E&P | NGI All News Access | NGI The Weekly Gas Market Report

U.S. Rig Tally Loses Five NatGas Units

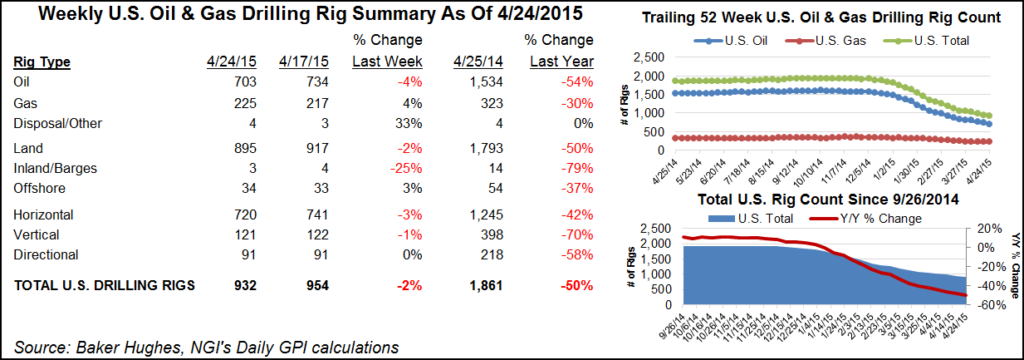

The pace of U.S. rig declines slowed in the latest report by Baker Hughes Inc., which was released on Friday. Meanwhile, spring break-up continued in Canada, and analysts had market rebalancing on their minds.

A net of four land-based rigs departed U.S. activity. That was five natural gas rigs departing, offset by one returning oil-directed rig.

The overall net rig loss was four units and combined with Canada, which lost 29 rigs, made for a North American rig count decline of 33 units.

Six of the departing U.S. rigs were horizontal units, joined by one directional rig. Three vertical units returned to the game.

Declines were spread fairly evenly across a number of the leading states and plays. The Eagle Ford Shale added two units to end at 45 rigs running.

“While 2H2016/2017 is looking a little better, E&Ps are still likely to stick with previously announced programs for 1H2016, resulting in a bottoming of the U.S. land rig count in the 375-400 range…” analysts at Cowen and Company said in a note Monday (March 14). “We expect an upward-sloping futures curve to revive some recovery in activity, stabilizing U.S. oil production levels in the 8 million b/d range.

“Depending on the global call to U.S. crude, we think this could result in demand for anywhere from 600 to 900 [U.S. land] rigs exiting 2017. Our updated estimates assume 401 rigs exiting 2016 and 739 exiting 2017.”

Cost declines in the shale oil patch will likely be harder to come by, Societe Generale analyst Michael Wittner said in a note Wednesday. “The early stages of global rebalancing, which requires U.S. crude oil production to decline significantly, have begun and will continue as long as WTI prices remain sufficiently low so that U.S. shale oil producers are forced to continue reducing output (by cutting spending and drilling).”

On the natural gas side, “…the lowest monthly production average of the last 16 months was 71.2 Bcf/d, which is only 0.7 Bcf/d lower than our April through June production expectation. While it is possible that production falls, and stays, below 71 Bcf/d, we see the risk of that holding over the full three-month springtime period as small,” Societe Generale analyst Breanne Dougherty said in a note Friday. “We also note that if production is to take a definitive turn lower this spring, driven by basin declines from the post-2014 retrenchment of drilling programs, then 2H2016 prices should definitely turn more constructive than the current curve. Producers are unlikely to respond aggressively or quickly enough to a return to above $2/MMBtu in spring to reverse what would then be a declining production base by the end of the year.”

In Canada, which is in the throes of spring break-up season, sixteen of the departing rigs were oil units, and 13 were gas units.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |