Marcellus | E&P | NGI All News Access | Utica Shale

Range Completes $110M Sale of Non-Operated Northeast Pennsylvania Assets

Range Resources Corp. has closed the sale of nearly 11,000 non-operated acres in Northeast Pennsylvania’s Bradford County as it continues to divest noncore assets and pay down debt during the commodities slump.

The company initially signed a purchase agreement with an undisclosed operator to sell the assets for $112 million. After purchase price adjustments based on a Jan. 1 effective date, Range said Monday that it instead closed the sale for $110 million and retained the asset’s net cash flow from the time of the effective date.

Range said it used the proceeds to reduce its debt and pay for other “corporate purposes.” It plans to include the Bradford County operations in its first quarter results.

Range sold an average 23% working interest in 10,900 net acres operated by Spain’s Repsol SA, which represented 22 MMcf/d of production. After the sale, Range’s borrowing base remains unchanged at $3 billion.

It was the latest divestiture for the company, which sold its coalbed methane assets to EnerVest Ltd. last year for $865 million (see Shale Daily, Dec. 31, 2015). Range continues to market its STACK (Sooner Trend, Anadarko, Canadian and Kingfisher) assets in Oklahoma.

During 2015, the company reduced its total debt by $378 million to $2.7 billion. It plans to keep controlling costs with a $495 million capital budget this year, down 45% from 2015 levels and 69% from 2014 levels.

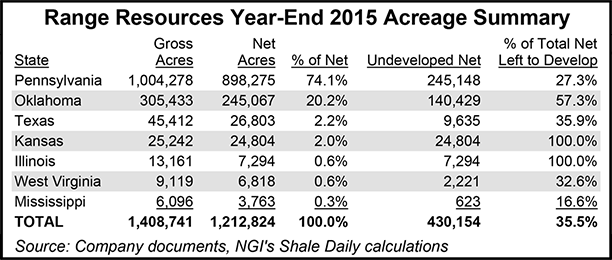

The company still has more than 1.5 million acres prospective for the Utica, Marcellus and Upper Devonian shales in Pennsylvania. Management said in February that all of the company’s operations this year would be focused on the Marcellus in southwest Pennsylvania (see Shale Daily, Feb. 26).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |