Markets | E&P | LNG | NGI All News Access

2015 Net Natural Gas Imports Lowest Since 1980s, EIA Says

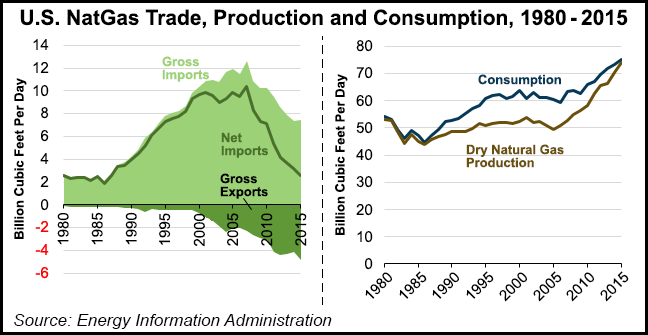

Net natural gas imports into the United States last year fell to 935 Bcf (2.56 Bcf/d), continuing a decline that began in 2007 and reaching a low not seen since the 1980s, according to the Energy Information Administration (EIA).

Net imports peaked in 2007 at 3.78 Tcf (10.37 Bcf.d) but have declined steadily since. Last year’s total was about the same as 1980, when the United States imported 936 Bcf of natural gas, EIA said Friday.

“While both U.S. natural gas consumption and production have increased in recent years, natural gas production has grown slightly faster, resulting in a decline in net imports. Increasing domestic production of natural gas has reduced U.S. reliance on imported natural gas and kept U.S. natural gas prices relatively low,” the agency said.

EIA expects that the United States will become a net exporter of natural gas by mid-2017.

Most U.S. imports of natural gas come by pipeline from Canada, with a small and declining amount of imported liquefied natural gas (LNG) coming mainly from Trinidad.

Most U.S. exports are sent by pipeline to Mexico and Canada. The United States also exported LNG and compressed natural gas to several countries, but those volumes were relatively minimal in 2015.

In April, Cheniere Energy Inc.’s Sabine Pass LNG export terminal sent its first cargo to Portugal, making it the first Lower 48 LNG export to Europe (see Daily GPI, April 22). Sabine cargos have previously been sent to Brazil, Argentina and India.

Since 2012, the natural gas pipeline industry has added 3.4 Bcf/d and 0.2 Bcf/d of export capacity to Mexico and Canada, respectively. As a result of the increased capacity and burgeoning production from domestic shale plays, exports to Mexico grew from 1.3 Bcf/d in 2011 to 2.9 Bcf/d in 2015. Imports from Canada have remained relatively stable since 2011, EIA said.

The natural gas industry plans to build 5.4 Bcf/d and 3.4 Bcf/d of additional export capacity to Canada and Mexico by 2019, respectively, according to EIA.

Net imports of natural gas in January fell to 105 Bcf (3.39 Bcf/d), a 22% decline compared with 135 Bcf (4.35/Bcf/d) in January 2015, EIA said in its recent Monthly Energy Review (see Daily GPI, April 26).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |