Markets | NGI All News Access | NGI Data

No Surprises In EIA NatGas Storage Data

Natural gas futures moved little Thursday morning after the Energy Information Administration (EIA) reported a storage withdrawal that was about in line with what traders were expecting.

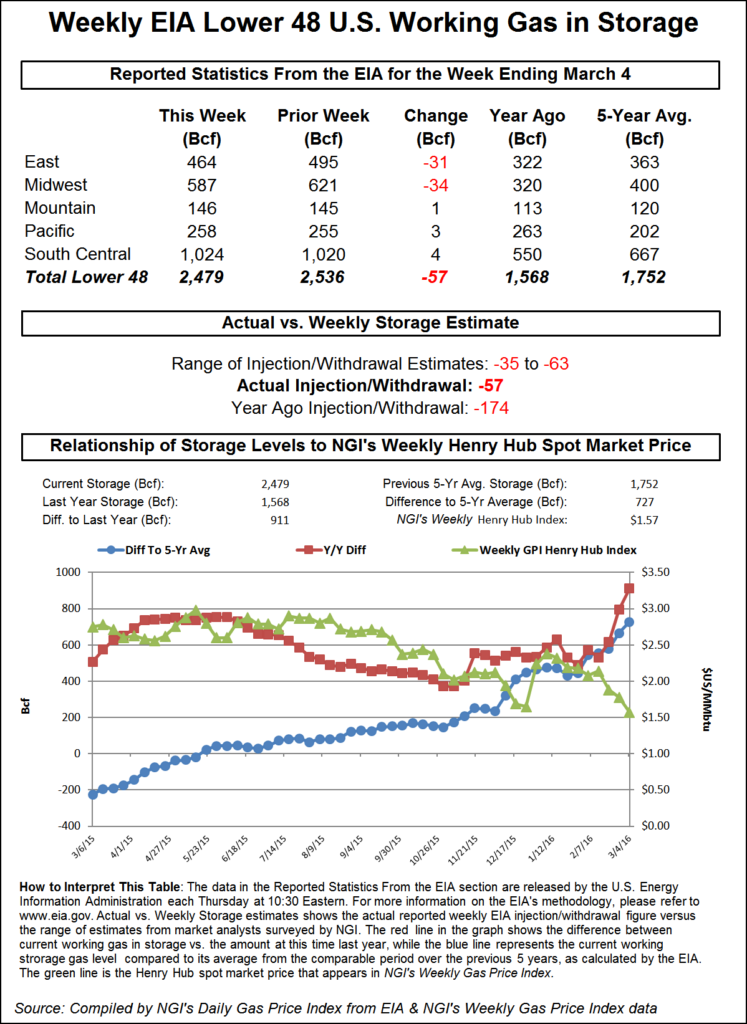

EIA reported a 57 Bcf withdrawal in its 10:30 a.m. EST release, about flat with expectations, and the market did not move out of the session’s trading range. The April high for the day prior to the release of the number was $1.796, and the low was $1.733. Once the number was released, April futures fell to a low of $1.752, and by 10:45 a.m. April was trading at $1.772, up 2.0 cents from Wednesday’s settlement.

“We didn’t make any new highs or lows off the number, and a 57 Bcf draw was what I had heard. The way this reacted, it seemed as though some were looking for a higher number rather than a lower number,” said a New York floor trader.

“The 57 Bcf net withdrawal for last week was largely in line with market expectations, and so we wouldn’t anticipate a strong price reaction. Knowing the number does remove a risk of surprise from the market, however, and so we could see some pickup in trading volume,” said Tim Evans of Citi Futures Perspective.

Inventories now stand at 2,479 Bcf and are a robust 911 Bcf greater than last year and 727 Bcf more than the five-year average. In the East Region 31 Bcf was pulled, and the Midwest Region saw inventories fall by 34 Bcf. Stocks in the Mountain Region rose 2 Bcf, and the Pacific Region was higher by 3 Bcf. The South Central Region added 4 Bcf.

Salt cavern storage was higher by 6 Bcf to 291 Bcf, while the non-salt cavern figure fell 2 Bcf to 733 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |