NGI Archives | NGI All News Access

Falling Production, Brief Cold Snap Lift NatGas Forwards

Natural gas forwards markets continued to strengthen during the third week of March as declining production and the expected return of cooler weather lifted prices by an average of 11 cents between March 11 and 17, according to NGI’s Forward Look.

The Nymex itself picked up 11.2 cents during that time despite a bearish storage report from the U.S. Energy Information Administration.

The EIA reported a 1 Bcf withdrawal from storage inventories for the week ending March 11, slightly below market estimates and far below both the year-ago and five-year average.

Inventories are now at 2,478 Bcf, 67.4% above year-ago levels and 48.3% above the five-year average.

But the meager storage withdrawal was not enough to pull prices into the red as it appears most bearish storage data has already been priced into the market.

Instead, market players looked to the latest weather forecasts showing a return of seasonal natural gas demand thanks to cooler temperatures spreading across the central, southern and eastern U.S. that will drop overnight lows below freezing.

“Cooling has also pushed deep into Texas and the South where more seasonable highs of 50s to 70s are expected through the weekend,” NatGasWeather said.

“The associated cold front is also now pushing through the Mid-Atlantic and East Coast, with highs dropping back to normal or slightly below after being much warmer than normal by 15-30F for quite some time,” the forecaster said.

Still, if market players are looking for any sustained demand, it’s not likely it’s going to happen anytime soon as most weather systems arriving during the next couple of weeks will be accompanied by breaks of mild weather in between.

“Ahead of weather systems, temperatures will be mild and stormy, followed by cooling with snow showers as they pass. This will bring swings in natural gas demand between light to moderate through the end of the month, but never strong enough or lasting long enough to produce much of a draw on supplies,” NatGasWeather said.

But market players are also keeping a watchful eye on production, which has fallen some 2 Bcf/d from recent record highs, according to Genscape.

Genscape, based in Louisville, KY, is a real-time data and intelligence provider for energy and commodity markets.

In particular, production out of the southeast and Texas remain restricted after heavy rains led to localized flooding in the region.

In the Southeast, the majority of the decline in output has been observed in the Haynesville Shale, which fell 0.3 Bcf/d to an average of 2 Bcf/d after this week, according to Bentek Energy.

Haynesville declines were primarily observed on Gulf South and ETC Tiger, which both fell by roughly 160 MMcf/d from last week.

About 0.2 Bcf/d of the decline in Texas came from East Texas as well as the Texas Gulf Coast. East Texas declines fell to 2 Bcf/d, about 0.1 Bcf/d from the prior 10-day average week.

Production along the Texas Gulf Coast also experienced a decline of about 0.1 Bcf/d, dropping to just 1.6 Bcf/d this week, Bentek said.

Taking a closer look at gas forward curves, prices moved in unison this week as typical shoulder-season fundamentals took hold of the market.

Prices were up an average 11.4 cents for April, 10 cents for May and about 9 cents for the balance of summer (June-October), according to Forward Look.

The exception was the Algonquin Gas Transmission citygates, which found additional strength on positive weather news that coincides with the start of major maintenance along the critical New England pipeline.

In its latest one- and three-month outlook, released March 17, the National Oceanic and Atmospheric Administration said the Northeast — especially New England — will likely face above-normal temperatures during both respective time frames.

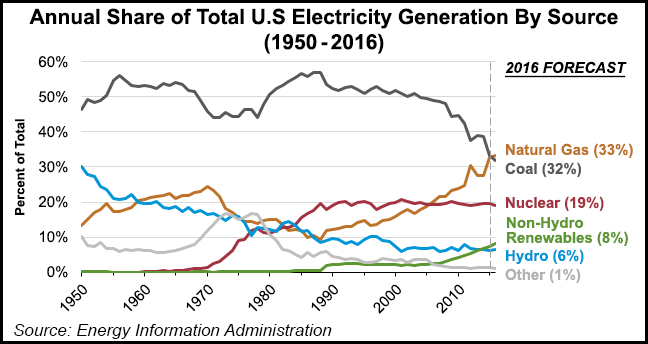

And with power burn possibly reaching a new record in April thanks to the additional 8.5 GW of new gas-fired generation that was brought online in 2015, prices responded accordingly.

AGT April fixed prices jumped 17.9 cents between March 11 and 17 to reach $2.57, Forward Look data shows. May was up 12.1 cents to $2.40, while the balance of summer was up 10 cents to $2.73.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |