Infrastructure | NGI All News Access

NatGas, Wind, Solar Accounting For Almost All New U.S. Generating Capacity, EIA Says

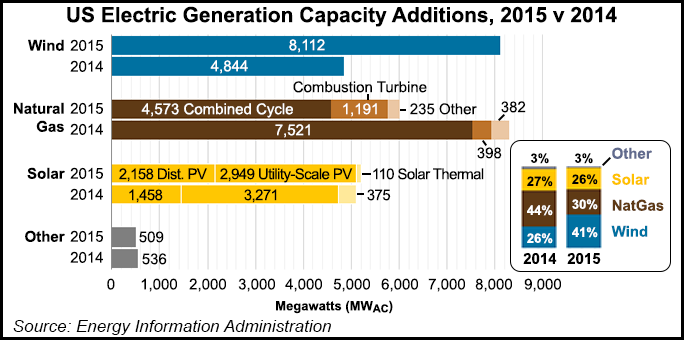

Wind accounted for the largest share of U.S. electric generation capacity additions in 2015, followed by natural gas and solar, according to a note published Wednesday by the Energy Information Administration (EIA).

Natural gas made up 30% of capacity additions in 2015, adding around 6 GW, while wind made up 41% with more than 8 GW, EIA said, citing preliminary data from its form EIA-860 survey.

Wind, gas and solar accounted for the lion’s share of new capacity additions in both 2015 and 2014. In 2014, gas made up 44% of capacity additions, compared to 27% from solar and 26% from wind.

“The trend of wind, natural gas and solar additions making up most new capacity is likely to continue in 2016,” EIA said.

As of December, natural gas accounted for 438.7 GW of the total 1,069.3 GW of utility-scale net summer generating capacity in the United States, compared to 72.6 GW for wind and 13.4 GW for solar, according to EIA’s most recent Electric Power Monthly report.

Natural gas additions were lower in 2015 than in previous years. Projects in New Jersey and Texas made up half of the 2015 additions (see Daily GPI, Aug. 18, 2015).

In New Jersey, the 685 MW Newark Energy Center and the 795 MW Woodbridge Energy Center, both combined-cycle, came online. The plants will pull supply from Transco (Transcontinental Gas Pipe Line Co. LLC), supported by additional capacity through the Leidy Southeast Expansion (see Daily GPI, Dec. 30, 2015; March 3, 2015; Dec. 18, 2014).

“In Texas, the second phase of the combined-cycle Panda Temple Power Station (734 MW) and three combustion turbine plants totaling 716 MW (Ector County Energy Center, Montana Power Station, and Elk Station) came online,” EIA said.

Over the past few years, cheap natural gas has been cutting into coal’s previously dominant share of U.S. electric generation. After surpassing coal for the first time ever on a month-to-month basis in 2015 (see Daily GPI, Dec. 28, 2015; Dec. 2, 2015; Oct. 28, 2015), EIA said recently it expects natural gas to fuel the largest share of U.S. electric generation for full-year 2016 (see Daily GPI, March 16).

While gas, wind and solar accounted for most of the capacity additions in 2015, coal accounted for 80% of the retired capacity for the year, with “relative fuel costs…encouraging a switch from coal to natural gas,” according to EIA economist Tyler Hodge (see Daily GPI, March 8).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |