NGI Archives | NGI All News Access

Weekly NatGas Cash Lifted By Yeoman-Like Gains on Winter Relapse

Weekly natgas gains were made possible by solid, though modest improvement across market zones and producing zones for the week ended April 8. The week also saw a futures prompt-month contract close above $2 for the first time in two months.

No region fell into the loss column. The NGI Weekly Spot Gas Average rose 12 cents to $1.87, and a couple of hefty triple-digit gains at eastern points led the Northeast to a 47-cent average advance to $2.05.

Northwest Sumas was the week’s softest point recording only a nickel loss to $1.35. At the Algonquin Citygate weekly gas jumped $2.01 to average $4.05 followed closely by Tennessee Zone 6 200 L with a $1.97 rise to $4.19.

Regionally East Texas was flat at $1.84 and South Louisiana added 2 cents to $1.86.

Both South Texas and the Rocky Mountains rose by 3 cents to $1.85 and $1.62, respectively, and California was up by 5 cents to $1.84.

The Midwest and Midcontient rose by 6 cents to $1.95 and $1.79, respectively.

May futures gained 3.4 cents to $1.990, and were it not for a nearly 11-cent rise on Thursday, futures would have languished in the red.

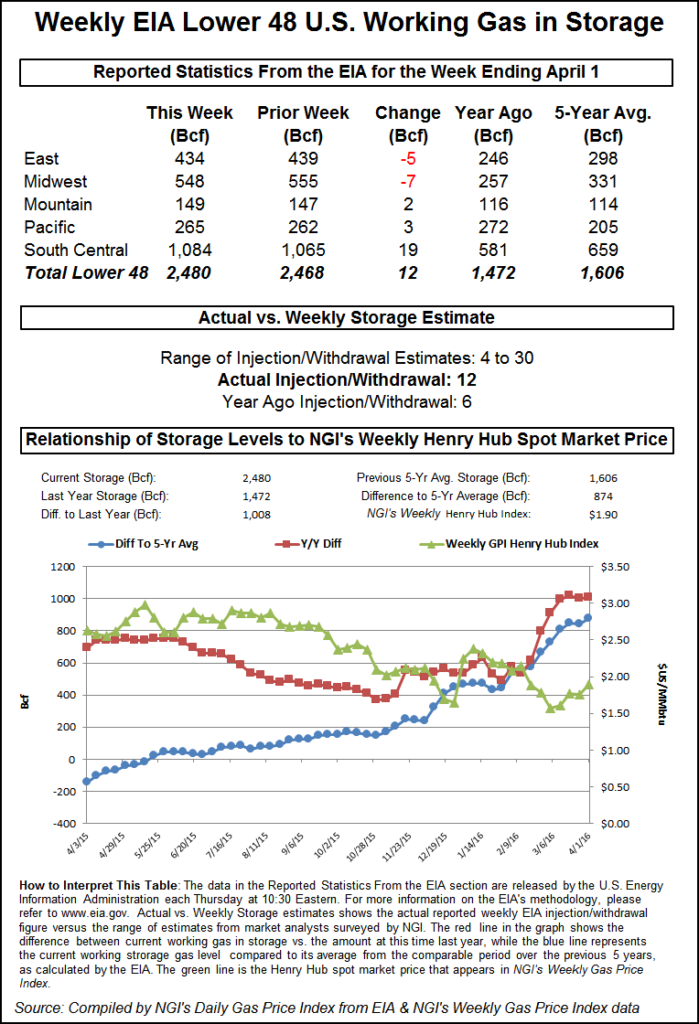

Thursday’s release of storage data and subsequent market reaction caught most traders by surprise. The Energy Information Administration (EIA) reported a storage increase of 12 Bcf, greater than what traders were expecting and prices made a counter intuitive advance. At the close on Thursday May had risen 10.7 cents to $2.018, which marked the first prompt month close above $2 since the March 2016 contract did it back on February 10.

Traders were scratching their heads following the release of the data. May futures were trading at about $1.940 just prior to the release of the data. and by 10:45 a.m. May was trading at $1.978, up 6.7 cents from Wednesday’s settlement.

“We were looking for a +6 to +8 build, but the market rallied. Why? I can’t tell you,” a New York floor trader said.

“I’m looking at the market and I see +12 Bcf so maybe we should come off a little bit, but maybe not make new lows. I’m seeing this thing climb higher, and I’m saying to myself ‘What am I missing here?'”

Inventories now stand at 2,480 Bcf and are a stout 1,008 Bcf greater than last year and 874 Bcf more than the five-year average. In the East Region 5 Bcf were withdrawn and the Midwest Region saw inventories fall by 7 Bcf. Stocks in the Mountain Region rose 2 Bcf, and the Pacific Region was higher by 3 Bcf. The South Central Region added 19 Bcf.

In Friday trading physical natural gas for weekend and Monday delivery moved little as gains in the East and Rockies were able to overcome a weak Texas market and flat Gulf Coast pricing.

The NGI National Spot Gas Average rose a penny to $1.87, and eastern points, on average, added more than a dime. Futures trading was uninspired, with prices held to a narrow 6-cent range and May failing to hold onto its Thursday close above $2. May slipped 2.8 cents to $1.990 and June dropped 2.4 cents to $2.077. May crude oil surged $2.46 to $39.72/bbl.

Eastern points firmed as temperatures over the weekend were forecast to dip before returning to seasonal norms. Forecaster Wunderground.com predicted that Boston’s Friday high of 52 degrees would drop to 45 Saturday before making it back to 55 on Monday. The normal high in Boston in early April is 53. New York City’s high temperature of 52 on Friday was seen dropping to 41 Saturday before climbing back to 59 on Monday, one degree above normal.

Weekend and Monday deliveries to the Algonquin Citygate rose by 61 cents to $4.17, and packages at Iroquois, Waddington came in 7 cents higher at $2.24. Gas on Tenn Zone 6 200L changed hands 33 cents higher at $3.86.

Deliveries to Tetco M-3 shed 12 cents to $1.59, and gas headed for New York City on Transco Zone 6 were quoted 4 cents lower at $1.70.

Firm on-peak Monday power prices also added to the appeal of gas purchases for power generation. Intercontinental Exchange reported that on-peak Monday power at ISO New England’s Massachusetts Hub rose $7.35 to $41.21/MWh, and gas at the PJM West terminal added $1.93 to $34.56/MWh. At the Indiana Hub, Monday power was quoted $1.07 to $33.75/MWh.

When May futures traded as high as $2.07 on Monday, it represented the highest trade in nearly 60 days. Recently, numerous cash points in the Rockies, Gulf Coast and Midwest have been able to post 30 day highs, among them Michigan Consolidated, Consumers and Chicago Peoples Gas.

Also, Transwestern San Juan, Opal, CIG and the Cheyenne Hub recorded 30 day highs in the mid $1.70s. The Henry Hub at $1.99 is a full nickel above its 30-day high.

With Friday’s settlement just under $2 and Thursday’s finish just over $2, interest in further selling may be limited. “Speculative short-covering is also a feature following the market’s show of resilience in the face of a seemingly bearish storage figure out of the EIA yesterday,” said Jim Ritterbusch of Ritterbusch and Associates in a Friday morning note to clients.

“Apparently, a further expansion of around 30 Bcf in the supply surplus against the five-year averages to a record level has been duly priced in, and the market is discounting some re-balancing off of declining production and some electric generation demand improvement. While these dynamics are always difficult to gauge on a current basis, it is obvious that potential sell hedgers have largely backed away from this market at sub-$2 levels and that the speculative community is becoming less interested in the short side. This will result in a broad based lack of selling interest that allows the market to advance on even a modicum of fresh buying.

“From a technical perspective, it would appear that additional gains lie ahead during the next couple of sessions, with May futures pushing up to about the $2.07 level by today’s close and possibly to around the $2.10 area early next week. The weather factor will be diminishing in importance next week following a current cold spell that will be seeing much of the nation’s Midcontinent experiencing freezing temperatures tonight.”

Gas buyers assessing weekend supplies across the MISO footprint may have plenty of renewable power available to offset gas purchases. WSI Corp. in its Friday morning report said, “A quick-moving disturbance and arctic cold front will slide across the Midwest today with the chance for scattered rain and snow showers. This will usher a reinforcing shot of much below average temperatures into the power pool during the next couple of days with max temps in the upper 20s, 30s and 40s north; 50s, 60s to mid 70s south.

“A northwest flow will continue to support a period of elevated wind generation today with output near 10 GW. After a brief drop-off during Saturday, a gusty south to northwest wind associated with the next storm system will support a surge of wind gen during Saturday night into Monday.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |