Markets | NGI All News Access | NGI Data

Market Unmoved by Nominally Supportive Natural Gas Storage Data

Natural gas futures were able to work higher but unable to take out session highs Thursday morning after the Energy Information Administration (EIA) reported a storage draw that was greater than what the market was expecting.

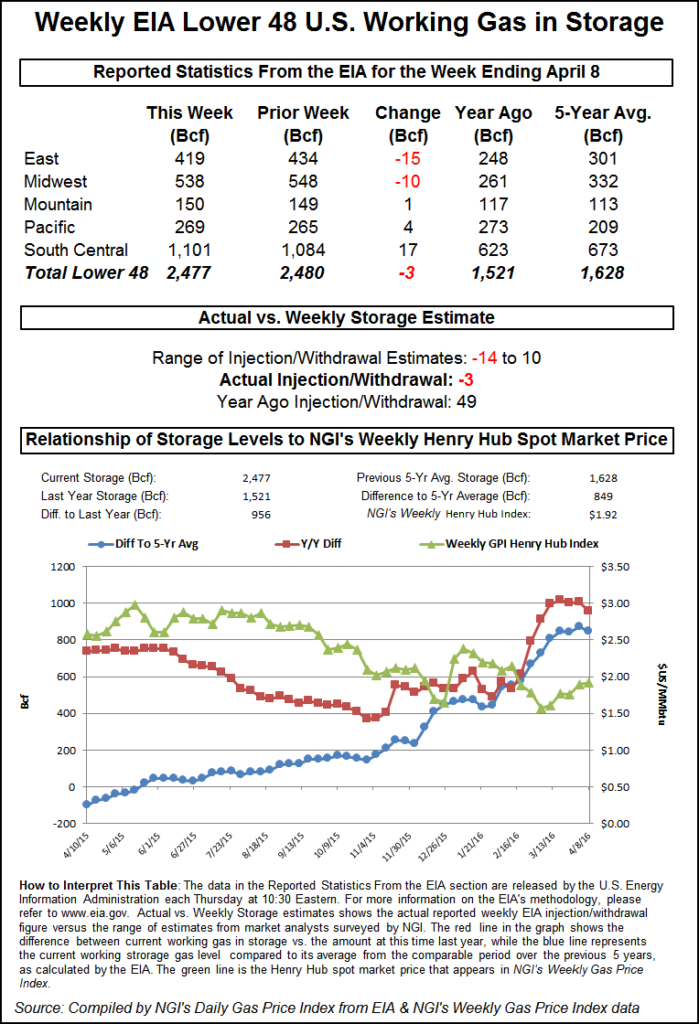

EIA reported a 3 Bcf storage withdrawal in its 10:30 a.m. EDT release, about 3 Bcf more than traders were anticipating. May futures were trading at about $1.978 just prior to the release of the data. and by 10:45 a.m. May was trading at $2.015, down 2.1 cents from Wednesday’s settlement.

The release of the data did not affect the day’s trading range, which was already in place with a low of $1.971 and a high of $2.048. The significance of the data will await a final settlement on the day’s trading.

“We have to see if this market can settle over $2,” said a New York floor trader. “That could be significant if we trade above $2 and stay above $2.”

“The net withdrawal of 3 Bcf was somewhat more supportive than the consensus expectation for a 0-3 Bcf build, and also bullish compared with the 22 Bcf five-year average net injection,” said Citi Futures Perspective analyst Tim Evans. “However, we expect the market to pivot to the upcoming warming trend that will translate into weak heating demand over the next two weeks. We don’t think the storage surprise was bullish enough to tip the balance in the market.”

Inventories now stand at 2,477 Bcf and are a stout 956 Bcf greater than last year and 849 Bcf more than the five-year average. In the East Region, 15 Bcf were withdrawn, and the Midwest Region saw inventories fall by 10 Bcf. Stocks in the Mountain Region rose 1 Bcf, and the Pacific Region was higher by 4 Bcf. The South Central Region added 17 Bcf.

Salt cavern storage was higher by 11 Bcf to 334 Bcf, while the non-salt cavern figure rose 6 Bcf to 767 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |