-term contracts have allowed the company to remain profitable and protect FlexRig investments,” its alternating current rig line. “We are able to focus energy on efforts that add value to our customers and help us to become even more efficient and effective as an organization.

“Whether we see more declines in activity or a significant improvement in demand, H&P is well positioned to respond. As we have described in the past, our strong and liquid balance sheet, robust backlog and lower spending requirements should allow us to continue to return cash to shareholders. Our strength is driven by our people, and we appreciate their attitude in the face of this adversity and their dedication to the company through these difficult times.”

The CEO lamented the personnel cuts that H&P has had to make since oil prices plummeted and work disappeared.

“It’s impossible to keep everyone,” he told analysts during a conference call. “We’ve made significant cuts in spending and in personnel. It’s been difficult to say goodbye to so many…”

Lindsay is hopeful that once the recovery begins H&P can lure some of its former employees to return. He thinks the recovery will begin in Texas, specifically the Permian Basin, which he said is the “premier” basin in the United States and among the “top three’ in the world.

U.S. land operational income was $63 million in fiscal 2Q2016, compared with $225 million a year ago and $56 million in fiscal 1Q2016.

“As compared to the first quarter of fiscal 2016, segment operating income increased as a result of a higher level of early termination revenue during the second fiscal quarter, which was partially offset by lower quarterly levels of activity and rig margins,” CFO Juan Pablo Tadio said during the call. The number of quarterly revenue days decreased sequentially by 20% to 9,601 days.

Rig utilization was 31%, versus 68% a year ago and 39% in the first three months of this year. At the end of March, H&P’s U.S. land segment had 94 contracted rigs generating revenue, including 82 under long-term contracts, and 253 idle rigs.

Operating income for the offshore slumped to $3.3 million, compared with year-ago income of $19 million and $7.7 million in fiscal 1Q2016. The sequential decrease was blamed on declines in management contract activity, average daily margins and rig revenue days. The average rig margin per day decreased sequentially from $7,920 to $7,346, and quarterly revenue days decreased from 736 days to 691 days.

The outlook through June for the U.S. land segment is not optimistic, with revenue days (activity) forecast to decrease by roughly 25-28%.

Excluding any impact from early termination revenue, the average rig revenue/day is expected to be roughly $25,000, and the corresponding average rig expense/day is expected to decrease to roughly $13,800.

“As of today, the U.S. land segment has approximately 84 contracted rigs that are generating revenue (including 77 under term contracts) and 263 idle rigs,” Tardio said. Revenue days in the offshore are forecast to decrease by about 8% sequentially, with average rig margin/day of around $8,000.

As of Monday, H&P’s existing fleet included 347 U.S. land rigs, 38 international land rigs and nine offshore platforms. In addition, three H&P FlexRigs are scheduled for delivery this year, all under long-term contracts with customers. However, Lindsay said he doesn’t expect H&P to begin building more rigs until exploration and production companies have more “confidence” in investing.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |