Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

U.S., Canada Need $546B Investment in NatGas, Oil, NGL Pipes by 2035, INGAA Says

The United States and Canada will need to invest $546 billion by 2035 — about $26 billion annually — on midstream natural gas, crude oil and natural gas liquids (NGL) infrastructure, according to a study released Tuesday by the Interstate Natural Gas Association of America (INGAA).

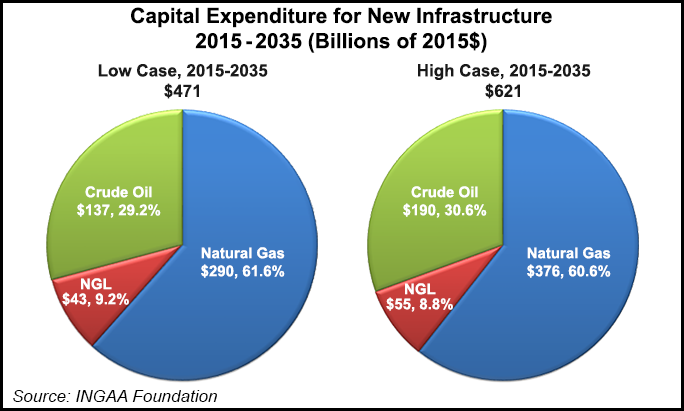

Natural gas infrastructure, including gathering and transmission pipelines, compressors, laterals, gas-lease equipment, processing, gas storage and liquefied natural gas export facilities, makes up more than 60% of the needed energy infrastructure identified in the report, with total investments of $290-376 billion ($333 billion midpoint) required 2015-2035. Over that 21 year period, the report calculates 18,000-30,000 miles of new natural gas pipelines will be built.

Crude oil infrastructure, including gathering pipeline, lease equipment, mainline pipeline and pumping, storage laterals and storage tanks, will require $137-190 billion of capital spending, with another $43-55 billion needed for new NGL transmission pipelines, pumping, fractionation and NGL export facilities.

The report also projects $24 billion in capital spending for incremental integrity management and emissions in the natural gas midstream space over the next 20 years.

The report, North American Midstream Infrastructure through 2035: Leaning into the Headwinds, was conducted by ICF International on behalf of the INGAA Foundation. It updates a 2014 infrastructure report to reflect changes in the natural gas, NGL and crude oil industry in recent years (see Daily GPI, March 18, 2014; March 6, 2014).

“While new midstream infrastructure is needed, it is less than was anticipated by the 2014 study as both the number and scale of projects declines from the level of activity that has occurred during the past five years,” the report said. “At the same time, even though fewer miles of pipe are required in the future, investment in new gas pipelines remains significant because of continued production growth from low-cost production areas like the Marcellus and Utica.

“Put another way, incremental production from low-cost areas tends to offset declines in activity elsewhere. Rounding out this supply-demand picture, NGL production will generally track natural gas production, as a substantial portion of new natural gas production has a relatively high liquids content. A key difference with the 2014 study, however, is that the growth of oil production is much less pronounced due to the reduced oil prices assumed in this study….

“Even though continued infrastructure development is significant, future midstream development will be less than it has been recently as the market has undergone a very robust period of development (i.e., $40-$50 billion of annual investment) between 2010 and 2015, with aggressive development of unconventional resources. In 2016, we expect continued buildout of gas, oil and NGL infrastructure with many pipelines already under construction. About 40-50% of the natural gas capacity originates in the U.S. Northeast, home to Marcellus and Utica development. Significant capacity is also built in the U.S. Southwest, mostly associated with LNG [liquefied natural gas] and Mexican export activity.”

Key trends identified in the report from 2015-2035:

“The [new infrastructure] development activity generally slows after 2020,” said ICF Vice President Kevin Petak. “We continue to see some robust buildout, particularly over the next couple of years, and then slowing activity thereafter.”

The behavior of energy markets, especially over a more than two-decade period, is far from guaranteed, Petak said.

“There’s probably been no greater period of uncertainty than what we’re experiencing right now,” he said. “There’s a lot of uncertainty regarding economic development and economic activity, particularly in Asia. There’s lots of uncertainty regarding commodity prices, particularly oil prices and the oil price rebound.”

In an effort to more accurately gauge coming trends, ICF’s analysis for the first time includes two scenarios: a high case, which assumes robust economic activity over the 21-year period, and a low case, which assumes slower economic activity. The low case projects natural gas use rising to 110 Bcf/day by 2035, while the high case sees growth to over 130 Bcf/day. The biggest difference occurs in the power sector, where the low case assumes lower electricity demand growth, greater energy efficiency and more significant penetration of non-gas generating resources. Both cases are viewed as plausible, Petak said.

Both cases project gas prices to average below $3/MMBtu through 2017. In the high case, Henry Hub gas prices rise to $4.00-5.50/MMBtu after 2020. Prices in the low case average 15% lower than the high case between 2020 and 2035.

In the high case, electric load grows at 0.9% per year from 2016 to 2020, and at 1.0% per year after 2020. In the low case, electric load growth increases by only 0.3% per year throughout the projection. The report assumes U.S. gross domestic product (GDP) growth at an average 2.6% in the high case. In the low case, GDP grows at 2% per year through 2025 and rebounds to 2.6% thereafter.

ICF assumes oil prices remain depressed through 2017, but rebound with an Asian economic recovery and slower development of North American oil supplies. In each case, oil prices recover to a longer-term price of $75/bbl, but the pace of recovery is much slower for the Low Case.

“The previous study showed much more robust growth in oil development,” Petak said. “This study shows much more modest growth in crude oil production over time. That in part is because the oil prices assumed in this study are lower than they were in the prior study.”

The midstream investment projected in the report would add $655-861 billion of value to the U.S. and Canadian economies and result in employment of between 323,000 and 425,000 workers per year. While many of the jobs associated with midstream development are concentrated in the Southwestern and Northeastern U.S. and in Canada, the positive economic impacts are geographically widespread.

“This report shows a vibrant natural gas market in the future, and this creates the need for additional midstream infrastructure to deliver affordable natural to consumers,” INGAA Foundation CEO Don Santa said. “The good news is that the natural gas industry has a proven track record of constructing and financing this level of infrastructure.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |