NGI Data | NGI All News Access

Expected Mild Weather Prompts Weekly NatGas Price Relapse

With winter now in the rear view mirror, the ghost of unseasonable warmth reappeared for the week ended April 15. The NGI Weekly Spot Gas Average fell 11 cents to $1.76 as forecasts were calling for milder than normal spring conditions.

Most points were down just under a dime and the market point showing the greatest gain was CIG DJ Basin with a rise of 7 cents to $1.64. Tennessee Zone 6 200 L brought up the rear with a drop of $1.17 to $3.02 followed closely by Algonquin Citygate with a loss of 92 cents to $3.13.

Regionally, the Northeast proved to be the week’s laggard with a decline of 31 cents to $1.74 followed not so closely by South Texas and the Midwest with losses of 9 cents to $1.76 and $1.86, respectively.

The Midcontinent came in with a drop of 8 cents to $1.71 and both South Louisiana and East Texas gave up 6 cents to $1.80 and $1.78, respectively.

Weekly gas prices in California fell 2 cents to $1.82, and the Rocky Mountains were unchanged at $1.62.

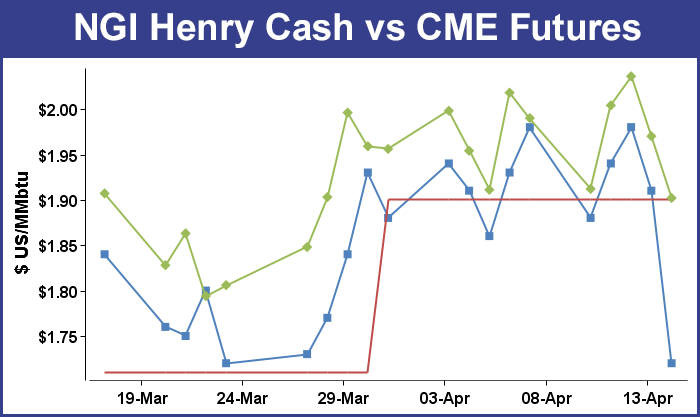

May futures on the week fell 8.8 cents to $1.902 but were able to scale the elusive $2 threshold on two occasions. Much of that decline was attributable to the market’s reaction Thursday to a seemingly supportive government storage figure. The Energy Information Administration (EIA) reported a withdrawal of 3 Bcf from storage for the week ended April 8, about 3 Bcf greater than what traders were expecting and prices made an initial move higher, but ended up lower on the day. At the close May had fallen 6.6 cents to $1.970 and June was down 5.6 cents to $2.063.

Prior to the release of the storage data estimates were coming in right around flat, but any way you slice it, it looked to be bullish. Last year, a stout 49 Bcf was injected, and the five-year average is for a 22 Bcf build.

John Sodergreen, publisher of Energy Metro Desk, said his survey came in at +2 Bcf with a range of -9 Bcf to +12 Bcf. “While demand was up nicely week/week due to the weather – about 20% colder than the week prior – production and imports from Canada were healthy, offsetting much of that storage draw. Many folks think it may be much lower than the editor’s 5 Bcf handle.”

Other estimates included Stephen Smith Energy at a -7 Bcf and PIRA Energy at +4 Bcf. A Reuters survey of 23 traders and analysts revealed an average of 0 Bcf with a range of -14 Bcf to +10 Bcf.

May futures were trading at about $1.978 just prior to the release of the data. and by 10:45 a.m. May was trading at $2.015, down 2.1 cents from Wednesday’s settlement.

The release of the data did not affect the day’s trading range, which was already in place with a low of $1.971 and a high of $2.048.

The significance of the data will await a final settlement on the day’s trading. “We have to see if this market can settle over $2,” said a New York floor trader. “That could be significant if we trade above $2 and stay above $2.”

All but two points followed by NGI fell into the loss column, and the NGI National Spot Gas Average dropped 15 cents to $1.60. Losses in the East reached well over 20 cents. Futures struggled as well, with the spot May contract slumping 6.8 cents to $1.902 and June dropping 6.6 cents to $1.997. May crude oil tumbled $1.14 to $40.36 ahead of the weekend OPEC meeting.

Several points in the Gulf Coast and Midcontinent traded below their 30-day lows. Gas at Katy changed hands at $1.68, 7 cents below its 30-day low, and packages on Florida Gas Zone 3 were a dime under their 30-day minimum at $1.68 as well.

In the Midwest and Midcontinent, gas at the Chicago Citygate was 11 cents lower than its 30-day minimum at $1.68, and gas on Northern Natural Ventura ducked 15 cents under its minimum at $1.55. Deliveries to Panhandle Eastern were seen 2 cents below its 30-day minimum at $1.52.

Gas at the PG&E Citygates was quoted two cents under its 30-day minimum at $1.83.

To the north, gas at AECO/NOVA has been in decline since early 2014, but in Friday’s trading recorded an all-time record low of C$0.88/GJ.

“There’s so much gas in storage and the temps are mild, and there is no reason to purchase natural gas,” said an industry pipeline veteran. “Our market focus going forward is demand and power load. We need to get some power plants ramped up and out of maintenance.”

Gas westbound on REX out of the Marcellus lost ground in the day’s trading, but deliveries to Midwest interconnects fell more as the market continued its trend of normalization.

Gas on Dominion South shed 9 cents to $1.23, and packages for weekend and Monday delivery on Tennessee Zn 4 Marcellus lost a dime to $1.20. Gas onTransco-Leidy Line was seen 8 cents lower at $1.24.

To the west, REX interconnects with NGPL, Trunkline and Midwestern gave up more ground. Deliveries to NGPL at Moultrie Country, IL, lost 14 cents to $1.61, and gas delivered to Trunkline at Douglas Country, IL, fell 12 cents to $1.63. Gas on Midwestern at Edgar County, IL, retreated 13 cents to $1.62.

Gas buyers tasked with securing weekend supplies for power generation across the MISO footprint may have an easy time of it as moderating temperatures and strong wind generation are forecast to affect the area. WSI Corp. in its Friday morning six- to 10-day outlook said, “A south-southeast flow around the western periphery of high pressure will support a warming trend during the next couple of days. Highs temps will top out in the upper 50s, 60s and 70s. However, a wave of low pressure will lead to clouds and periods of rain across MISO South (Entergy).

“Eventually, a frontal boundary and a slow-moving upper-level system over the Plains will introduce a chance of showers during the end of the weekend into early next week, which will scale back some of the warmth. A fluctuating southerly wind will support strong wind generation during the next couple of days. Output will peak 8-10 GW, and wind gen will likely subside Sunday into early next week.”

Looking beyond the weekend, WSI said, “the six-10 day period forecast features widespread above to much above average anomalies, except for portions of New England and South Texas. [Friday’s] forecast is generally warmer than yesterday’s forecast over the eastern two-thirds. CONUS and GWHDDs are down 4.1 and are forecast to be 21.4 for the period. PWCDDs are up to 11.”

That warming trend and beyond “will be translating to some normalized injections beyond next week’s release that will maintain a huge supply cushion at this early stage of the injection cycle,” said Jim Ritterbusch of Ritterbusch and Associates in a Friday morning note to clients. “In addition to some additional production decline, this market may require some supply disruptions or an early start to a hot summer if storage overcrowding is to be precluded. We agree with the EIA’s projected end-of-season supply in excess of 4.1 Bcf by the beginning of November, a record high. With such a stock capable of meeting even the strongest of winter requirements, buying activity going forward will continue to be quelled until summer weather forecasts and hurricane activity acquires some clarity.”

Much of the oversupply is located near the Henry Hub, bringing additional price pressure. “Meanwhile, gas supplies in the futures-related South Central region increased a further 17 Bcf last week in contrast to declining trends in most other regions. South Central supply currently accounts for an unusually large 45% of total U.S. storage. This represents a potential bearish consideration to the physical market, in our view, that could force renewed significant expansion in the spread carrying charges, especially if the speculative community charges back into the short side of the liquid nearby futures or ETFs such as DGAZ.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |