Markets | NGI All News Access | NGI Data

Slightly Bearish 73 Bcf Build Partially Erases May NatGas Gap; Northeast Cash Sinks

With the news that a bit more natural gas than had been expected was injected into storage for the week ending April 22, traders pushed June futures lower on Thursday morning, perhaps in an effort to align the newly minted prompt month with where the May contract terminated on Wednesday. For a second consecutive day, cash prices were a mixed bag and relatively quiet as traders are likely already focused on next-month deals.

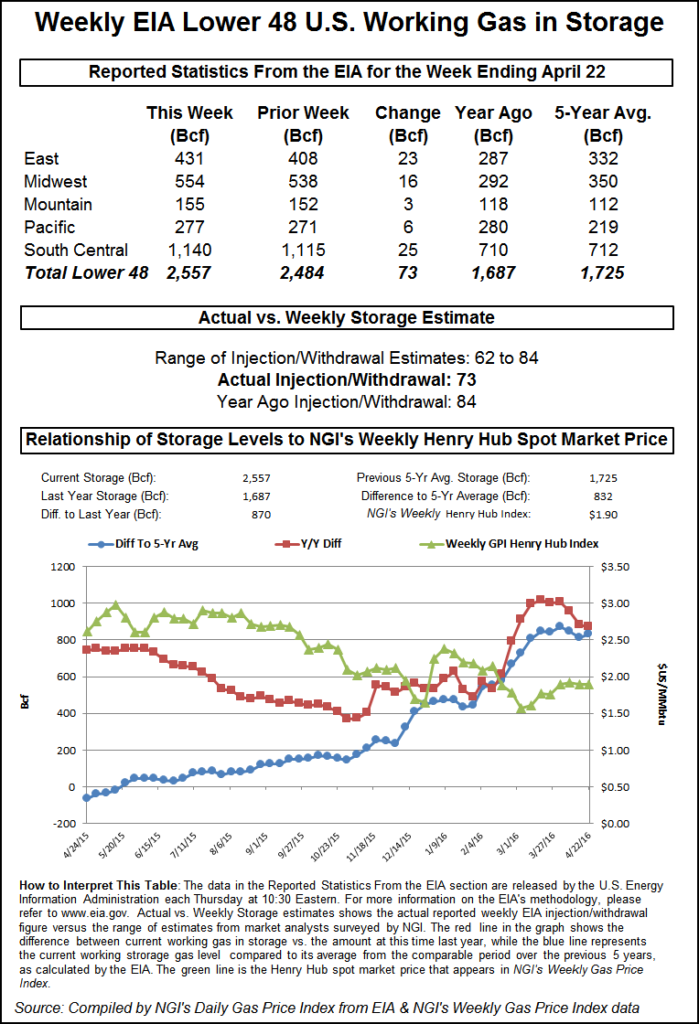

The Energy Information Administration (EIA) reported Thursday that 73 Bcf was injected into underground stores for the week ending April 22, which was a few more molecules than industry consensus expectations.

Prior to the 10:30 a.m. EDT report, June futures were already at a discount to the contract’s $2.153 Wednesday close. In the minutes before the report, the contract was hovering at $2.095, and immediately after the release, June sunk to a session low of $2.075. After some back-and-forth, the prompt-month contract closed out the regular session at $2.078, down 7.5 cents from the regular session close on Wednesday. July futures followed suit, declining 5.2 cents to $2.253.

Before the report, many were expecting an inventory build to fall between last year’s 84 Bcf addition for the week and the five-year average of a 52 Bcf injection. Citi Futures Perspective analyst Tim Evans was on the record with an 81 Bcf injection expectation, while a Reuters survey of 22 industry experts produced a 62 to 84 Bcf build range with a consensus estimate of a 70 Bcf injection.

The weak winter, which left robust storage inventories, has some analysts concerned that the U.S. storage capacity limit could be tested this refill season. However, others are not so sure. Some market-watchers took Thursday’s deficit to last year’s build for the week as a sign that the storage situation could be undergoing some corrective action.

“We believe the storage report will be viewed as neutral,” said Randy Ollenberger, an analyst with BMO Nesbitt Burns Inc. “Storage remains at record levels but the level of injections is well below last year and points to a rebalancing over the course of the summer. We believe that U.S. working gas in storage could exit the summer season at five-year lows, assuming normal weather.”

While the 73 Bcf build was smaller than last year’s 84 Bcf build, the margin was significantly slimmer than the prior week, where 7 Bcf was injected for the week ending April 15, compared to 82 Bcf in the previous year’s week.

NGI Market Analyst Nathan Harrison said it’s far too early to tell how the 2016 injection season will play out but noted that Thursday’s build report fell well within historical norms. “Early on in the summer, historical injection rates should be a decent indicator of what to expect. If we start to close in on the a full-storage situation later this summer, an asymptotic decline in injection rates will likely result simply due to pressure.”

As of April 22, working gas in storage stood at 2,557 Bcf, according to EIA estimates. Stocks are now 870 Bcf higher than last year at this time and 832 Bcf above the five-year average of 1,725 Bcf. For the week, The South Central Region injected 25 Bcf and the East Region injected 23 Bcf, while the Midwest deposited 16 Bcf. The Pacific and Mountain regions each chipped in 6 Bcf and 3 Bcf, respectively.

Natural gas cash price movement for gas to be delivered Thursday and Friday was a mostly quiet affair as many traders have already flipped their calendars to June. NGI’s National Spot Gas Average dropped 4 cents to $1.79. Most notable on the day was the sea of red in the Northeast. Prompted by temperatures cooling from their recent 80-plus degree readings in a number of major cities, quite a few individual points declined by a dime or more in the region.

The ever-volatile Algonquin Citygate declined by 58 cents to average $2.32, while Tenn Zone 6 200Line came off 58 cents to average $2.29. Tennessee Zn 4 Marcellus slipped a dime to $1.23, and Transco-Leidy Line Line lightened by 15 cents to $1.24.

Other areas of weakness included Louisiana and California, albeit most declines in these regions were limited to a few pennies. The Midwest, Midcontinent and Rockies were mostly in the black with gains from a couple of cents to about a nickel. Texas points were mostly a penny or two on either side of unchanged.

“We’re in that period of time where cash isn’t trading too extensively because everyone is getting their business done for the next month, so there is not too much to reference here,” said Tom Saal, vice president at FCStone Latin America in Miami.

Turning attention to the screen, Saal said he thinks Thursday’s futures price action had a lot to do with May’s expiration a day prior. “There is a little bit of a roll-gap. We settled May at $1.995, and June started its run nearly 16 cents higher, creating a gap on the chart,” he told NGI. “It looks like we’re trying to connect the dots here. The storage number came out a little bit on the bearish side and futures ended up a little bit lower. I really don’t think we’ll head much lower. We might get down to the May settlement, but that’s about it.”

Looking ahead, Saal said a small uptick could be in store. “From what we’ve seen on the CFTC Commitment of Traders Report, the speculators are liquidating some of their short positions, so at least for now, they are not looking to be too aggressive on the short side,” Saal added. “We may be running out of natural sellers, unless they crush the market.”

Temperatures in much of the East have moderated over the last few days as a split in the jet stream will produce the variance in the weather pattern from north to south. While dry air holds over much of New England through Saturday, rounds of rain and storms will take aim on much of the mid-Atlantic into next week, according to AccuWeather.com.

“One part of the jet stream will push a flow of dry and cool air from southeastern Canada to New England,” said AccuWeather Chief Meteorologist Elliot Abrams. “The other part of the jet stream will allow rounds of moisture to stream in from the Pacific Ocean and Gulf of Mexico toward the mid-Atlantic.”

Meanwhile in the West, the forecasting firm sees enough cold air in place for another round of heavy snow to fall across Colorado to end the week. However, drier and milder weather will return to the region during the first week of May.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |