M&A | NGI All News Access | NGI The Weekly Gas Market Report | Regulatory

Halliburton, Baker Nix Merger; Baker to Reduce U.S. Pressure Pumping Business

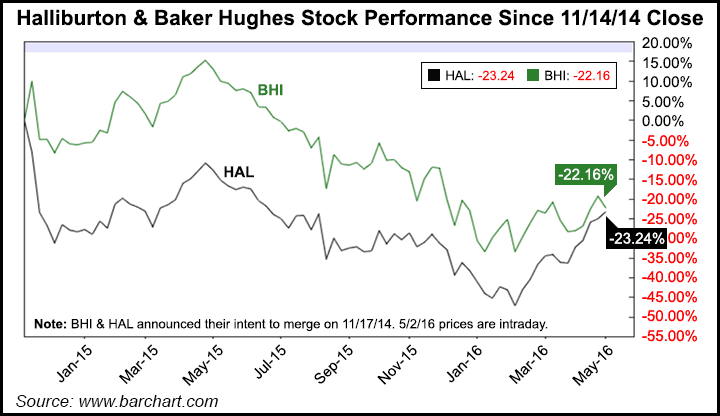

Halliburton Co. and Baker Hughes Inc. terminated their merger agreement on Sunday, ending an 18-month saga in which U.S. and European regulators challenged the multi-billion dollar tie-up.

The merger between the No. 2 and No. 3 oilfield services companies, was announced in November 2014 and at the time was estimated to be worth $34.5 billion (see Daily GPI, Nov. 17, 2014). The scuttled merger, which today would have been worth around $28 billion, had faced a self-imposed Saturday (April 30) deadline, and most analysts had bet against it after the U.S. Department of Justice last month challenged it in court (see Daily GPI, April 25; April 6).

“While both companies expected the proposed merger to result in compelling benefits to shareholders, customers and other stakeholders, challenges in obtaining remaining regulatory approvals and general industry conditions that severely damaged deal economics led to the conclusion that termination is the best course of action,” Halliburton CEO Dave Lesar said. “While disappointing, Halliburton remains strong. We are the execution company — our strategy, technologies and service quality are focused on helping customers maximize production at the lowest cost and driving industry leading growth, margins and returns.”

Baker Hughes CEO Martin Craighead said the outcome “is disappointing because of our strong belief in the vast potential of the business combination to deliver benefits for shareholders, customers and both companies’ employees. This was an extremely complex, global transaction and, ultimately, a solution could not be found to satisfy the antitrust concerns of regulators, both in the United States and abroad.

“As we turn the page on this chapter, I want to thank our customers for their patience and continued loyalty over the past 18 months. I also want to thank the entire Baker Hughes team for their unwavering dedication and commitment during this process. Baker Hughes is strongly positioned to build on its foundation and heritage as a technology innovator that differentiates for our customers and delivers compelling value to shareholders.”

Halliburton said it would, as stipulated in the merger agreement, pay Baker Hughes a $3.5 billion break-up fee by Wednesday. Lesar and Craighead plan to discuss the failed merger on Tuesday in separate conference calls. However, Craighead on Monday outlined a series of actions to reduce the Houston company’s costs and to simplify its business. And he plans to put the $3.5 billion payment to good use.

Among other things, Baker Hughes “has decided to retain a selective footprint in its U.S. onshore pressure pumping business, while preserving the flexibility to expand for the right opportunities. This approach will allow the company to achieve cash-positive operations in a capital-intensive segment that is expected to remain challenging due to overcapacity, commoditized pricing and low barriers to entry.”

Exactly where Baker Hughes may reduce its domestic onshore operations was not detailed. The initial phase of the cost reduction efforts is expected to result in $500 million of savings annually by the end of 2016. The company “is evolving its go-to-market strategy to align with a changing marketplace and maximize its return on invested capital” and plans to begin “rationalizing” its current full-service model to “build a broader range of global sales channels for select countries, including tailored operating models,” Craighhead said. “These new channels will allow Baker Hughes to take its products to market more efficiently and participate differently in existing markets with lower investment and fewer risks.”

The company “is well positioned to build on its heritage as a product innovator, focusing on the development of products that lower costs and maximize production for operators in the oil and gas industry,” he said. “Innovation is what we do best and what our customers need the most. It is an enviable capability that is part of our culture and continues to differentiate us in the market…More than ever, our customers need to lower their costs and maximize production.

“These objectives align with our strengths in well construction, where we have leading capabilities in drilling services, drill bits and completions, and well production, where we have a unique portfolio with artificial lift systems, wireline services and production chemicals. We intend to build on our strong foundation and market position by simplifying the structure of our business and evolving our commercial strategy to deliver significant value to shareholders.”

Baker Hughes management said last week it expected the North American rig count to fall sequentially from 1Q2016 by an estimated 30% (see Daily GPI, April 27). It had kept many of its regional operations staffed in preparation for the Halliburton tie-up in compliance with its agreement.

Using the break-up fees it recoups, the company intends to buy back $1.5 billion in shares and $1 billion in debt. In addition, the company intends to refinance its $2.5 billion credit facility, which expires in September.

“The company will approach these actions thoughtfully, decisively and swiftly to position the company for success and to maximize shareholder value,” Craighead said. “As we implement these changes, we remain focused on running the business efficiently while capitalizing on our strengths as a product innovator to create new growth opportunities.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |