Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Weak Commodities Erode Kinder Morgan Outlook

The expected continuation of weak commodity prices dimmed the outlook for the remainder of the year at Kinder Morgan Inc. (KMI), which is feeling the effects of production declines, particularly in the Eagle Ford Shale.

“…[W]e have looked at the potential impacts for the remainder of 2016 due to continued weakness in the sector. We now estimate on a full-year basis for 2016 a negative impact of about 3% to the EBITDA [earnings before interest, taxes, depreciation and amortization] that we showed in January,” CEO Steven Kean told analysts Wednesday afternoon. “But because of our ongoing efforts to high grade our capital spend and to pursue the joint ventures where it makes sense, we expect to meet our investment grade credit metrics, notwithstanding the 3% reduction.”

The 3% reduction in EBITDA yields a 4% reduction in distributable cash flow (DCF). “As the year goes on, we will try to mitigate that negative, but we are not assuming in this outlook any dramatic turnaround for our producer customers by the end of the year as some analysts have predicted,” Kean said.

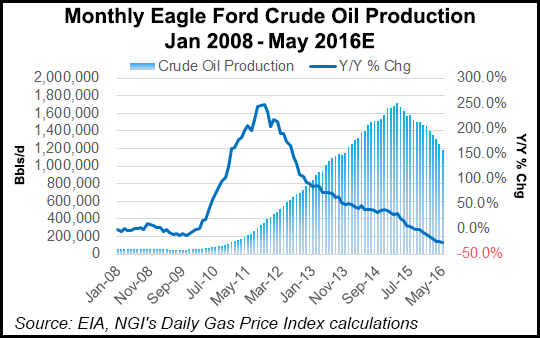

“…[B]ut I think when you put this in the context of the dramatic production declines particularly in the Eagle Ford, which is down 28% on oil from its peak and 15% on gas and credit weaknesses, our business is really diversified and insulated from the full brunt of the weakness in the producing sector.”

Kean said nearly half of the deterioration was due to lower volumes out of the Eagle Ford. These affect both the midstream group in the company’s natural gas business unit and also its refined products group.”…[T]his is all comparing to our original outlook, so this is not a year-over-year look; this is versus our January outlook that we presented at the [investor] conference,” Kean said.

Coal industry bankruptcies led to another 20% of the deterioration, he said.

“…[W]hile the current year outlook for North American energy production is experiencing weakness, we’re still bullish on the longer term. We believe that we’ll continue to see more of our North American energy needs met by North American energy production that will grow our exports; we’ve already been growing refined products, natural gas to Mexico,” Kean said. “I think we’ll continue to see growth in natural gas and natural gas liquids exports.”

Kean also addressed counterparty credit risk. KMI has called on collateral and put other credit-support arrangements in place, he said.

“Given our diverse business mix, we’ve got a very broad and diverse customer base,” he said. “We’ve got producer customers, of course, but we also have integrated energy companies, gas and electric utilities and industrial users of our services. We’re not exposed to any single sector, commodity or service. That diversifies our exposure, which reduces our risk. Our top 25 customers constitute 44% of our revenue. And of that revenue, 85% is investment grade. Of our total revenue, about 75% is investment grade or has substantial credit support and 86% is rated ‘B’ or better.”

KMI reported first quarter distributable cash flow (DCF) of $1.233 billion versus $1.242 billion for the comparable period in 2015. The decrease was primarily attributable to a decline in the company’s carbon dioxide (CO2) segment and higher preferred stock dividends, partially offset by increases in the natural gas pipelines and products pipelines segments. DCF per share was 55 cents for the first quarter compared to 58 cents for the first quarter of 2015.

First quarter net income was $446 million compared to $445 million for the same period in 2015, with the increase driven by higher segment earnings offset by higher depreciation, depletion and amortization (DD&A) expense, book taxes, and general and administrative expense.

“Given our tremendous amount of cash flow, we do not need to access the capital markets to fund growth projects in 2016,” said Executive Chairman Rich Kinder. “This cash flow in excess of our dividends insulates us from challenging capital markets and significantly enhances our credit profile. Moreover, by continuing to high-grade our backlog, we do not expect to need to access the capital markets to fund our growth projects for the foreseeable future beyond 2016.”

For 2016, KMI’s budgeted DCF is $4.7 billion and budgeted EBITDA is $7.5 billion. “Due to continued weakness in the energy sector in 2016, the company now expects EBITDA to be about 3% below its plan and distributable cash flow to be about 4% below its plan. KMI expects to generate excess cash sufficient to fund its growth capital needs without needing to access capital markets and expects to achieve its targeted year-end debt to EBITDA ratio of 5.5 times.”

The company’s growth capital forecast for 2016 is $2.9 billion, a reduction of $400 million from its budget of $3.3 billion and a reduction of $1.3 billion from its preliminary 2016 guidance of $4.2 billion.

“We reduced our growth capital backlog from $18.2 billion at the end of the fourth quarter 2015 to $14.1 billion at the end of the first quarter 2016,” said CEO Steve Kean. “The reduction in our backlog was driven primarily by the removal of the Northeast Energy Direct (NED) Market project due to insufficient contractual commitments from customers in the New England market [see related story], and the removal of the Palmetto Pipeline project following unfavorable action by the Georgia legislature regarding eminent domain authority and permitting for petroleum pipelines” (see Daily GPI, March 31).

KMI’s natural gas pipelines business produced first quarter segment earnings before DD&A and certain items of $1.130 billion, compared to $1.087 billion for the same period last year.

“Growth in this segment compared to the first quarter last year was led by contributions from the Hiland acquisition and improved performance on Tennessee Gas Pipeline (TGP) driven by projects placed into service and favorable 2016 firm transportation revenue,” Kean said. “First quarter growth was partially offset by lower commodity prices and reduced volumes affecting certain of our midstream gathering and processing assets. The expiration of a minimum volume contract at KinderHawk, a customer contract buyout at Kinder Morgan Louisiana pipeline and unfavorable contract renewals on Cheyenne Plains pipeline also negatively impacted earnings.”

Natural gas transport volumes were down 2% compared to the first quarter last year, driven by lower throughput on Wyoming Interstate Co. pipeline due to lower production in the Rockies and lower throughput on TGP, Southern Natural Gas pipeline and Natural Gas Pipeline Company of America (NGPL) as a result of milder weather during the first quarter compared to the same period in 2015. These decreases were partially offset by higher throughput on the El Paso Natural Gas pipeline from additional deliveries to California and higher throughput into Mexico on the Sierrita Gas Pipeline.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |