E&P Distress, Regulations Among ‘Variables and Uncertainties’ Impacting NatGas, BP Exec Says

With so many “variables and uncertainties” impacting the natural gas industry looking ahead, risk management will be key for market participants, according to BP Energy Co. CEO Orlando Alvarez.

During a keynote address Tuesday at the LDC Gas Forums Southeast conference in Atlanta, Alvarez emphasized that “volatility is coming back” to the gas industry, despite sustained low prices driven by a mild winter and a supply glut. Alvarez’s remarks continued on the theme of volatility established earlier that morning during a presentation from the Macquarie Group’s Vikas Dwivedi (see Shale Daily, April 14).

Based in Houston, Alvarez oversees BP’s gas, natural gas liquids and power groups, handling trading, marketing, supply and derivatives activities in North America.

Noting that he was “not here to provide a price forecast, I’m just here to lay out some facts,” Alvarez said the market is changing rapidly and becoming more complex, creating a recipe for volatility not just in prices but “in the broader sense.”

There’s a lot of uncertainty over how much demand will be created by exports to Mexico and through liquefied natural gas (LNG) terminals, Alvarez said. He pointed to 33 LNG trains under construction which will add 19 Bcf/d by the end of 2018, increasing global production by 50%.

Then there’s the question of how many of the proposed pipeline projects will get built. There’s also the regulatory uncertainty created by a slate of new environmental and safety regulations on top of more hawkish market oversight. Regulatory and policy changes, such as new federal rules limiting air and water emissions, water disposal, and methane restrictions are waiting in the wings, some of them tied up in court. A handicapped U.S. Supreme Court and looming national elections could influence the rules.

Factoring in power burn, industrial demand and exports, among other variables, the U.S. demand forecast ranges from around 83 Bcf/d to more than 100 Bcf/d by 2025, depending on the outlook, Alvarez said.

“You’ve got all these different signals,” he said.

He discussed the various forces negatively impacting the exploration and production (E&P) sector that create uncertainty for the market. E&Ps now face a higher cost of capital as equity prices are moving lower.

“Stating the obvious, the production has overwhelmed the demand side,” Alvarez said, but identifying exactly when the pullback from E&Ps will start to impact production is difficult given uncertainty over the number of drilled but uncompleted (DUC) wells. “The question is, how long are those DUCs going to last?”

He discussed how the uncertainty in the E&P sector is also clouding the future of some of the proposed pipeline projects (see Daily GPI, March 9; March 8; Feb. 23)

As an example, Alvarez said he counts approximately 17 Bcf/d of planned Northeast pipeline expansions, with 48% of that capacity subscribed to by producers. Having so many “long-term contracts held by non-LDCs [local distribution companies]” creates a lot of risk for the market, he said.

“What happens to the [firm transportation] contracts” in the event of a bankruptcy? “What if they’re no longer there? What happens to those expansions? Are they delayed? Are you counting on them bringing gas today? What’s that going to do to regional prices?” he said.

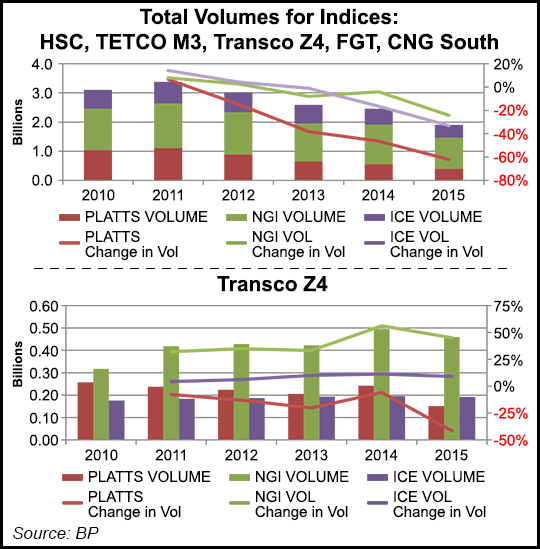

Adding to the uncertainty is a decrease in reported volumes to publishers’ price surveys at various trading points in recent years, something Alvarez said is resulting in “less transparency in the physical world.” Part of the reason is that the market has shrunk since speculator trading has fallen off with lower prices. But regulatory risk also is driving some companies not to report since trading is “being scrutinized more than ever” by regulatory bodies.

“If you rely on indices, this is something for you to watch,” Alvarez said.

But even though the industry currently faces “more [uncertainty] than I’ve ever seen in 30 years in the business,” the market will ultimately do what it always does and rebalance, he said.

“The market works. We’ve seen it. We’ve seen it over the last 10 years. When we thought we needed LNG [imports], what happened? Production response came into play. The market works,” Alvarez said. “It’s just going to take time to get back into balance.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |