E&P | NGI All News Access | NGI The Weekly Gas Market Report

Patterson-UTI Stacks Half of Horsepower — 1 Million HP — as Producers Shun Onshore Drilling

Onshore drilling contractor Patterson-UTI Energy Inc. has to date stacked more than half of its pressure pumping horsepower, an estimated 1 million hp, and expects the fracturing unit to see a 20% further decline in activity during the second quarter, management said Thursday.

Things have begun to settle down in North America, PTEN’s sole focus, as prices appear to stabilize, but that doesn’t mean any of the producers are eager to get back to work, CEO Andy Hendricks said during a conference call Thursday.

Pressure pumping activity at PTEN should decline another 20% in the second quarter, likely increasing the amount of stacked horsepower now, estimated at 54%. Even when activity resumes, Hendricks said there is a big problem facing all contractors — not having anyone to run the equipment.

“Labor initially is easy to find, but we expect it to be challenging to meaningfully increase it quickly, given the magnitude and duration of the downturn.” Former employees who were laid off within the past six months might be interested in getting their jobs again, but anyone laid off earlier than that likely has begun working elsewhere, the CEO said.

Still, while the workload is low, PTEN has been “selective in selecting work, rather than chasing work,” he said. The stack of horsepower is getting higher, but that’s the same story for other oilfield service operators. PTEN continues to fund operating expenditures and capital expenditures “for our own equipment…so that all of the stacked equipment is capable of going back in the market once there is a recovery.”

The recovery can’t come soon enough for the Houston operator.

“During the first quarter, our rig count averaged 71 rigs in the United States and three rigs in Canada, compared to the fourth quarter average of 88 rigs in the United States and three in Canada,” Hendricks said. In the year-ago period, 165 rigs were working in the United States, with eight in Canada.

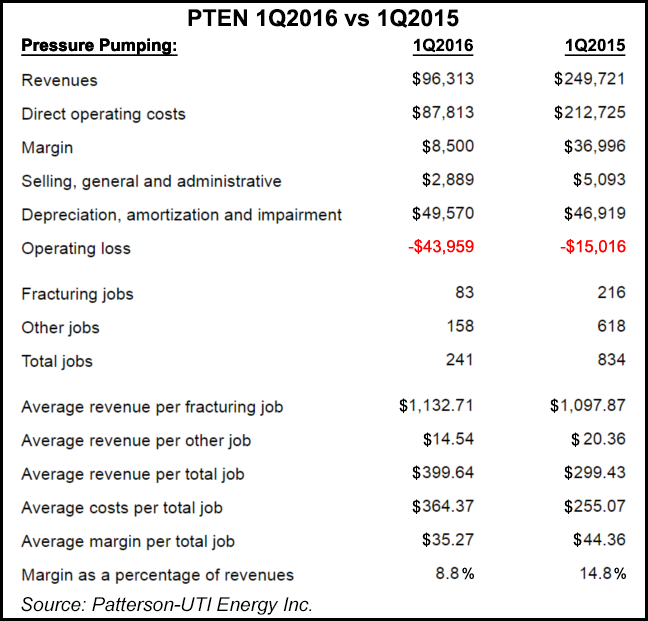

Fracturing jobs in North America fell to 83 from 216 in 1Q2015, while total drilling jobs plunged to 241 from 834. The average costs per total job increased to $364.37 from $255.07, while margin/total job declined to $35.27 from $44.36, reducing the margin as a percentage of revenue to 8.8% from 14.8%. In the contract drilling business, North American operating days fell year/year to 6,657 from 15,520, with revenue falling to $168,659 from $401,478.

Through June, business looks no brighter.

“For the month of April, we expect our average rig count will be 56 in the United States, and in Canada we expect a minimal number of operating days,” both because of the the industry downturn and spring breakup, Hendricks said.

Besides not securing work, producers are letting rigs go, contract or no contract.

“We recognized $16.8 million of revenues related to early contract terminations in our drilling business during the first quarter,” Hendricks said. “These early termination revenues positively impacted our total average rig revenue per day of $25,340 by $2,520. Excluding early termination revenue from both the fourth and first quarters, total average rig revenue per day during the first quarter would have been $22,820, compared to $23,140 in the fourth quarter.”

Total average rig operating costs/day during 1Q2016 decreased $490 to $12,150 from $12,640 in the fourth quarter. In addition, the proportion of rigs on standby increased to 13, reducing the average rig operating costs per day — because standby rigs have little associated costs. Total average rig margin per day, excluding early termination revenue, increased to $10,660 from $10,500.

At the end of March, PTEN had term contracts for drilling rigs to provide around $580 million of future dayrate drilling revenue.

“Based on contracts currently in place, we expect an average of 43 rigs operating under term contracts during the second quarter, and an average of 40 rigs operating under term contracts during the remaining three quarters of 2016,” Hendricks said. “We also expect approximately $5 million of early termination revenues during the second quarter.”

In the pressure pumping business, “pricing remains unsustainable,” he said. “We believe it is prudent to be disciplined in the use of our assets and have chosen to stack horsepower rather than operate the equipment at pricing levels that do not generate acceptable cash flow.”

With the lower activity levels and stacked horsepower, pressure pumping revenue fell 27% sequentially Gross margin as a percentage of revenues decreased to 8.8% from 10.4% in the fourth quarter.

“We believe the U.S. rig count is beginning to stabilize as crude oil prices have improved from the cyclical lows reached in the first quarter,” Chairman Mark S. Siegel said. “The outlook for crude oil prices remains uncertain, with numerous economic and geopolitical concerns. For this reason, visibility into the timing of a recovery remains limited, and we do not believe current oil prices in the mid-$40s are sufficient to support a meaningful increase in U.S. drilling activity.”

Even though there is “limited visibility into a recovery, we remain optimistic about a recovery in our cyclical industry,” Siegel said. “We believe this unprecedented low level of U.S. drilling activity will further reduce U.S. oil production and help to balance oil supply and demand.”

PTEN lost $70.5 million net (minus 48 cents/share) in 1Q2016, versus year-ago profits of $$9.1 million (6 cents). Total revenue fell to $269 million from $658 million. To improve its liquidity position, PTEN has reduced its quarterly dividend to 2 cents/share, which should save it about $47 million annually.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |