Markets | NGI All News Access | NGI The Weekly Gas Market Report

Robust Storage, Weak Demand Equal Downside Room for Canadian NatGas Prices

Natural gas prices along the AECO forward curve — which already are showing signs of weakness further out the curve — could see near-month packages fall substantially in the coming weeks. Storage inventories in western Canada are nearing maximum capacity only one month into the traditional injection season, and demand is proving lackluster in high-density population centers that the region typically relies upon to take gas.

AECO May fixed prices fell 3 cents between April 8-14 to reach 81.5 cents, according to NGI’s Forward Look.

By comparison, the Nymex was down 2 cents for May, as were average U.S. prices.

Further out the curve, the western Canadian market hub’s June slid 1.4 cents during that time to 92.3 cents, and the balance of summer (July-October) stayed flat at $1.26, according to Forward Look.

Nationally, June and balance of summer traded similarly.

But further out the curve, AECO prices took a steeper fall as the winter 2016-2017 package dropped 9 cents from April 8-14 to reach $1.95, and the winter 2017-2018 package slipped 3 cents to $2.28.

Those packages barely budged at other market hubs.

The reason behind the sharp decline in prompt-winter prices on AECO is three-fold, and could be why prices at the front of the AECO could see additional weakness in the coming weeks.

For one, storage inventories in western Canada currently sit more than 250 Bcf above year-ago levels and just 64 Bcf shy of the five-year high set in 2013.

Secondly, production on TC Alberta’s system remains at or near capacity, which could lead to already robust storage levels swelling faster than normal.

“TransCanada’s monthly outage forecast for its Alberta system indicates that if production continues to run at or near capacity, AECO could have an extra 473 MMcf/d this April compared with last, and an extra 750 MMcf/d this May compared to last,” according to Bentek Energy.

“If this extra gas over the next two months goes to storage, this could mean that about 38 Bcf could be injected in April, and about 55 Bcf could theoretically be injected in May. This would put Alberta inventories at the five-year high in mid-May,” the company said.

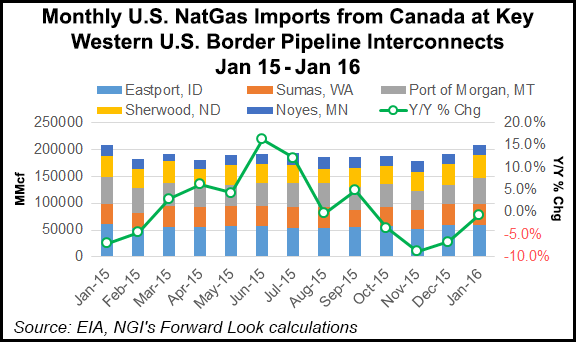

And finally, while western Canada has typically relied upon regions like the Northeast and Midwest to take some its supplies during higher demand periods like the summer, record-high storage inventories across the U.S. and generally mild temperatures have left little need for imports, at least not yet.

In the Northeast — where gas stocks are roughly 69% above the year-ago level and 39% above the five-year average — demand is projected to fall to 9.74 Bcf/d by April 22 and to 9.14 Bcf/d by April 29 after averaging 12.24 over the past seven days, according to Genscape.

Genscape, based in Louisville, KY, is a real-time data and intelligence provider for energy and commodity markets.

Midwest demand doesn’t hold much promise either.

Genscape shows demand in that region — where inventories are 106% above year-ago levels and 62% above the five-year average — falling to 8.57 Bcf/d by April 22 and to 8.10 Bcf/d by April 29, down from an average 11.76 Bcf/d over the past seven days.

“While there will still be numerous weather systems impacting the U.S. over the coming weeks, especially the southern U.S. and at times the Northwest and Northeast corners, temperatures overall just won’t be very cold and will result in very light natural gas demand as much of the country experiences highs of 60s to 80s, which is near ideal for this time of the year,” forecasters with NatGasWeather said.

There is one beacon of hope for AECO gas, however. A summerlong maintenance on New England’s Algonquin Gas Transmission pipeline is expected to increase the need for western Canadian gas via Iroquois to help meet summer demand.

The six-month maintenance event is in full swing now as the pipeline on April 13 cut capacity through its Stony Point compressor station in New York by 0.6 Bcf/d, a level it will remain at through Sept. 7.

The Algonquin mainline has been restricted at various levels since April 2.

Taking a closer look at their respective forward curves, Algonquin Gas Transmission citygates holds a solid premium over AECO throughout the summer, even more so than Midwest markets.

AGT May sat April 14 at a roughly $1.69 premium over AECO, while the balance of summer sat $1.53 over the corresponding AECO package, according to Forward Look.

By comparison, Chicago held a 93-cent premium over AECO for May and a 91-cent premium for the balance of summer.

If the cash market is any indicator, near-term prices at AECO could see additional downside sooner rather than later.

AECO was poised to set a new all-time record low of 0.88 $C/GJin April 15 trading, beating its previous record of $0.91 set earlier this month on April 1, NGI’s historical price data shows.

The western Canadian market hub has been on a steady decline since at least early 2014.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |